Selling your home can feel overwhelming because of all the steps needed in a traditional sale, such as prepping the property and finding the right buyer. But what if a simpler, faster, and hassle-free way to sell existed? Enter the world of selling to real estate investors—a solution designed to meet your needs with speed, convenience, and flexibility.

Whether you're facing a tight timeline, managing a property in less-than-perfect condition, or simply looking to avoid the headaches of the traditional selling process, selling to an investor could be the perfect solution. In this article, we’ll guide you through everything you need to know about this exciting alternative, showing you how to get the most value while saving time and energy. Ready to discover the smart way to sell your home? Let’s dive in!

Understanding Real Estate Investors

Selling your home to an investor can feel unfamiliar, but understanding who they are and why they buy homes can give you confidence in this process. Let’s break it down.

Who Are Real Estate Investors?

Real estate investors come in various forms, but their common goal is to make a profit from property transactions. Here are the key players:

- Individual Investors: These are often local buyers looking for homes they can improve and resell or use as rental properties. Think of the handy neighbor who enjoys flipping houses.

- House Flippers: These investors specialize in buying properties that need work, renovating them quickly, and reselling them for a profit. They thrive on transforming outdated homes into modern, market-ready spaces.

- Institutional Buyers: Larger organizations, such as real estate investment firms or iBuyers, purchase homes to add to their rental portfolios or as part of long-term investment strategies.

Investors use a variety of strategies depending on the property type and their goals:

- Fix-and-Flip: Buying homes needing repair, updating them, and selling at a higher value.

- Rental Properties: Holding onto homes to generate long-term income from tenants.

- Buy-and-Hold: Purchasing homes in appreciating markets and selling them later for a higher price.

Why Investors Buy FSBO Properties

For Sale By Owner (FSBO), properties are desirable to investors. Here’s why:

- Streamlined Negotiation: Investors often prefer dealing directly with homeowners rather than through agents, simplifying the process and creating faster deals.

- Opportunity for Discounts: FSBO properties are sometimes priced below market value, making them appealing to buyers who want to maximize profits.

- Less Competition: Unlike traditional listings, FSBO homes can go unnoticed, creating opportunities for investors to act quickly.

How to Determine If Selling to an Investor Is Right for You

Deciding to sell your home is a big step, and choosing the right buyer is just as important. Selling to an investor can be a great option, but it’s not for everyone. Let’s explore the advantages, potential drawbacks, and ideal scenarios to help you decide if this is right for you.

Advantages of Selling to an Investor

There are several benefits to selling your home to an investor:

- Speedy Transactions: Investors often buy with cash, eliminating the need for lengthy mortgage approvals. Some deals close in as little as a week.

- As-Is Sales: No need to worry about costly repairs or renovations—investors typically purchase homes in any condition.

- No Showings or Open Houses: Avoid the stress of preparing your home for endless viewings.

- Flexibility: Many investors accommodate your schedule, offering options such as delayed closings or leasebacks if you need more time.

For example, if you’re relocating for a new job and need to sell fast, an investor can provide the quick turnaround you need without the hassle of traditional methods.

Potential Drawbacks

While selling to an investor has its perks, it’s essential to consider potential downsides:

- Lower Offers: Investors prioritize profitability, so their offers may be below market value.

- Limited Buyer Pool: You won’t benefit from competing offers as you might in a traditional sale.

- Less Emotional Connection: Investors see your home as a business transaction, which can feel impersonal.

Understanding these trade-offs helps you weigh the convenience of selling to an investor against the potential financial impact.

Ideal Situations for Selling to an Investor

Selling to an investor might be the best choice if you’re in one of these situations:

- Need to Sell Quickly: Whether you’re relocating for work, dealing with a sudden life change, or avoiding foreclosure, investors can offer a fast and reliable solution.

- Financial Issues: If you're struggling with mortgage payments or other financial challenges, selling to an investor can help you move forward with less stress.

- Difficult-to-Sell Properties: Homes in less desirable locations, those needing significant repairs, or properties with title complications are prime candidates for investor purchases.

For instance, if you inherited a fixer-upper in an out-of-the-way area, finding a traditional buyer might take months. An investor, however, sees the value in properties others might overlook, making it a win-win for both parties.

How to Attract Investors as an FSBO Seller

Selling your home directly to an investor as a For Sale By Owner (FSBO) seller requires a slightly different approach than a traditional sale. To grab the attention of investors and secure the best possible deal, you’ll need to focus on strategic marketing, creating a compelling listing, and setting the right price.

Marketing Your Home to Investors

Investors are always looking for properties, but targeting them effectively increases your chances of a quick sale. Here’s how:

- Highlight Investor-Friendly Features: Emphasize a good location, potential for renovations, or a high-demand rental area. For example, “Fixer-upper in an up-and-coming neighborhood” speaks directly to flippers or buy-and-hold investors.

- Advertise in the Right Places: Post your listing on platforms investors frequent, such as Zillow, Craigslist, Facebook Marketplace, and investor-specific forums or groups.

- Network Locally: Attend real estate meetups or contact local investor groups. Building connections can quickly bring in interested buyers.

For instance, if your property is near a growing business district, mention its rental income potential—this can appeal to rental property investors.

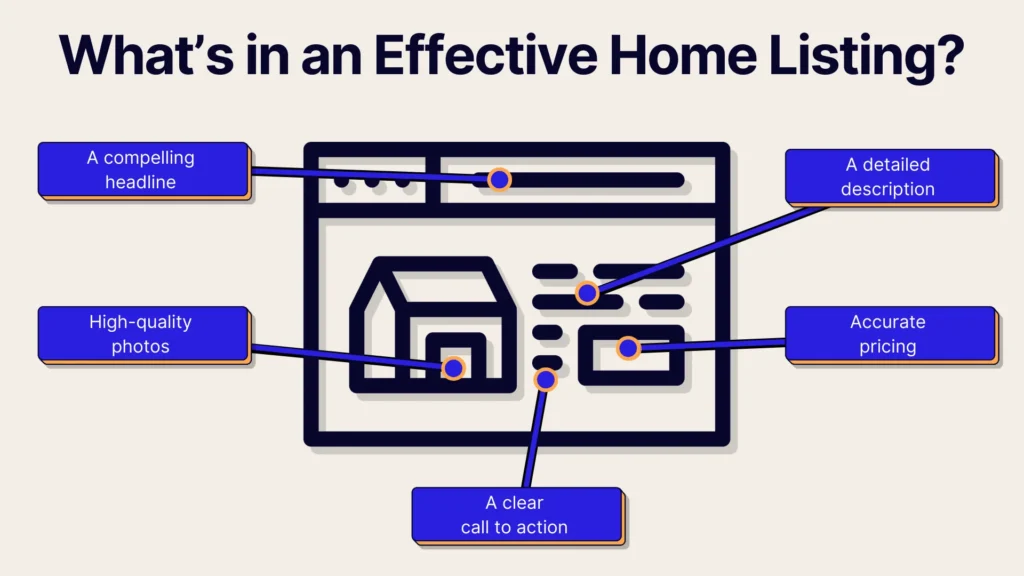

Creating a Competitive Listing

Investors look for properties that stand out as good opportunities. Make your listing appealing by being transparent and detailed:

- Provide Essential Information: Include the size, layout, condition, and notable home features. Mention repairs needed or the potential for upgrades.

- Use High-Quality Photos: Even if the property isn’t pristine, clear, well-lit photos help investors evaluate its potential.

- Be Transparent: Investors appreciate honesty. If the roof needs replacing or the plumbing is outdated, include that information to build trust and avoid wasting time.

A great example of a competitive listing might be a “3-bedroom home needing updates, with a spacious backyard and proximity to schools and public transit. Perfect for a fix-and-flip or rental property investment.”

Setting the Right Price

Pricing is critical when selling to an investor, as they factor in the cost of repairs, market conditions, and potential profit. Here’s how to establish a fair asking price:

- Conduct Market Research: Check the sale prices of similar properties in your area. Online tools like Zillow or Redfin can help you identify trends and benchmarks.

- Understand Investor Margins: Investors typically aim for a specific return on investment (ROI). For example, a house flipper may calculate the expected resale value minus repair costs and still expect a 10–20% profit margin.

- Price to Attract Offers: Set a competitive price that accounts for your home’s condition and leaves room for negotiation.

Suppose your home’s after-repair value (ARV) is $300,000, and the estimated repair costs are $50,000. An investor might aim to purchase the house for around $200,000 to ensure a profit. Pricing slightly above this range but within reason signals your understanding of the market while leaving room to negotiate.

Negotiating with an Investor

Once you’ve attracted investor interest, the next step is negotiating terms that work for both parties. Selling to an investor often means balancing speed and convenience with a fair deal. Here’s how to approach the process with confidence.

Preparing for Offers

Investors are usually prepared to make quick offers, but these offers may be below market value since they factor in their expected profits and potential repairs. Be ready for this and focus on the advantages, such as faster closing timelines and fewer contingencies.

You’ll also need to negotiate terms beyond just the price. Investors may propose flexible closing dates or request specific conditions like leaving appliances or selling the property “as-is.” Knowing what’s important to you—whether it’s a quick sale or particular terms—will help you navigate these discussions.

Key Negotiation Tips

Keeping a clear, business-focused mindset is essential when negotiating with an investor. Here are some tips to help you stay on track:

- Focus on the Benefits: Highlight the speed and simplicity of the deal for both sides. By being flexible or selling as-is, emphasize the value you’re offering.

- Avoid Emotional Attachment: Investors aren’t buying your memories—they’re buying a property. To negotiate effectively, keep emotions out of the conversation.

- Know Your Bottom Line: Before negotiations begin, determine the minimum price and terms you’re willing to accept. This clarity will help you avoid feeling pressured into an uncomfortable deal.

If you’re selling a home that needs repairs, remember that the investor is taking on that burden, which justifies their slightly lower offer.

Addressing Common Investor Requests

Investors may have specific requests during the negotiation process. Being prepared to address these can make the process smoother:

- Property Access: Investors often want to bring contractors or inspectors for walk-throughs to assess repair needs. Be flexible but set clear guidelines on scheduling.

- Flexibility on Closing Dates: Some investors might need extra time to finalize financing or line up contractors, while others may want to close quickly. Be transparent about what works for your timeline.

- Including Items in the Sale: It’s common for investors to request that certain appliances or fixtures stay with the property. Decide in advance what you’re willing to leave behind.

For example, if an investor asks for a 30-day closing instead of the standard 14 days, consider whether the trade-off is worth it for a stronger overall deal.

Common Pitfalls to Avoid

Selling your home to an investor can be a smooth and rewarding experience, but there are potential missteps that could cost you time or money. Knowing what to watch out for can help you navigate the process confidently and avoid common pitfalls.

Accepting an Offer Too Quickly

It’s tempting to accept the first offer, especially if you’re eager to sell, but rushing the decision can backfire. Take the time to compare offers and research the buyer’s credentials. Even an excellent upfront offer might have unfavorable terms or unexpected complications.

For example, an investor might offer a quick close but include clauses that require additional concessions from you later. Always read the fine print and understand the terms before accepting.

Not Verifying the Investor’s Experience

Not all investors are created equal. Some have a solid track record, while others might need more expertise or funding to follow through on their promises. Before committing, ask for references, check online reviews, and verify their credentials.

An investor who avoids direct questions about their funding or past transactions might be a red flag. Choose someone reputable to minimize the risk of delays or failed deals.

Overlooking Market Research

You could accept an offer far below its worth without understanding your home's market value. Do your homework by researching comparable sales and determining your property’s condition.

For instance, if the average sale price for homes like yours is $250,000, and you receive an offer for $180,000, ensure you understand why the offer is lower. Is it due to repair costs, or is the investor undervaluing your home?

Ignoring Red Flags in Contracts

Investors often use their own contracts, which may include clauses that aren’t in your favor. For example, a clause that allows the investor to back out at the last minute without penalties could leave you stranded. Review the agreement carefully, and if possible, have a real estate attorney or experienced professional look it over before signing.

Neglecting Contingency Planning

Even with the best preparation, deals can sometimes fall through. A backup plan, such as an alternate investor or a traditional sale strategy, ensures you’re not left scrambling if things don’t go as planned.

Conclusion

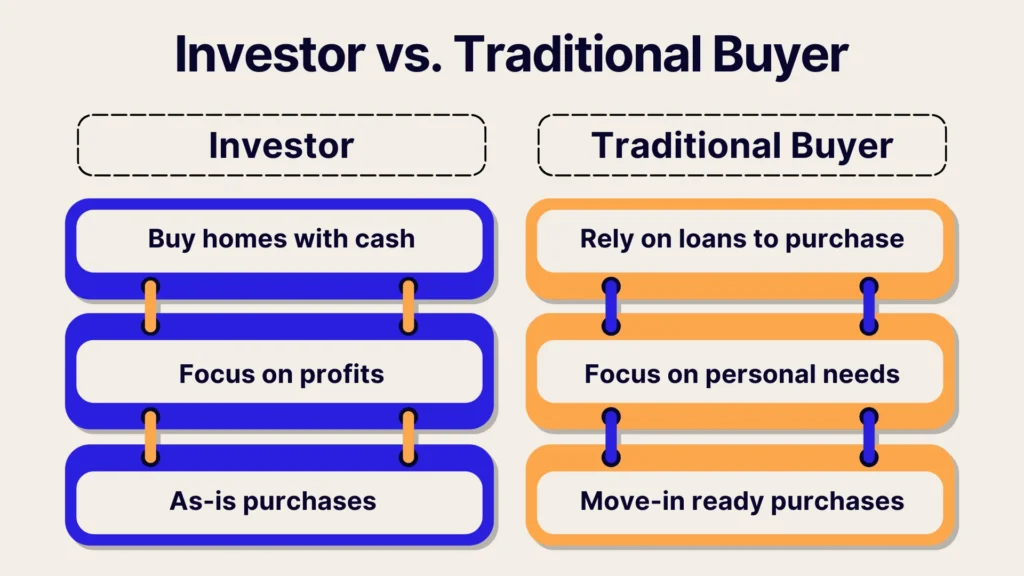

Selling your home is a significant decision, and choosing the right buyer – whether an investor or a traditional buyer – depends on your specific goals. Investors offer speed and convenience, while traditional buyers may provide higher offers and a personal touch.

With Propbox, you don’t have to choose blindly. Our platform empowers you with AI-enhanced pricing tools, real-time updates, and transparency at every step, ensuring you maximize your home’s value and find the perfect buyer on your terms. Start your journey to a smarter sale with Propbox today!