Not sure when to put your home on the market? Don't worry - lots of homeowners wrestle with this decision. Getting the timing right can make a real difference in how quickly your home sells and the price you get for it.

Think of it like putting together a puzzle. You'll want to look at what's happening in your local housing market, what season it is, how the economy's doing, and what's going on in your own life. Keep reading this guide to learn how to identify the prime time to sell your home.

What is the Best Time to Sell a Home?

Picking the best time to sell your home comes down to a few key things to watch for. First, keep an eye on your local market - when there are lots of eager buyers but not many homes available, you're more likely to get a great price and a quicker sale.

Spring and summer are usually the busiest seasons for home buying, as more people are out looking and homes tend to show better. The overall economy plays a big part as well, as things like interest rates, job market health, and inflation can affect how many buyers are house hunting and how much they can spend.

But don't forget about your own situation. Maybe you're ready for a bigger home, relocating for work, or looking to cash in on your investment. Whatever your reason, the best time to sell is when both the market looks good and the move makes sense for you personally.

What Factors Influence the Best Time to Sell a Home?

Several critical factors determine the optimal timing for selling a home, each interlinked with the broader real estate market and personal circumstances. Let’s take a look at each one for a deeper understanding of how they affect home sale profitability:

Market Conditions

Market conditions are a pivotal factor in determining the optimal time to sell a home. The dynamic between buyer demand and inventory levels sets the stage for a seller's advantage, often leading to quicker sales and elevated prices. Meanwhile, a surplus of homes with fewer interested buyers tips the scale towards a buyer's market, potentially prolonging sale times and reducing sale prices.

Seasonal Trends

The influence of seasonal trends cannot be overstated, with spring and summer consistently marked as prime times for selling. These seasons are characterized by increased buyer activity, offering an opportune moment for homeowners to list their properties. However, it's important to note that regional differences can affect the optimal season for home sales, underscoring the importance of localized market insight.

Economic Indicators

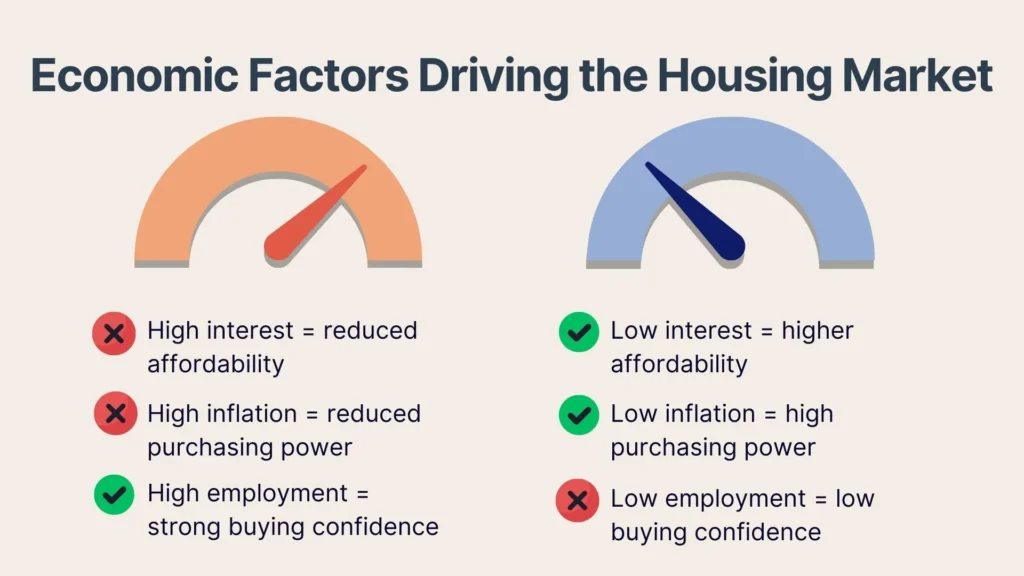

Economic indicators such as interest rates, employment rates, and inflation wield considerable influence over the housing market's health. Favorable interest rates enhance mortgage affordability, spurring buyer interest, while robust employment rates fortify buyer confidence. On the other hand, rising inflation can erode purchasing power, negatively impacting buyer demand.

Personal Circumstances

Ultimately, personal circumstances play a decisive role in the timing of a home sale. Whether driven by financial necessities, life transitions, or the pursuit of investment opportunities, these personal considerations can significantly impact a homeowner's decision on when to sell.

How Do Market Conditions Affect Home Selling?

Market conditions are a critical factor in the home selling process, influencing both the speed and profitability of sales. Some factors result in a seller’s market, while others result in a market more favorable to buyers. Let’s dive in further to learn how to take advantage of good market dynamics:

Buyer Demand

Buyer demand plays a pivotal role in shaping the home selling landscape. When demand is high, the market becomes competitive, empowering sellers to achieve higher sale prices and swift transactions. In contrast, low demand may lead to extended periods on the market and could compel sellers to adjust prices downward to entice buyers.

Accurately assessing buyer interest is crucial for sellers aiming to optimize their sale timing and strategy.

Inventory Levels

Inventory levels are a fundamental factor affecting home sale dynamics. A low inventory scenario typifies a seller's market, where the scarcity of available homes intensifies buyer competition, often resulting in elevated sale prices and quicker sales. Meanwhile, a market saturated with listings creates a buyer's market, offering buyers more choices and leverage, potentially leading to lower sale prices and pushing sellers to make more concessions.

Local Market Trends

Local market trends offer critical insights into the nuanced conditions affecting home sales within specific communities or regions. Elements such as economic development, employment opportunities, and new housing developments can significantly sway buyer interest and activity. Sellers who grasp these local nuances can more effectively position their homes in the market, leveraging favorable conditions to their advantage.

How Do Seasonal Trends Impact Home Sales?

Seasonal trends significantly shape the dynamics of home sales, influencing both buyer behavior and sale outcomes. Traditionally, spring and summer emerge as peak seasons for selling due to increased buyer activity, attributed to more favorable weather and the desire to move before the new school year. Homes listed during these months often benefit from higher visibility, potentially leading to quicker sales and more competitive offers.

Fall and winter see a slowdown in the market, with lower buyer activity but also less competition among sellers. This seasonal rhythm allows sellers to strategically plan their listing to align with times of high demand, optimizing their chances for a successful and lucrative sale.

Economic Indicators When Selling A Home

Economic indicators play a crucial role in the home selling process, directly impacting both the market environment and potential buyers' behavior. Key indicators such as interest rates influence mortgage affordability, with lower rates typically boosting buyer interest by making home loans more accessible. Employment rates serve as a gauge of economic health, where higher employment suggests more financially secure buyers entering the market.

Inflation can affect purchasing power, potentially dampening buyer demand if it leads to higher living costs without commensurate wage increases. Sellers must consider these indicators to time their sale effectively, aligning with economic conditions that favor high buyer activity and willingness to invest in real estate.

Interest Rates

Interest rates significantly dictate mortgage affordability, serving as a key driver in the real estate market's dynamics. Lower interest rates reduce the cost of borrowing, enhancing buyers' purchasing capabilities. This often results in increased market demand, potentially leading to favorable outcomes for sellers, such as faster sales and higher transaction prices.

Impact on Mortgage Affordability

The impact of interest rates on mortgage affordability is profound. As interest rates decline, the financial burden of new mortgages lessens, making home ownership more attainable for a wider audience. This accessibility can invigorate the housing market, creating advantageous conditions for sellers.

Employment Rates

Employment rates serve as a critical indicator of economic stability and exert a substantial influence on buyer confidence. A robust employment landscape instills confidence in potential buyers, encouraging them to commit to significant investments like home purchases. This heightened buyer activity can positively affect the real estate market.

Influence on Buyer Confidence

The influence of employment rates on buyer confidence is direct and significant. Economic stability, as evidenced by solid employment figures, reassures buyers about making large financial decisions. This increased confidence can lead to heightened demand in the housing market, benefiting sellers.

Inflation

Inflation plays a crucial role in shaping the real estate market by impacting purchasing power. Rising inflation means the cost of living increases, which can erode the amount of money buyers have available for home purchases. This erosion of purchasing power may lead to a cooling of the housing market, presenting challenges for sellers.

Effect on Purchasing Power

The effect of inflation on purchasing power directly influences buyer activity in the housing market. As inflation climbs, the real value of money diminishes, potentially reducing the pool of buyers able to afford homes. This decrease in purchasing power can slow market activity, affecting how quickly and at what price homes are sold.

How Can a Homeowner Determine the Best Time to Sell Their Home?

A homeowner can pinpoint the best time to sell their home by analyzing:

- Market conditions

- Seasonal trends

- Economic indicators,

Aligning these factors with your personal circumstances to get insights into buyer demand, gain a deeper understanding of the home's value within the current market, and plan for your financial goals. By synthesizing this information, you can make informed decisions and sell at a time that maximizes your financial benefit and aligns with your plans.

Research the Local Market

Researching the local market is crucial for homeowners aiming to understand the nuances of market conditions. This step uncovers vital information on buyer demand and inventory levels, providing insights into whether the current market favors sellers or buyers.

Market Analysis Tools

Market analysis tools empower homeowners with in-depth analyses of the real estate market, including comparative market analysis (CMA). These tools help in understanding how similar homes in the area have been priced and sold, offering a benchmark for pricing and insight into prevailing market trends.

Online Valuation Tools

Online valuation tools offer a quick and accessible means to estimate a home's market value, drawing on extensive market data and property specifics. While not replacing a professional appraisal, these tools provide a valuable preliminary assessment, helping homeowners in gauging their property's worth within the current market landscape.

Personal Financial Goals

Personal financial goals play a pivotal role in the decision to sell a home. Homeowners should carefully consider how the sale aligns with their broader financial objectives, be it upgrading, downsizing, or reallocating assets. Optimal timing for the sale is key to ensuring it supports these long-term financial plans.

Signs That It’s the Right Time to Sell

Identifying the right time to sell a home involves recognizing key signals within the market and aligning them with personal readiness. High buyer demand coupled with low inventory levels in the local market often indicates a seller's market, presenting an opportune moment for homeowners to achieve favorable sale conditions. Seasonal patterns, such as increased activity during spring and summer, can also signal advantageous selling times.

Positive economic indicators, including low interest rates and strong employment rates, suggest a robust market where buyers are more likely to purchase. On a personal level, achieving financial stability or encountering life events that necessitate a change in living arrangements can be strong indicators that the time is right. Recognizing these signs, both in the market and in one’s personal life, is crucial for timing the sale of a home for optimal results.

Signs to Wait Before Selling

Sometimes waiting to sell your home makes just as much sense as jumping into the market. If there are lots of houses for sale but not many buyers looking, you might face a tough time: your home could sit on the market longer and you might have to lower your price. The market typically slows down in fall and winter too, when fewer people are house hunting.

The overall economy plays a big role as well. When interest rates go up or jobs become scarcer, buyers often need to tighten their belts, making it harder to sell your home. And if you're dealing with your own financial uncertainty, or if selling now doesn't match up with your money goals, it's perfectly fine to wait. By paying attention to these signs, you can avoid selling at the wrong time and wait for better market conditions.

Conclusion

Selling your home isn't just about putting up a "For Sale" sign; it's about finding the right moment when everything lines up. You'll want to look at what's happening in your local housing market, what time of year it is, how the economy is doing, and most importantly, whether it fits with your own financial plans.

The best scenario is usually when there are lots of buyers but not many houses for sale - that's when you're likely to get the best price. But at the end of the day, the perfect time to sell is when the market works in your favor and you're personally ready for the move. This way, you can feel confident you're making the right decision for your situation.