Selling a home without the assistance of a real estate agent, also known as "For Sale By Owner" (FSBO), is a challenging process that can save sellers money by removing a realtor’s commission fee. One of the most critical steps in this process is determining the right asking price for your property. This is one of the most challenging parts of the process, with 17% of home sellers listing it as the most difficult task.

Home valuation tools can significantly ease this burden by providing FSBO sellers with valuable insights, enabling them to set a competitive price that maximizes their return while attracting potential buyers. In this guide, we’ll discuss everything FSBO sellers need to know about home valuation tools – what they are, how they work, and their pros and cons.

What is a Home Valuation Tool?

A home valuation tool is a resource or software designed to estimate the market value of a property. These tools analyze various factors, including recent sales of comparable properties, the home's specific features, and current market conditions, to provide an estimated price range for the property. They range from automated online estimators to professional-grade software used by appraisers and real estate experts.

Why Does Accurate Valuation Matter?

Accurate home valuation matters for FSBO sellers because it directly influences the success of the sale. Setting the right price helps you attract the right buyers and close the deal quickly.

Prevents Overpricing, Speeding Up The Sale

Overpricing a property can deter potential buyers, causing the home to sit on the market for extended periods. Properties that linger unsold often develop a stigma, leading buyers to question what might be wrong with them. Accurate valuation helps FSBO sellers avoid this mistake and maintain buyer interest from the beginning of the listing. Homes priced correctly are also more likely to attract multiple offers, creating competition among buyers and potentially increasing the final sale price.

Prevents Underpricing, Ensuring Maximum Profit

Underpricing a home can result in lost revenue that a buyer would otherwise pay. An undervalued property might also lead buyers to perceive issues with the home, further complicating the selling process.

Understanding the true market value of their property helps FSBO sellers maximize their financial return, keeping money from being left on the table.

How Do Valuation Tools Work?

Home valuation tools use advanced algorithms and data analytics to estimate property values. Here are the primary components of their functionality:

- Analyzing Recent Local Sales Data: Valuation tools pull information from databases containing records of recent sales in the area. These "comparables" (comps) are similar properties in terms of size, location, and features. The tools can establish a baseline for estimating the value of a home by analyzing these comps.

- Adjusting for Property Specifics: The tools account for unique aspects of the property, such as its square footage, condition, upgrades, and amenities. For example, a home with a recently renovated kitchen or a swimming pool may be valued higher than a similar property without these features. This adjustment ensures that the valuation reflects the true worth of the property’s unique attributes.

- Incorporating Market Trends: Many tools factor in broader market trends to provide a more accurate estimate, such as rising or declining home prices in the area. These trends can significantly influence the perceived value of a home, especially in dynamic markets.

Types Of Valuation Tools

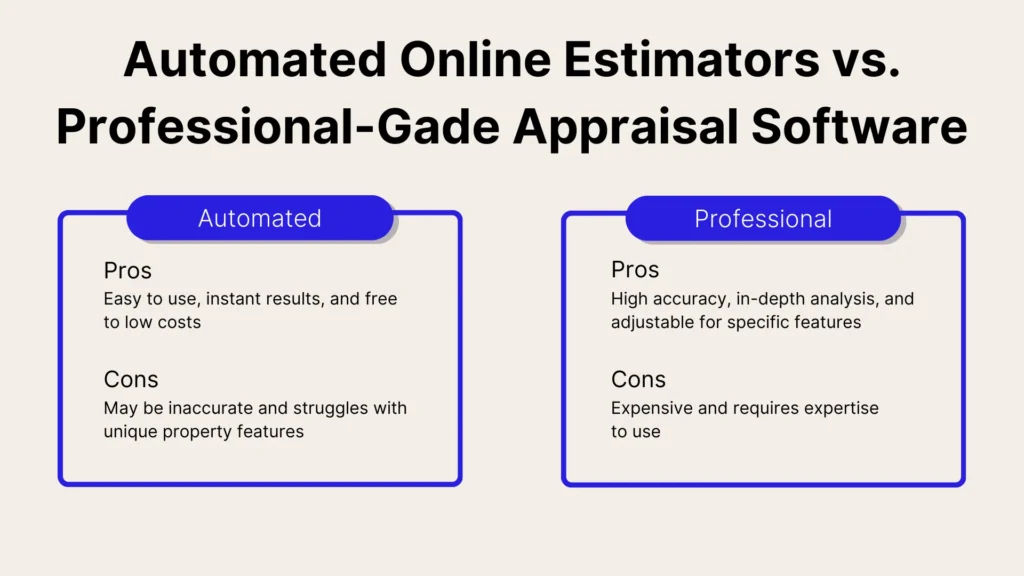

There are a couple of types of home valuation tools available, each catering to different needs and levels of expertise. Here are two common types of valuation tools that FSBO sellers can explore:

Automated Online Estimators

Automated online estimators are the most accessible and widely used valuation tools. Platforms like Zillow’s Zestimate or Propbox use algorithms to provide instant property value estimates based on publicly available data.

These tools are convenient, easy to use, and often have free plans or features. They’re particularly useful for sellers looking for an initial idea of their property’s value without any financial commitment. However, estimates by these tools may lack precision, especially if the property has unique features or if local data is outdated. Sellers should treat these estimates as a starting point rather than a definitive figure.

Professional-Grade Appraisal Software

You can also utilize sophisticated tools used by licensed appraisers and real estate professionals. Examples include software like Total by a la mode or HomeGauge. These tools provide high accuracy, detailed reports, and adjustments for property specifics. They are designed for in-depth property analysis and often include features like floor plan creation and neighborhood assessments.

Unfortunately, accessing these tools can be expensive and may require technical expertise to use effectively. FSBO sellers may consider hiring an appraiser to use these tools if they require highly detailed valuations.

Benefits Of Valuation Tools

Home valuation tools offer significant advantages to FSBO sellers, such as:

- Instant Preliminary Price Estimates: These tools save time by providing quick valuations, enabling sellers to act promptly. Sellers can use these estimates to gauge whether their property’s value aligns with their financial goals.

- Reduces Expenses on Professional Appraisals: Sellers can avoid or reduce the cost of hiring professional appraisers by using home valuation tools themselves. This is particularly useful in the early stages of the selling process. This cost-saving benefit is especially valuable for budget-conscious FSBO sellers.

- Allows Decision-Making From Data: Access to data-driven estimates empowers sellers to make educated decisions about pricing and marketing strategies. With the right information at their fingertips, sellers can negotiate with confidence and justifiable data.

Limitations Of Valuation Tools

Despite their benefits, valuation tools are not without limitations. Here are some of the most common ones among valuation tools:

- May Overlook Unique Property Features: Automated tools may struggle to account for unique or subjective elements, such as architectural charm or landscaping quality. For instance, a home with custom-built features might be undervalued by generic algorithms.

- Risk of Inaccurate Data Affecting Estimates: Errors in public records or outdated sales data can lead to incorrect valuations. Sellers should cross-check estimates with recent local sales to ensure accuracy.

- Limited Insight Into Buyer Behavior: These tools provide quantitative estimates but don’t account for intangible factors like buyer sentiment or market demand spikes. For instance, a home’s proximity to a new school or business district might significantly influence its appeal, but valuation tools many not always consider these variables.

Choosing The Right Valuation Tool

You need to select the right valuation tool to get accurate and reliable estimates. When choosing a home valuation tool to use, FSBO sellers should do the following:

Seek Tools With High Accuracy Ratings

Research user reviews and expert recommendations to identify tools known for their precision. Tools that integrate multiple data sources and have strong validation mechanisms are more likely to deliver reliable estimates. High accuracy ratings often correlate with the quality and breadth of data the tool uses.

Prefer Tools Using Wide-Ranging Data

Choose tools that leverage diverse datasets, including recent sales, market trends, and regional economic conditions. A broader data pool enhances accuracy and contextual relevance. Sellers should also look for tools incorporating real-time data updates, ensuring estimates reflect current market dynamics.

After Valuation: Next Steps

Once you have an accurate estimate of your home’s value, it’s time to move forward with the selling process. Use the valuation tool’s estimate as a starting point to set an attractive asking price. Consider pricing slightly below comparable properties in the area to generate interest and potentially spark a bidding war. FSBO sellers should evaluate their financial goals and timelines to determine the most strategic price point.

Marketing your home properly can also drive more interest in the property. Highlight your home’s best features in listings and marketing materials. Use professional photography, virtual tours, and compelling descriptions to capture buyer interest. Social media platforms and online real estate marketplaces can also amplify your reach, ensuring that your property gains maximum exposure.

When you have potential buyers interested in your property, be ready to negotiate with them. An accurate valuation provides a solid foundation for negotiations. Be prepared to justify your asking price with data and remain flexible to accommodate serious offers. Documenting improvements and unique features can strengthen your position during negotiations.

Monitoring Market Changes

The real estate market can be dynamic and fast-moving, which means that FSBO sellers need to keep informed to stay on top of changes. Monitor recent sales in your area to ensure your asking price remains competitive. Adjust your valuation as new data becomes available. Keeping track of neighborhood sales can also provide insights into local buyer preferences.

If your property is not receiving sufficient interest, consider lowering the price. Conversely, if market conditions improve, you might have room to increase the asking price. Being flexible with pricing is important to keep your property in an ideal spot in the market.

Keep an eye on trends such as seasonal demand fluctuations, changes in mortgage rates, and regional economic developments. These factors can significantly impact buyer behavior and property values. Networking with local real estate professionals or joining community forums can also provide valuable insights.

Conclusion

Home valuation tools are invaluable resources for FSBO sellers, providing valuable insights to help set the right asking price and maximize profits. Sellers can use these tools to get an accurate home valuation, allowing them to price and negotiate confidently.

Home valuation tools are essential, but with Propbox, you get more than just a number. Organize, automate, and sell your home without the headaches. Say goodbye to hidden fees and hello to a streamlined FSBO experience. Try Propbox today!