Ever spot a home labeled “contingent” and wonder what that actually means? Think of it as a temporary hold: the buyer and seller have agreed on a sale, but it won’t be final until a few conditions like inspections or financing are met. Understanding contingencies helps you make smarter decisions, whether you’re selling and want to protect yourself or buying and need loan certainty.

Let’s dive deeper into how contingent listings differ from others and why sellers often choose this status in the first place.

What Is A Contingent Home Listing?

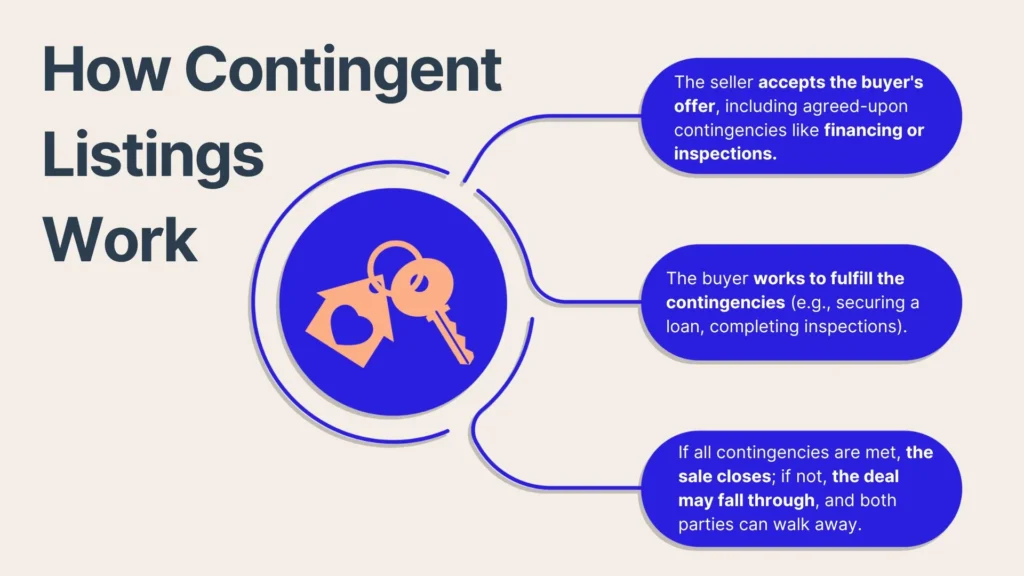

A contingent home listing means the property is under contract, but the sale isn’t final until certain conditions like financing or inspections are met. You can think of it as the deal being “on hold.” If everything goes smoothly, the sale moves forward; if not—say the buyer can’t secure a loan—the buyer can back out and both parties walk away.

What makes a contingent listing different from a pending sale is that there are still some loose ends to tie up. Pending sales have cleared most major hurdles, while contingent listings indicate a few remaining conditions that need resolving.

Now that we know what a contingent home listing is, let’s explore why sellers sometimes choose to list their homes this way.

Why List Homes As Contingent?

Listing your home as contingent isn’t just a bureaucratic step—it’s a strategic move that can really work in everyone’s favor. In fact, a recent survey by the National Association of Realtors found that nearly 30% of home sales include contingency clauses.

This shows that contingencies play a key role in today’s market. By marking a home as contingent, sellers make it clear that the deal depends on certain conditions being met—like a smooth inspection process or the final green light on mortgage approval.

Not only does this give buyers the confidence to move forward with their purchase, but it also shields sellers from potential headaches if something goes awry. Let’s take a closer look at what that means:

Ensures Buyer’s Ability To Proceed

One of the biggest worries for sellers is whether the buyer can actually close the deal. Contingencies, such as those related to financing or the sale of the buyer’s current home, provide a framework that keeps the transaction on track.

When the buyer meets these contingencies, the seller gains confidence that the buyer is serious and financially capable. If a buyer fails to meet a financing contingency, for example, the contract often allows the seller to step away and consider a more reliable offer.

Mitigates Risks For Sellers

A contingent listing can actually lower the seller’s overall risk. Imagine a situation in which a buyer finds a significant issue during an inspection and wants expensive repairs. Because there’s an inspection contingency in place, the buyer can either request repairs, renegotiate the price, or exit the deal if no agreement is reached.

It might sound like a headache for the seller, but the contingency essentially prevents bigger disputes down the line. If both sides can’t see eye to eye, they end the contract under the contingency terms, which can be less messy than a legal battle after closing.

Common Home Listing Contingencies

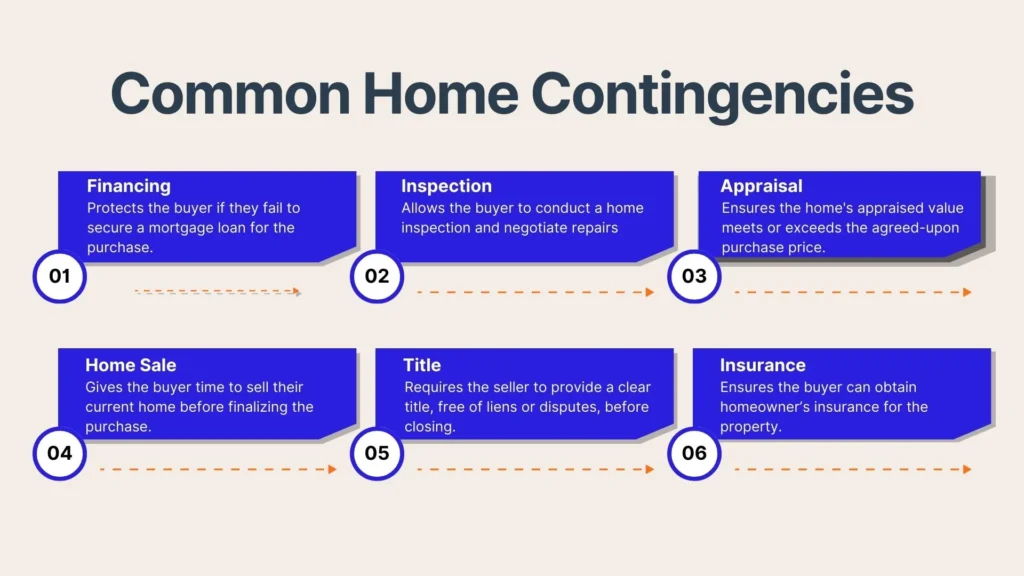

Contingent listings often involve one or more typical stipulations. These can vary depending on regional real estate practices, the nature of the property, or even the financial situation of the buyer. Let’s break down some of the most common scenarios you’re likely to see.

Inspection Contingencies

Inspection contingencies give buyers a comfortable way to ensure the home is in good shape before sealing the deal. In fact, around 85% of buyers include this clause in their contracts, which shows just how common and useful it is.

With this safety net, you get the home professionally evaluated, helping uncover any hidden issues like structural damage or mold that might not be immediately obvious. If problems pop up, you can chat with the seller about making repairs, lowering the price, or finding another solution that works for both parties.

And if you can’t reach an agreement, you have the freedom to walk away without any penalties. This approach not only protects you from unexpected repair bills but also encourages sellers to be upfront about the home’s condition.

Financing Contingencies

Most home purchases involve a mortgage. A financing contingency states that if the buyer can’t finalize their loan, they can pull out of the deal and have their deposit returned.

This clause is important for anyone who isn’t paying cash because life can be unpredictable—employment changes, interest rates can fluctuate, or unforeseen debts might come to light.

A financing contingency covers these potential pitfalls and gives the buyer an exit strategy, while the seller isn’t stuck waiting indefinitely for a loan that may never come through.

Appraisal Contingencies

An appraisal contingency ensures that the home’s appraised value meets—or surpasses—the agreed-upon sale price. Lenders typically require an official appraisal to confirm the home’s worth before approving a mortgage.

If the home appraises for less than the purchase price, it can jeopardize the buyer’s ability to secure a loan for the full amount. In these cases, buyers and sellers often renegotiate. If they can’t reach a mutual understanding, this contingency allows the buyer to back out without losing their earnest money.

Sale Of Current Home Contingencies

Some buyers need to sell their existing property before purchasing another one. A “sale of current home” contingency gives them time to do just that. This can be comforting to buyers who aren’t comfortable juggling multiple mortgages, but it introduces an added layer of uncertainty for sellers.

If the buyer’s home sale is delayed or falls through, the entire new purchase could collapse. Often, sellers will agree to this contingency only if they feel confident in the buyer’s ability to sell quickly or if the real estate market is particularly strong.

Contingent Status Impact on Buyers

Seeing a home marked as “contingent” doesn’t mean it’s completely off-limits. In many cases, a contingent listing is still open for backup offers, and you never know if the current deal will actually go through. As a buyer, you might have specific approaches to consider when you spot a contingent listing.

Potential For Negotiation

When a home is labeled contingent, the seller and buyer have already struck some kind of agreement. However, there may still be room for negotiation, especially if one of the contingencies hits a snag. For instance, if an inspection uncovers issues that lower the home’s value, the buyer might attempt to renegotiate the price.

Should that buyer back out, you could swoop in with a competitive offer. Adding to this flexibility, PropBox’s Automated Counteroffers feature can automatically send counteroffers that incorporate seller preferences for closing timelines, contingencies, or price changes, giving you an edge in fast-moving situations.

Price And Terms May Be Adjustable

Contingencies aren’t just about buyer protection. They also play into how flexible the overall transaction is. If an appraisal comes in low, the seller might reduce the price or the buyer might increase their down payment. Changes to the closing timeline may also crop up.

As a potential backup buyer, you could negotiate more favorable terms for yourself if the primary deal starts to wobble. Keep in mind that the seller is likely receiving multiple offers, so you’ll want to stay agile and ready to act quickly.

Signals Closing Delays

Even if a contingent status doesn’t always result in a delay, the reality is that factors like financing delays, extra inspections, or prolonged negotiations over repairs can extend the closing process.

This delay can be a significant source of frustration when strict move-in or move-out schedules are at play. Contingencies are important for protecting everyone’s interests, yet they might contribute to further delays.

With PropBox’s AI negotiation suggestions feature, you receive expert risk assessments that cover issues such as financing challenges and contingency details, helping you negotiate better under pressure.

Contingencies Can Extend Closing Timeline

We’ve alluded to this above, but it’s worth reiterating: one or more contingencies can tack on days, weeks, or even months to a home sale. This might mean a second appraisal is required, or that the buyer’s first lender falls through and they need to find another.

If you’re considering jumping in as a backup buyer, understand that your own closing process could be delayed if the first deal takes extra time to resolve.

Approaching Contingent Listings

When you come across a property labeled as contingent, you shouldn’t immediately rule it out. Instead, gather information, assess your options, and engage in open communication with your agent. Here are some practical tips on how to handle contingent listings.

Understand All Contingencies

First and foremost, find out exactly which contingencies are in place.

Is the buyer waiting on a clean inspection report? Are they trying to sell another property? Or is the hold-up related to finalizing a mortgage? Once you have that information, you can figure out whether the existing contract is likely to close smoothly or if there’s a decent chance of it falling apart.

Know What Each Contingency Entails

Different contingencies carry different levels of risk. A financing contingency might be a straightforward wait-and-see situation. For example, if the buyer’s loan is near approval, the deal might not collapse. On the other hand, if it’s a “sale of current home” contingency, there’s a bit more unpredictability.

The buyer’s local market conditions, their listing price, and how quickly they can attract offers can make or break the deal.

Prepare For Negotiations

If you decide to place a backup offer, make sure you’re ready to negotiate. Consider crafting an offer that’s either more appealing in price or more flexible in closing terms. By presenting an offer without demanding additional contingencies, you might entice the seller to keep you in mind if the primary deal begins to unravel.

Anticipate Counteroffers And Conditions

It’s entirely possible the seller will come back with counteroffers, especially if they’re already mid-negotiation with the current buyer.

They may leverage your interest to prompt the original buyer to remove certain contingencies or meet certain demands more quickly. Be patient and prepared to navigate a dynamic situation. Even if you don’t end up with the property, your strong backup offer might just position you favorably for another opportunity the seller might have.

Conclusion

In today’s market, contingent home listings help ensure that sellers avoid wasting time with unqualified buyers and that buyers remain protected from issues like unexpected inspection flaws or financing difficulties. Although contingencies sometimes prolong the sales process, they promote fairness and open the door to strategic negotiations and backup offers.

PropBox revolutionizes your selling experience by automatically reviewing and comparing offers using advanced AI that evaluates price, financing, and contingencies. It instantly calculates net proceeds and provides informed, risk-aware negotiation suggestions while automating counteroffer submissions, preparing acceptance documents, and coordinating crucial timelines.

Transform your home-selling journey—choose PropBox today and take full control of a faster, simpler, and more rewarding sale than ever before.