An accurate home appraisal is crucial to the overall success of your sale because it establishes the value of your property and influences your pricing strategy. But what happens when an appraisal is wrong?

Incorrect appraisals can disrupt the selling process, creating stress, financial setbacks, and delays. If you’re managing your own home sale, keep reading. We’ll give an in-depth explanation of why appraisals may be inaccurate, how they can affect your sale, and what steps you can take to address these issues.

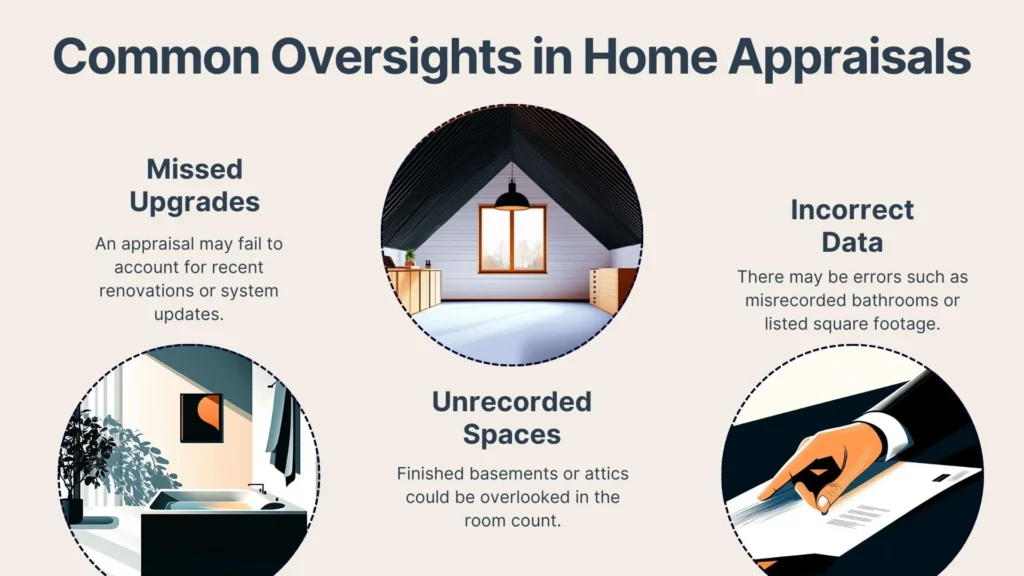

Reasons Why A Home Appraisal May Be Wrong

Appraisals are designed to provide an objective evaluation of a property’s value, but they aren’t perfect. Mistakes or misjudgments can occur for a variety of reasons, such as the following:

Human Error In Data Collection Or Analysis

Human error is one of the most common reasons appraisals go wrong. Appraisers rely heavily on accurate data collection, but mistakes in measuring square footage, counting rooms, or noting features can result in an undervalued or overvalued home.

For instance, missing an additional finished basement or failing to account for recent upgrades, like a new HVAC system, can skew the valuation. Even seemingly small oversights, like misrecording the number of bathrooms, can have a significant impact, leaving sellers at a disadvantage.

Market Volatility Affecting Property Values Rapidly

The real estate market can change quickly, and appraisals don’t always keep up. In fast-paced markets, where demand pushes prices higher, appraisals may lag behind actual property values.

Conversely, in a cooling market, appraisals might overestimate value based on older, higher-priced sales. This is especially common in neighborhoods undergoing rapid changes or areas with highly seasonal demand. Appraisers working with outdated data may unintentionally undervalue or overvalue a home.

Inconsistent Comparables Due To Unique Properties

Not all homes fit neatly into standard comparisons, and this can lead to inaccurate appraisals. Properties with unique designs, premium finishes, or substantial upgrades may not have comparable homes nearby, making it harder for appraisers to determine value.

In rural areas or neighborhoods with limited recent sales, appraisers often rely on older or less relevant data, which can skew results. For example, a home with a fully landscaped outdoor area or energy-efficient systems might be undervalued when compared to properties lacking these features.

Lack Of Local Market Knowledge By The Appraiser

An appraiser unfamiliar with the nuances of a local market may overlook critical factors that influence property values. Proximity to good schools, public transit, or local amenities can significantly affect a home’s worth. Appraisers who don’t have a deep understanding of these regional dynamics may fail to account for them, resulting in an inaccurate appraisal. This issue is particularly problematic in areas experiencing rapid growth or gentrification.

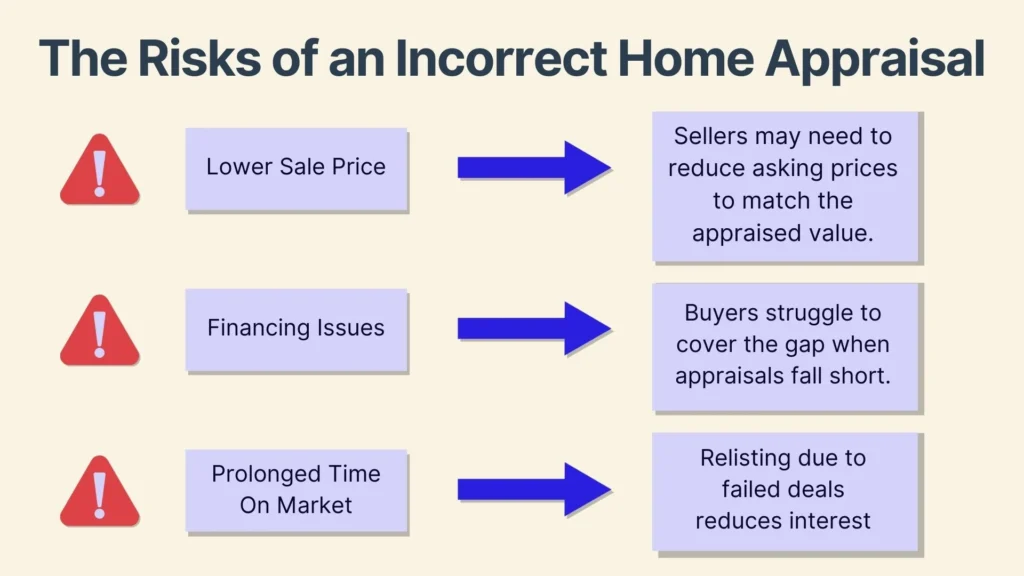

How Can An Incorrect Appraisal Affect Your FSBO Sale?

For FSBO sellers, an incorrect appraisal can create significant obstacles. If the appraised value doesn’t align with expectations or the agreed-upon sale price, the transaction may face complications. These are some of the most common ones:

Lower Than Expected Sale Price

A low appraisal often forces sellers to lower their asking price to keep the deal alive. Since most buyers finance their purchase – on average covering 74% of the home price – lenders will only approve loans up to the appraised value. This leaves sellers with limited options.

For FSBO sellers, this can be especially frustrating, particularly if the appraisal discrepancy stems from an error or outdated data. Even in competitive markets, a low appraisal can undermine the perceived value of a home, creating unnecessary challenges.

Difficulty In Securing Buyer Financing

Appraisal issues can also complicate buyer financing. If the appraised value is lower than the agreed sale price, the buyer may struggle to secure sufficient funds. This is a significant concern for first-time buyers, who represent 24% of the market. Many first-time buyers lack the financial flexibility to cover the gap, which can lead to canceled deals, protracted negotiations, or requests for price reductions.

Prolonged Time On The Market

Incorrect appraisals can prolong the time your home stays on the market. When deals fall through due to appraisal issues, sellers often need to relist the property, which can lead to additional costs and reduced interest from potential buyers.

Homes that linger on the market too long may develop a bad reputation, with buyers assuming there’s an issue with the property. This makes it even more important for sellers to ensure the initial appraisal is as accurate as possible.

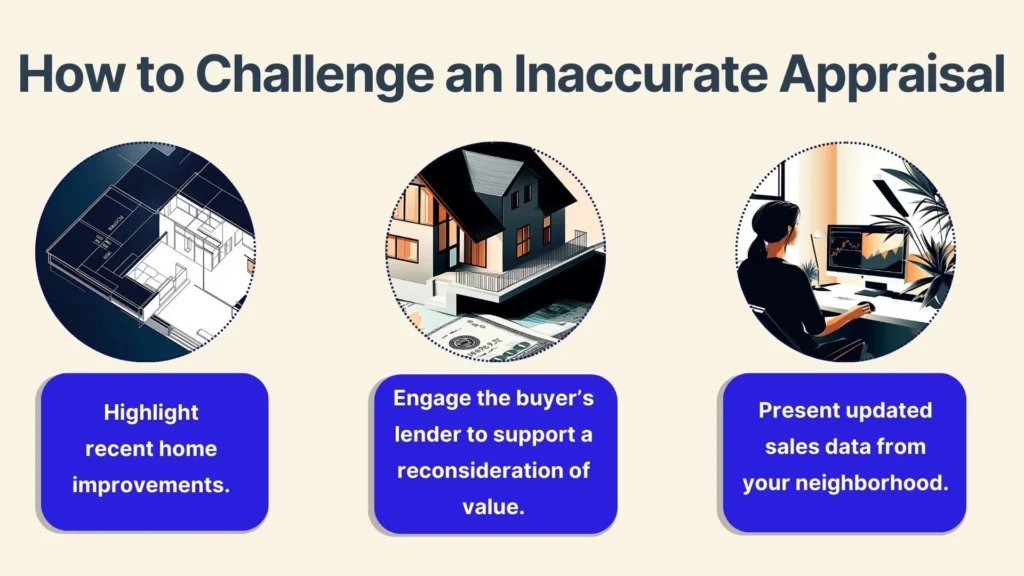

What Can You Do If You Believe Your Home Appraisal Is Wrong?

If you suspect your appraisal is inaccurate, there are steps you can take to address the issue and protect your sale. Here’s what you can do:

Request A Review Of The Appraisal Report

Start by thoroughly reviewing the appraisal report for discrepancies. Verify the accuracy of square footage, room counts, and property details. Ensure that recent upgrades, such as a remodeled kitchen or new roof, are accurately reflected in the valuation.

Don’t forget to check that the appraiser used comparable sales from the same neighborhood or a similar market. If you find errors, request a formal review or reconsideration of value, and provide supporting documentation to strengthen your case.

Obtain A Second Appraisal From Another Firm

If the original appraisal seems significantly off, consider getting a second opinion. Hiring an experienced appraiser with strong local market knowledge can provide a more accurate assessment.

A second appraisal doesn’t just offer clarity: it can also be valuable in disputes with buyers or lenders. While this option comes with additional costs, it may help prevent larger financial losses from an inaccurate valuation.

Challenge Inaccuracies In The Appraisal Report

When substantial errors are identified, you can challenge the appraisal by presenting evidence to support your claims. Document any recent home improvements, provide updated sales data, and highlight errors in the original report. Engaging your buyer’s lender in the process can also help ensure the revised valuation aligns with the property’s true worth. A well-documented challenge can resolve discrepancies and keep your transaction moving forward.

How To Prepare For An Appraisal To Avoid Errors

Preparing your home thoroughly before the appraisal can reduce the risk of inaccuracies and help ensure a fair valuation. Take these measures to positively impact your home appraisal prior to a sale:

Ensure The Home Is In Good Condition

A home’s condition heavily influences its appraised value, so make sure your property looks its best. Address visible issues like peeling paint, broken fixtures, or overgrown landscaping. Small improvements can leave a positive impression and make the appraiser more likely to view your home favorably.

Clean And Declutter All Areas

A clean and organized home makes it easier for appraisers to assess the space. Decluttering rooms can highlight square footage, while a well-maintained appearance reflects pride of ownership. Don’t forget to tidy areas like closets, basements, and attics, as these can also factor into the appraisal.

Make Minor Repairs And Improvements

Even small fixes can enhance your home’s value. Replacing outdated light fixtures, applying fresh paint, and repairing leaky faucets can demonstrate that the property is well cared for. These minor updates may seem insignificant, but they can positively impact the appraiser’s perception of your home.

Compile A List Of Recent Improvements

To ensure your home’s upgrades are accounted for, provide the appraiser with a detailed list of recent improvements. Include dates, costs, and descriptions of upgrades such as kitchen remodels, new flooring, or energy-efficient installations. This documentation helps the appraiser understand the added value these changes bring to your property.

Gather Data On Comparable Home Sales In The Area

Providing relevant comparables can help guide the appraiser. Focus on homes sold within the last three to six months, as these reflect current market trends. Include details such as size, layout, and proximity to your home. This proactive approach ensures the appraiser uses the most relevant data when evaluating your property.

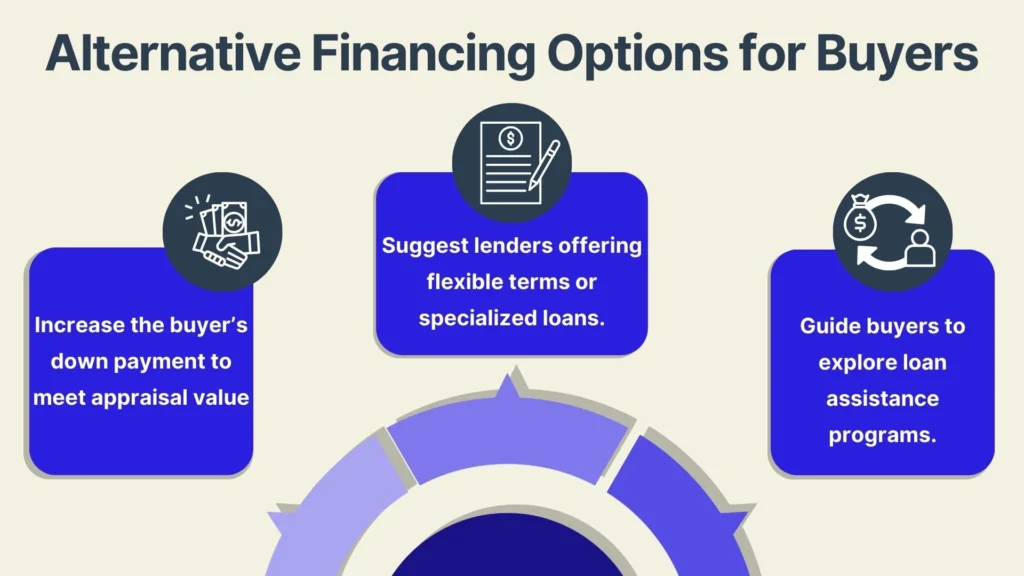

What Are The Next Steps After Addressing An Appraisal Discrepancy?

Once you’ve resolved any appraisal issues, you can move forward with your sale. Here are things you’ll likely have to do once a discrepancy has been identified in your home appraisal:

Negotiate With The Buyer Based On New Appraisal

If the appraisal is revised, use the updated valuation to renegotiate with the buyer. This might involve adjusting the sale price or offering concessions to bridge the gap between the appraised value and the buyer’s financing. Open and transparent communication can help both parties reach an agreement confidently.

Explore Alternative Financing Options For The Buyer

If the buyer’s financing challenges persist, consider exploring alternative solutions. Buyers may need to increase their down payment or seek lenders offering more flexible terms. Helping buyers navigate these options can keep the deal on track and prevent further delays.

Lease-To-Own Agreements

For buyers unable to secure immediate financing, a lease-to-own agreement could be a viable alternative. This arrangement allows the buyer to rent the property with the option to purchase it later, providing you income while keeping the sale in progress.

Conclusion

Appraisal errors can disrupt FSBO sales, but with the right preparation and tools, you can confidently tackle these challenges and achieve your selling goals. By staying organized and proactive, you’ll keep your home sale on track and well within your expected timeline.

Propbox makes this even easier. From AI-powered valuation tools to seamless task management, our platform eliminates the stress of selling FSBO. Avoid the 6% fee, sell faster, and protect your interests – all with less effort. Take control of your home sale with Propbox and sign up now!