Property taxes are a crucial part of any real estate transaction, affecting both buyers and sellers. They play a role in the overall financial picture of homeownership and can significantly impact negotiations, closing costs, and even the timing of your home sale.

Understanding property taxes can make selling your home a lot easier, especially if you're selling on your own – a choice made by 6% of homeowners. Ultimately, staying informed helps you avoid unexpected challenges along the way and ensures a smoother, more successful closing.

In this article, we’ll break down property taxes and explain why they’re so important to ensuring a seamless real estate transaction.

Why Property Taxes Matter in Real Estate Transactions

Property taxes have a major impact on the cost of owning a home. For example, if a buyer discovers unexpectedly high property taxes, they may negotiate a lower offer to account for future costs. Unpaid taxes can also delay closing while both parties work to resolve the issue – a challenge faced by 13% of FSBO sellers.

Basics of Property Taxes

Property taxes are fees you pay to your local government based on your home’s assessed value. These taxes fund important community services like schools, roads, and emergency services. Here's some important information to help you understand how they work and how they can affect your homeownership costs.

How Property Taxes Are Calculated

Local tax offices determine property taxes using two things: your home's assessed value and your area's tax rate, also known as the millage rate. Assessors usually estimate your home's value by comparing it to similar homes that have recently sold nearby.

However, the tax rate can vary significantly. Different towns and cities set their rates based on factors like local budgets, public service needs, and community improvements, causing tax amounts to change from place to place.

When Property Taxes Are Typically Billed

Property taxes can be billed once a year, twice a year, or even quarterly, depending on where you live. The billing schedule usually follows one of these formats:

- Annual Billing: Billed once a year, typically following a calendar year (January to December) or a fiscal year with different start and end dates.

- Semi-Annual Billing: Billed twice a year, scheduled based on either the calendar year or a fiscal year.

- Quarterly Billing: Billed four times a year, with payments spread throughout the year based on the chosen schedule.

The Concept of Prorated Property Taxes

Prorated property taxes ensure buyers and sellers pay their fair share based on the ownership period within the tax year. Understanding how proration works will help you make sure that financial settlements at closing are fair and accurate. Here's a closer look at how it works.

Definition of Proration

Proration means splitting financial responsibilities fairly between the buyer and the seller based on the exact date of ownership transfer. If you sell your home mid-year, for example, proration calculates exactly how much tax each party owes, ensuring neither side pays more than their fair share.

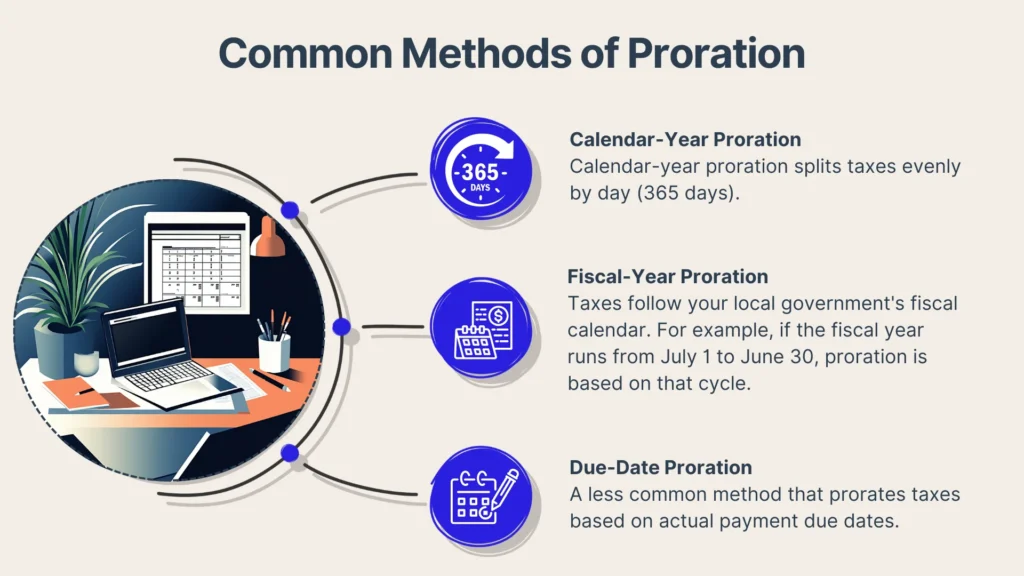

Common Methods of Proration

Prorated property taxes can be calculated in various ways depending on local practices, but they generally follow one of these methods:

- Calendar-Year Proration: Divides the annual tax by 365 days, assigning daily charges proportionately.

- Fiscal-Year Proration: Similar to calendar-year proration but follows the local jurisdiction's fiscal calendar.

Understanding how your community calculates proration is important because it helps you pay the correct amount. For instance, if your area follows a fiscal-year schedule and you assume a calendar-year method, you could miscalculate your share of taxes at closing.

Are Property Taxes Due at Closing?

The short answer is yes, property taxes are typically due or adjusted at closing. However, this can vary depending on your local tax billing cycle, escrow arrangements, or specific terms negotiated between the buyer and seller.

Typical Scenarios

FSBO homes typically sell for around $380,000, while agent-assisted sales average $435,000, showing how much the seller can save on commission fees, even though the sale price might be lower. However, it’s important to manage financial details like property taxes carefully.

In most transactions, property taxes are split at closing. If the seller has already paid the full year’s taxes, the buyer reimburses their share. If not, the seller credits the buyer for the time they owned the home, and the buyer covers the full tax bill later. This way, both parties pay their fair share of taxes based on their time of ownership.

The Role of Escrow Accounts

An escrow arrangement involves your lender or a neutral third party holding and managing funds specifically to pay for property taxes and insurance on your behalf.

If you have an escrow account, your lender usually handles your property tax payments. At closing, escrow accounts are adjusted to match the actual tax amounts owed. If there's a discrepancy in the payment, either the buyer or seller will pay the difference or receive a refund to make sure everything balances out.

Seller’s Responsibilities

Selling your home as For Sale By Owner (FSBO) means managing property tax obligations for a smooth closing. Proper documentation is key, especially since 10% of FSBO sellers face paperwork issues that delay closing. Here are some key responsibilities to keep in mind.

Paying Outstanding or Delinquent Taxes

First-time home sellers or those opting for a For Sale By Owner (FSBO) sale need to make sure that any overdue property taxes are paid before closing. Unpaid taxes can result in a lien, a legal claim that allows the government to collect the debt when the home is sold, potentially delaying or even preventing the sale.

These issues can add significant time and stress, potentially requiring you to reschedule closing dates or renegotiate terms with the buyer. Keeping property taxes current helps avoid these complications and keeps the sale on track.

Providing Proof of Payment

If you're selling your home, collect and organize your property tax payment receipts in a simple and accessible way. Create a dedicated folder, either physical or digital, to store records like payment dates, amounts, and confirmation numbers.

Clear documentation makes it easier to verify payments during closing and proves compliance with local regulations, helping you avoid delays or disputes.

The Closing Disclosure and Property Taxes

The Closing Disclosure is a detailed document that outlines the final terms of your mortgage, including property taxes. It shows how much you owe, what’s already been paid, and any adjustments made to guarantee both the buyer and the seller pay their fair share.

Here's an overview of the Closing Disclosure and how it covers property taxes to help you understand them better.

Where Property Taxes Appear on the CD

Your Closing Disclosure (CD) lists property taxes in the "Other Costs" or "Taxes and Government Fees" section. This breakdown shows what taxes have been paid, what’s still owed, and how much is your responsibility.

Be sure to review the "Cash to Close" summary carefully. This section gives you a clear picture of whether you need to pay additional taxes at closing or if you’ll receive a credit for taxes the seller has already covered. Understanding these details can help you avoid surprises and prepare for the final costs.

Reconciling with the Loan Estimate

Always compare the final Closing Disclosure with your initial Loan Estimate provided earlier in the transaction. There may be small differences between estimated and actual taxes, but any big discrepancies should be addressed and clarified before closing.

Special Situations Affecting Property Tax at Closing

Some situations can complicate property tax calculations at closing. Factors like unpaid taxes, recent reassessments, or pending exemptions can all affect the final amount. These are some scenarios to watch out for to make sure you're prepared and avoid any unexpected costs.

Newly Constructed Homes

Newly built homes often lack historical tax assessments, making it challenging to estimate exact tax obligations. To negotiate to your benefit, start by researching local tax rates and consulting your local tax assessor for preliminary figures.

Additionally, clearly agree on a method for adjusting prorated taxes once official assessments arrive. You might also negotiate holding funds in escrow until final numbers are available, ensuring neither side overpays or is surprised by unexpected tax bills.

Tax Appeals or Exemptions

Ongoing tax appeals or exemptions, like senior citizen or veteran discounts, must be sorted out before closing. If you're buying a home, check whether these benefits will still apply after you take ownership. If you're selling, be upfront about any disputes or appeals in progress to keep things clear and avoid misunderstandings.

Tax Liens

Unpaid property taxes can lead to a tax lien, a legal claim against the home that must be paid off and cleared before the sale can move forward. If ignored, liens can block the property from having a "clear title," which is required to transfer ownership.

Resolving a lien can take time, from tracking payment records to working with tax offices and filing paperwork. These delays can push back closing or even cause the deal to fall through. Handling liens early helps keep things on track.

Conclusion

Property taxes are an essential part of the closing process, and having the right knowledge helps things run smoothly. With 17% of FSBO sellers struggling to set the right price and 21% reducing their asking price, tools like PropBox can help you price accurately and simplify your sale.

Clear communication, thorough preparation, and accurate proration minimize stress for everyone involved. PropBox is specifically designed to help you easily navigate property taxes and closing details, guiding you through a seamless home sale.