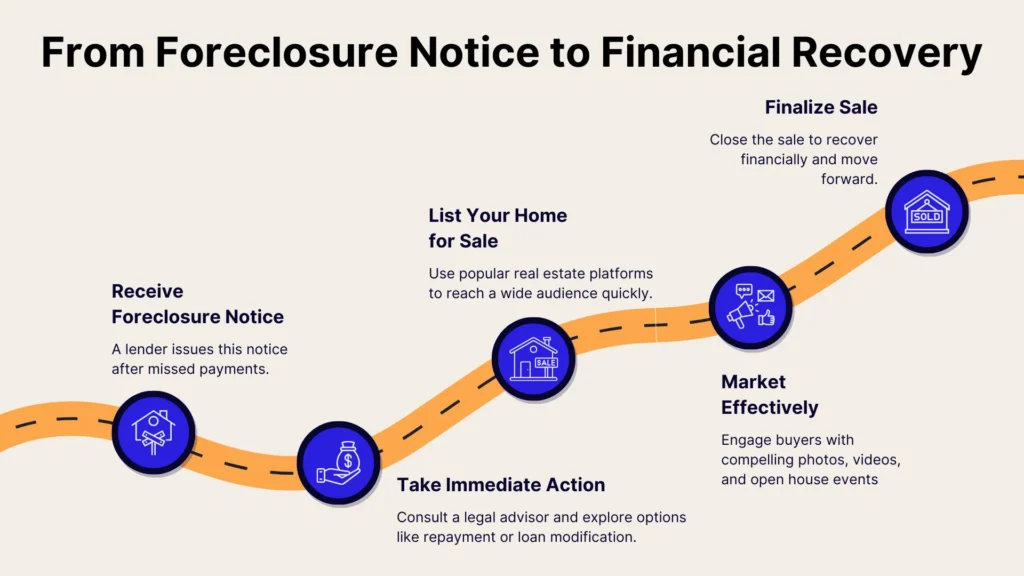

Facing a foreclosure notice can be daunting for any homeowner because of the remaining mortgage payments you’d have to make in a usually tight timeline. But what if you decide to sell your property after receiving such a notice? Doing so offers you a quick way to settle your foreclosure payments – and if done well – even make you profit along the way.

While the foreclosure process leaves you with less time and fewer chances to make the perfect sale, selling your property can still be your most viable and financially liberating option. In this guide, we’ll walk you through everything you need to know to sell your post-foreclosure notice property, offering a lifeline during a challenging period.

Dive in to discover how to turn a difficult situation into an opportunity for a fresh start.

What is a Foreclosure Notice?

If you’ve defaulted or missed too many payments on your mortgage, your lender or bank can issue a foreclosure notice, starting a legal process that may end in your property’s repossession. While the document is essentially a legal final warning, you’re usually given a reasonable timeline to settle this debt according to your situation.

The process and specific requirements for issuing a foreclosure notice can vary by jurisdiction, but either way, you’ll have to be quick about resolving the situation to avoid losing your home. Be sure to understand the legal implications and specifics of foreclosure in your locality to ensure compliance and avoid further issues when attempting to settle with your bank or mortgage lender.

How to Market Your Home Post-Foreclosure

Marketing your home after receiving a foreclosure notice requires a strategic approach to attract potential buyers quickly. There are three things that will generally improve your home listing’s visibility and attract interested When executed well, these marketing strategies can expedite the sale of your home post-foreclosure and pave your path to financial recovery:

Using Major Real Estate Listing Websites

Use major real estate platforms like Zillow or Redfin to maximize your home's visibility. These tools are frequented by potential buyers actively seeking new properties, meaning you tap into a vast audience, greatly increasing your chances of quickly attracting serious interest.

Creating Engaging Content for Social Media

Develop engaging content for social media to capture and retain the interest of potential buyers. Use high-quality images, compelling videos, and captivating stories about your property to showcase and emphasize its features and increase your home’s exposure.

Organizing Well-Timed Open Houses

Ensure the property is ready for well-timed open houses to provide interested buyers with a real-life experience of your property. Open houses and even private viewings are great for making personal connections and giving buyers a true sense of the home's atmosphere.

Legal Considerations for FSBO Sellers

Familiarizing yourself with the foreclosure process can prevent potential legal pitfalls, as it’s the same process that sets the legal framework within which you can even sell your property. The mandates and procedures may vary from state to state, so make sure to work with trusted legal counsel when selling your post-foreclosure home.

Let’s take a look at some of the most important things to consider when selling your home under foreclosure.

There is usually a pre-foreclosure process that you can navigate to avoid repossession in the first place. It’s not always just about completing your mortgage payments on time. Regardless of your specific situation, understanding the pre-foreclosure process and its related rights and obligations helps you explore all available options to avoid foreclosure. This empowers you to make informed decisions that best suit your situation:

Mandatory Disclosures About Property Condition

Whether or not you had enough time to prep your property for sale, you’re obligated to inform your potential buyers of any known defects or issues with the property, such as the foreclosure notice itself.

This transparency is not only a legal obligation but also fosters trust between you and the buyer, potentially facilitating a smoother transaction and safeguarding both parties from future legal challenges.

Pricing Strategies for a Quick Sale

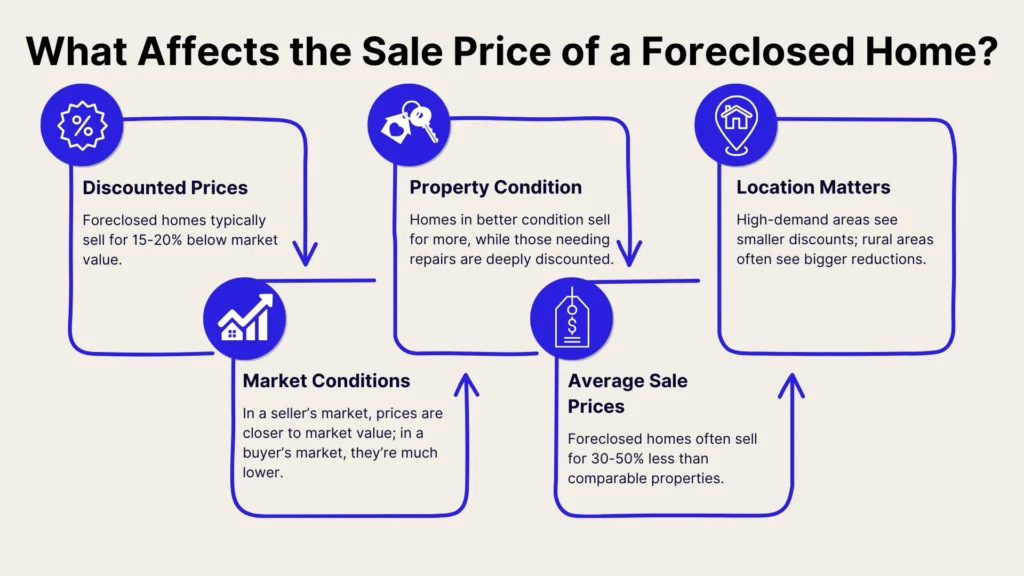

Pricing your property well is key to facilitating a quick sale, especially in a post-foreclosure scenario. The total mortgage can be a good benchmark for pricing your property, as any value over this would net you a profit that you typically won’t have to share with your bank or mortgage lender.

You’ll have to make sure to keep your price realistic, considering a quick sale is likely more important to you than a perfect one. Let’s take a look at how to achieve this.

Conducting a Thorough Comparative Market Analysis (CMA)

Conduct your market research to set a competitive price for your home. This process entails a detailed comparison with similar properties in your area that have recently been sold, are on the market, or were previously listed but did not sell.

A comprehensive CMA provides a deep understanding of the local real estate market, enabling you to price your home in a way that attracts potential buyers while ensuring you do not undervalue your property.

Adjusting for Repairs and As-Is Condition

Recognize that your home may require significant repairs – pricing it accordingly can attract a specific segment of buyers looking for homes they can renovate or customize. This pricing strategy accounts for the current condition of your home and offers it at a price that reflects its value. By considering essential repairs and adjusting the price, you’ll speed up the sales process.

Effective Negotiation Tactics

Establishing your minimum asking price and being more flexible about terms and dates can give you signficant advantages in selling your property. Here’s how you can combine these tactics for effective negotiations to increase the likelihood of closing a sale.

Establishing Minimum Acceptable Offers

Set minimum acceptable offers as a firm foundation for the selling process. This streamlines negotiations by eliminating lowball offers but also ensures that discussions start from a position that respects your financial needs. By defining this threshold, you prioritize serious offers that align with your valuation of the property.

Flexibility in Terms and Closing Dates

Flexibility in terms and closing dates significantly increases the appeal of your property to a broader audience of potential buyers. An openness to negotiate various aspects of the sale, beyond just the price, can meet the diverse needs of buyers. This flexibility, especially regarding closing dates, can be particularly appealing, offering a competitive edge in the real estate market and facilitating a smoother path to sale completion.

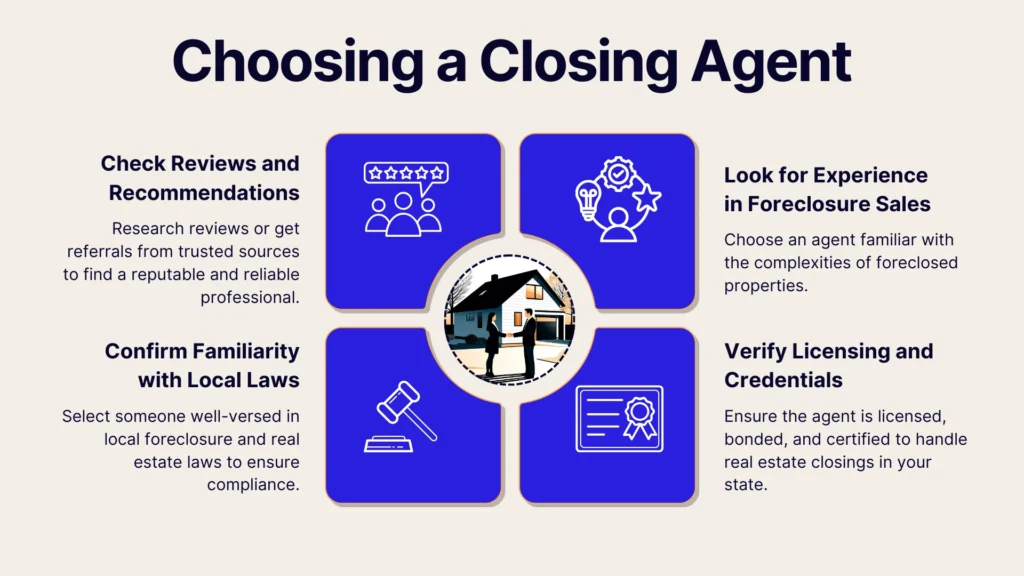

Streamlining the Closing Process

Streamlining the closing process is crucial for a smooth and efficient sale, particularly for FSBO sellers. Selecting an experienced closing agent plays a vital role in this phase. A knowledgeable agent can navigate the complexities of real estate transactions, ensuring all legal and financial requirements are met.

Additionally, gathering necessary documents early on is imperative. Being prepared with all required paperwork, such as the deed, loan documents, and home inspection reports, can prevent delays. This proactive approach not only expedites the closing process but also minimizes stress for both sellers and buyers, leading to a successful and timely property transfer.

Selecting an Experienced Closing Agent

While you can forego a real estate agent’s help if you’re going the FSBO route, you may want to get a closing agent to handle the title and deed preparations for the home. Their expertise is invaluable in navigating potential challenges and ensuring the sale concludes successfully and without unnecessary delays.

Gathering Necessary Documents Early On

Gathering necessary documents early on is a must for expediting the closing process. Early preparation of critical documents, including the property deed, loan documents, and home inspection reports, can prevent last-minute hurdles.

This forward-thinking approach allows for a more streamlined transaction, ensuring all parties have access to the required information promptly. Overall, preparing ahead will lead to a smoother and quicker conclusion to the sale.

Post-Sale Financial Planning

After successfully selling a property – especially under foreclosure conditions – post-sale financial planning becomes crucial. Understanding the tax implications and seeking professional advice can help mitigate unexpected tax burdens. Likewise, you’ll need to consider securing your housing after the sale.

Let’s take a look at what steps you can take after your sale to better secure your financial standing:

Handling Potential Tax Liabilities

Handling potential tax liabilities is another important step in post-sale financial planning. Optimize the financial outcome of your sale by understanding the tax consequences surrounding it. Consulting with a tax professional can illuminate the path to minimizing liabilities, ensuring you maximize the proceeds from your sale.

Securing Housing After Selling Under Foreclosure

Securing housing after selling under foreclosure demands strategic foresight. Identifying your next living situation, whether it involves renting a new place or purchasing another property, should be approached with consideration of your current financial standing. Early planning facilitates a smoother transition, offering you peace of mind and stability following the sale.

Conclusion

A foreclosure notice doesn’t have to mean the end of the road—it can be an opportunity to settle debts and secure a fresh start. Selling quickly and efficiently is key, but hiring a realtor can be expensive and time-consuming.

With Propbox, you don’t have to sacrifice efficiency for affordability. Our flat-rate platform provides everything you need to sell your home quickly – AI-powered pricing tools, automated organization, and seamless marketing – all without the 6% commission. Join now and list your home smarter with Propbox!