Selling an inherited property can be overwhelming if you’re already confused by all the steps in the For Sale By Owner (FSBO) process. Besides prepping, listing, negotiating, and closing, there are also several legal considerations if the property is inherited, such as titles and heirs. While a realtor can help with such hassles, controlling the sale FSBO can be more financially rewarding.

Whether you're new to real estate or looking to brush up on the latest strategies for selling a property FSBO, taking control of the selling process means saving on realtor fees, negotiating directly with buyers, and making decisions that best suit your unique situation. In this guide, we’ll walk you through everything you need to know to get the most out of selling your inherited home.

What is FSBO?

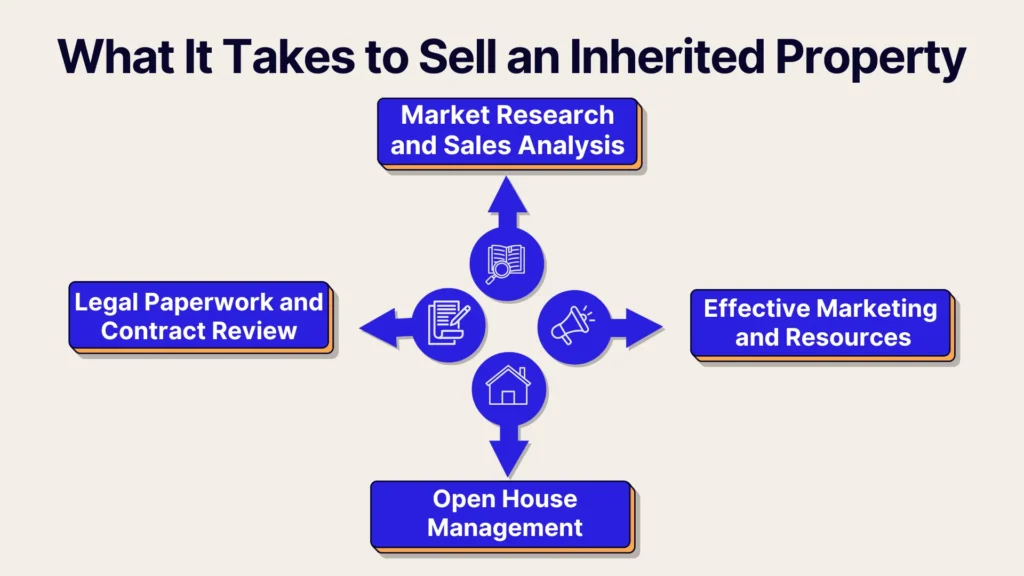

FSBO, or "For Sale By Owner," is a real estate transaction approach where the property owner opts to sell their property without the assistance of a real estate agent or broker. In an FSBO transaction, the seller assumes all responsibilities of the sale process, including marketing the property, conducting open houses, negotiating with potential buyers, and handling the legal paperwork.

However, FSBO needs time, effort, and a basic understanding of real estate laws and practices. Sellers choosing this route should be prepared to conduct market research to price their home competitively, effectively market their property, and navigate the complexities of real estate transactions.

Why Sell An Inherited Property FSBO?

Typically, homeowners go FSBO to maximize the outcome of a sale while avoiding commission costs from real estate professionals. While you lose the broker’s expertise, you get more control over the sale process, the ability to set your own selling price, and direct influence when negotiating with buyers.

This hands-on interaction can give you a more personalized and potentially quicker sale process, as you and the buyer can communicate your needs and expectations without intermediaries. Let’s explore why such advantages can be more beneficial to you than commissioning an agent.

Save On Realtor Commission Fees

Typically, realtor fees can range from 5% to 6% of the sale price, which means you save that much if you decide to sell your inherited property on your own.

Direct Negotiation With Buyers

Being the owner means you understand your situation, property, and sale more completely than a hired realtor would. This allows you to communicate your selling price, needs, and expectations with your potential buyers – clearly and with more leverage.

Determining Your Property's Value

First and foremost, evaluate your property. What benefits and qualities of life will your buyer enjoy? Is the property in good condition? Where is it located? How much are the nearby properties for sale? Such questions will help you establish a fair but competitive asking price, which essentially determines the success of your sale.

Conducting A Comparative Market Analysis

This analysis examines the sale prices of similar properties in your area to gauge your property's market value. Thorough market research helps your listing price align with current market conditions, making your property more attractive to potential buyers. Online tools like Propbox’s AI-powered valuation software can help you benchmark and identify trends.

Hiring A Professional Appraiser

An appraiser offers an objective assessment of your property's worth. They factor in location, property condition, and recent market trends, to determine a fair market value. Even if you have already identified the market value you’re confident is both accurate and attractive, an appraiser’s expertise still signals credibility when negotiating with buyers.

Preparing The Property For Sale

Preparing your home for sale goes hand in hand with valuation as any changes or improvements can affect both the property’s market value and the potential buyer’s impression. For example, opting to leave the property fully furnished may be a valid reason to increase asking price but can also narrow your buyer pool – now excluding someone who might want a neutral space to furnish and decorate themselves.

At this point, it’s also important to consider and understand what kind of market you want your property to attract. Whether you’re settling with simple repairs or planning full-blown renovations, you’ll have to be ready to adjust your selling price and expect different offers.

Decluttering Personal And Inherited Items

Make sure to leave enough room for your buyers to imagine how they would fill and make use of the space you’re selling. Clear out or replace any objects or furniture with noticeable wear, as well as personal items like certain toiletries, footwear, and the like. You’d generally want to give buyers the impression that the property is brand new.

Addressing Essential Repairs

Thoroughly check for leaky faucets, cracked windows or tiles, chipped paint, faulty hinges, and so on. Investing in the most essential home repairs ensures not only the home’s best condition but also protects your asking price.

Upgrading For Market Appeal

Depending on factors like location, market conditions, and competition, you might consider making strategic improvements or even renovations to the home to account for the needs of the market your property is likely to attract. For example, some buyers may be too busy to decorate and would appreciate not having to put too much effort, or vice versa.

Staging For Potential Buyers

Staging is the final touch in preparing your property for sale. By arranging furniture and decor in a way that highlights the property’s best features, staging can make a home more inviting and can help buyers envision themselves living in a space that suits their specific needs – whether maximum comfort or a conducive workspace.

Legal Considerations For Inherited Properties

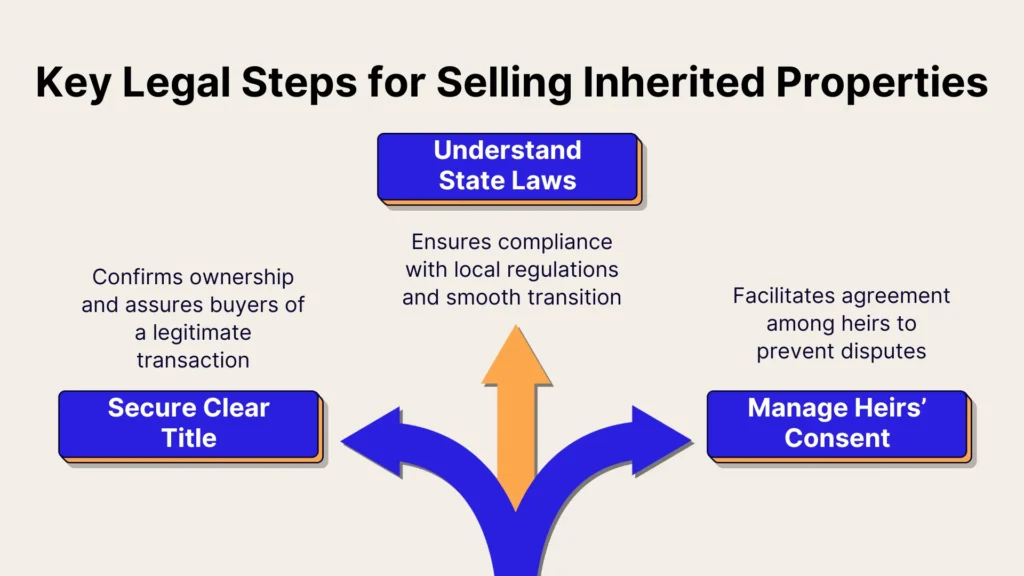

If your property is inherited, it’s likely there are more legal matters involved than otherwise. It’s generally a matter of clarifying whether or not and how much of the property is yours to sell. Let’s explore the most important steps to take in verifying ownership and avoiding legal setbacks in selling your inherited home.

Understanding State Inheritance Laws

Inheritance laws vary by state and dictate the legal process for transferring property ownership after the original owner’s passing. Familiarizing yourself with these regulations ensures compliance and smoothens the transition, avoiding legal complications and ensuring a seamless sale process.

Securing A Clear Title

Having a clear title means the property is free from liens, disputes, or any other encumbrances that could hinder the sale. Such a document not only confirms ownership and compliance but also assures buyers of a worry-free and legitimate transaction.

Managing Multiple Heirs' Consent

When a property is passed down to more than one heir, all parties must agree to the terms of the sale. This often needs clear communication, negotiation, and sometimes legal agreements between heirs to ensure the sale proceeds without disputes.

Effective Marketing Strategies

Once you’ve determined your price point and set up your property, you’re ready to start selling it. Choosing how and where to start listing your inherited property is the first step, but your marketing campaign shouldn’t stop there. Let’s check out the most effective strategies to attract potential buyers to your inherited FSBO home.

Listing On Popular Real Estate Platforms

Listing is where you begin putting your property out there. Take advantage of popular real estate platforms already frequented by potential buyers actively looking for properties. Platforms like Zillow or Craigslist can help you reach an audience already in the market for real estate transactions.

Utilizing Social Media For Exposure

Expand and market your listing across social media platforms to not only reach more real estate audiences and beyond but also increase your property’s visibility. By sharing your listing on social media, you also get more freedom to emphasize certain aspects and highlights of the property, like home offices or kitchen space – useful for attracting specific audiences.

Creating Virtual Tours

If you’re feeling a bit extra on marketing, you can also opt to add virtual tours to your real estate and social media platform listings. Such tours would also give your audiences an idea of even the space between the property’s highlights, allowing them to envision how they would like to use it.

Hosting Open Houses And Private Showings

Opening the property to public and private viewings allows buyers to explore it themselves and immerse themselves in the idea of living in the home. Whatever buyers see and experience in open houses and private showings is usually what makes or breaks deals, so make sure the property is spot-clean and ready for this.

Negotiating With Buyers

After you’ve set up your marketing strategies, your inherited property should already be attracting serious offers. As an FSBO seller, you get to assess and decide which of the offers best suit your interests. It’s best to be patient and thoroughly consider each one, as more buyers might have better offers, and different buyers might be willing to adjust theirs to your liking.

Let’s take a look at the most important things to consider when negotiating with your potential buyers.

Setting A Competitive Asking Price

This is where your appraisal and market research comes into play. It involves balancing the property's market value with the desire to achieve a swift sale. A well-priced property can generate significant interest and lead to multiple offers, improving your negotiating position.

Evaluating Offers Critically

Understand the buyer's terms, including contingencies, closing timelines, and financing conditions. You may narrow offers down based on which ones align best with your own terms and financial interests. While some offers might be flexible enough to improve over time and negotiations, others might already be great but can’t wait too long.

Managing Counteroffers Strategically

Some buyers might not be open to too much negotiation. Try to keep your interests clear and your dealings well-paced. Decide when to stand firm on your asking price and when flexibility could lead to a beneficial agreement.

Closing The Sale Efficiently

Ensuring this last step of selling your inherited FSBO property goes quickly and smoothly is important because buyers can still lose interest if there are too many complications, delays, or setbacks in transferring the property. Pay close attention to all the details involved when finalizing and closing the transaction so you can rest easy after a successful FSBO sale.

Let’s see what steps you can take to streamline a worry-free closing process.

Selecting A Reputable Closing Agent

A closing agent coordinates all the legal and financial details, ensuring that everything is in order for the sale to be finalized. Choosing someone experienced and trustworthy can prevent complications and streamline the closing process.

Preparing For Closing Costs

Be aware of and budget for the expenses incurred during closing, which can include title search fees, attorney fees, and property taxes. Ensure you and your closing agent understand these costs in advance to help avoid surprises and ensure a smooth financial transition.

Finalizing And Signing Sale Documents

Once you’re ready to sell your FSBO property, make sure to double-check that everything is in order to finally review and sign the various legal documents, contracts, and agreements that transfer property ownership to the buyer, legally completing the transaction and securing the sale proceeds.

When all is said and done, you’ve finally sold your inherited FSBO property!

Conclusion

Selling an inherited property without a realtor may seem daunting, but it doesn’t have to be. FSBO allows you to save on commissions and get more from your sale, especially when you have the right tools to guide you.

Propbox makes the FSBO process easier and more efficient with AI-driven pricing, task automation, and seamless organization. Avoid the 6% fee, protect your interests, and sell your property faster and for more – all while staying in control. Start your FSBO property-selling journey the smart way with Propbox!