If you're a For Sale By Owner (FSBO) seller, understanding the terminology and processes associated with selling your home is crucial for a successful transaction. “Close of Escrow” and “Closing Date” are two terms that may seem similar at first glance, but represent different stages in the transaction. Understanding the distinction between the two and how they affect your responsibilities as a seller can allow you to prepare requirements sooner and help your sale go smoother.

In this article, we’ll discuss the differences between these two terms, where they’re relevant in the selling process, and what you should be doing to prepare for each date as an FSBO seller.

What is Close of Escrow?

In real estate, the close of escrow refers to the point in time when the property transfer process officially begins. It signifies that all the conditions outlined in the purchase agreement have been met, and the necessary documents and funds are now in the hands of an escrow agent, ready to be exchanged.

The close of escrow impacts both the buyer and the seller. For the buyer, it means the property is on a clear path to becoming theirs, and for the seller, it marks the official start of the finalizing process. Once escrow is closed, the roadmap toward the actual closing date (when ownership is transferred) becomes much clearer.

The Escrow Process Explained

The escrow process involves a neutral third party — the escrow agent — who ensures both buyer and seller meet their contractual obligations before the sale can be completed. The escrow agent holds all funds, documents, and instructions until the terms of the sale have been satisfied. This helps protect both the buyer and the seller from potential disputes or issues arising from misunderstandings or incomplete transactions.

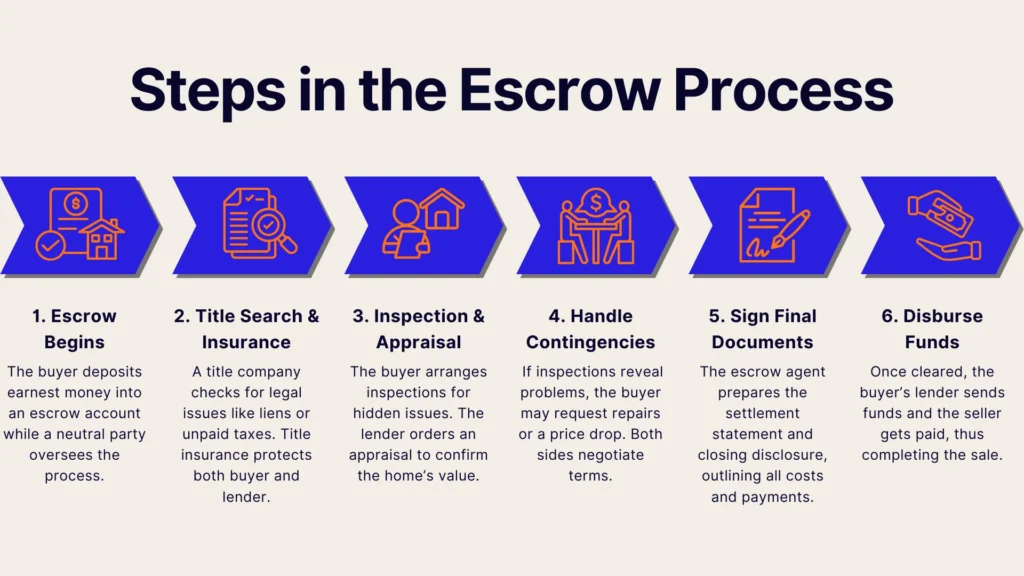

During escrow, a variety of tasks and checks occur to make sure that all financial transactions are safeguarded until the terms of the sale are completed. Here’s a step-by-step overview:

- Opening Escrow: After you’ve accepted an offer, the buyer deposits earnest money into an escrow account. This deposit shows their commitment to the deal and is held by the escrow company until the sale is completed.

- Title Search and Insurance: A title company performs a title search to ensure there are no legal issues, such as liens or unpaid taxes, associated with the property. Title insurance is typically purchased to protect both the buyer and the lender.

- Inspection and Appraisal: The buyer will typically arrange for inspections to identify potential issues with the home, and the lender will schedule an appraisal to assess the property's value.

- Contingencies and Negotiations: The buyer may request repairs or a price reduction if issues are uncovered during inspections or the appraisal. Both parties negotiate these contingencies during escrow.

- Finalizing Documents: The escrow agent prepares the final documents, which include the settlement statement and closing disclosure, detailing all the financial aspects of the transaction.

- Disbursement of Funds: Once everything is in order, the buyer’s lender provides the necessary funds, and the seller receives payment for the sale of the property.

What is the Closing Date?

The closing date is the final step in the home sale process. It’s the day when the property officially changes ownership from the seller to the buyer. The closing date is set in the purchase agreement and marks the completion of the transaction.

On this day, the buyer provides the final payment for the property, and the seller transfers the deed to the new owner. Essentially, the closing date is when both parties finalize their respective roles, and the keys are handed over to the new owner.

The Closing Process Explained

On the closing date, several actions take place to complete the sale:

- Review of Documents: Both parties review and sign various documents, including the deed, the bill of sale, and any other relevant paperwork related to the transfer of ownership.

- Financial Transactions: The buyer provides the remaining funds, including the down payment and other fees. If the buyer is financing the purchase, the lender will provide the necessary funds. According to recent statistics, buyers who finance typically cover around 74% of the home’s price, highlighting the importance of the mortgage and financing steps.

- Transfer of Ownership and Keys: After all financial transactions are settled, the property deed is officially transferred to the buyer. The seller hands over the keys, and the buyer becomes the legal owner of the property.

Key Differences Between Close of Escrow and Closing Date

While the close of escrow and the closing date are related, they refer to distinct events. Here’s a detailed comparison:

| Close of Escrow | Closing Date | |

| Definition | The moment when all contingencies are met, and the funds are released to the seller. | The finalization of the sale, with the exchange of ownership. |

| Timing | Occurs before the closing date, typically a few days to a week. | The official day the sale is completed and ownership is transferred. |

| Financial Transactions | Escrow account holds funds, pending final approval. | Final payments are made, including mortgage and closing costs. |

| Documents Signed | Preliminary documents, like disclosures, are signed. | Final legal documents, including the deed, are signed. |

| Who’s Present? | Escrow agent, buyer, seller, and title company may all be involved. | Buyer, seller, lender, title company, and possibly an attorney may all be present. |

Impact on Sellers

As a seller, the close of escrow and closing date represent important steps in the selling process. At the close of escrow, your primary responsibility is to ensure all the agreed-upon conditions are met, including repairs and inspections. During this phase, you’ll also need to finalize any remaining financial and legal documents and prepare the property for its new owner.

On the closing date, you will need to:

- Ensure the home is in good condition and ready for transfer.

- Sign the necessary documents, including the deed.

- Transfer the keys to the buyer.

The timing of these events can affect your financials, as the close of escrow typically occurs a few days or weeks before the closing date. Delays in either process can impact when you receive payment and when the buyer officially becomes the homeowner.

The Importance of Both Dates for FSBO and First-Time Sellers

For FSBO sellers and first-time home sellers, understanding the timeline and roles associated with both the close of escrow and closing date is vital. The timing of these events impacts your overall transaction schedule, and any delay could extend the sale process, potentially affecting your moving plans and finances.

First-time buyers account for about 24% of the market and tend to be younger, with a median age of 28. These buyers may have unique questions or concerns, which can lead to more contingencies or negotiations. As an FSBO seller, you can mitigate confusion by clearly explaining the steps to close escrow and outlining exactly what will happen on the closing date.

Ensuring a Smooth Transition Between Dates

- Stay Organized: Keep track of key dates and documents to ensure everything is in order.

- Communicate with the Buyer: Stay in touch with the buyer to address any concerns or contingencies that arise.

- Prepare for Closing: Make sure the property is ready for the final walk-through, and address any last-minute repairs.

How to Prepare for the Close of Escrow and Closing Date

As a seller, preparation for the close of escrow and closing date ensures a smooth, stress-free transition. Here’s what you can do to stay organized and avoid last-minute delays:

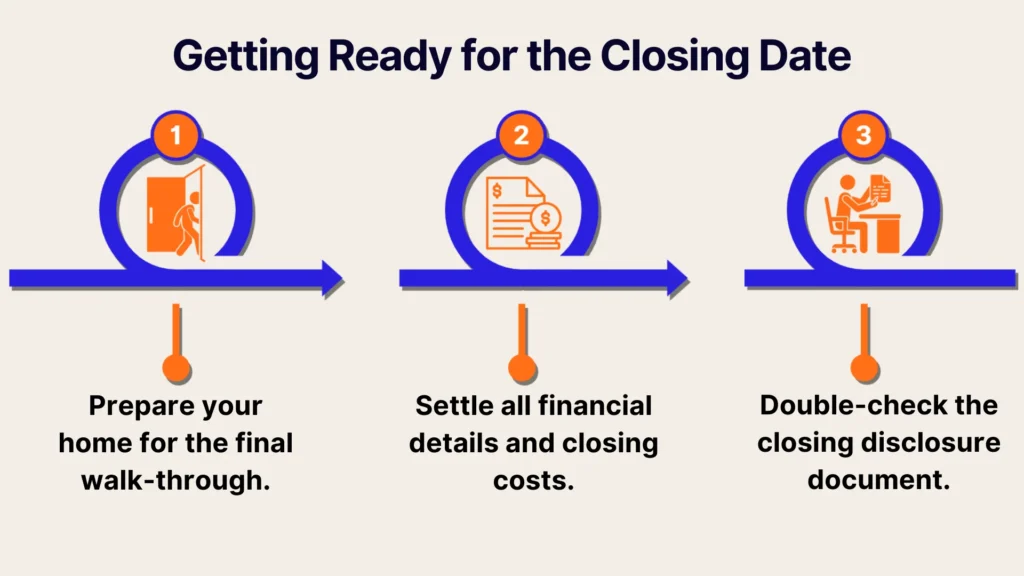

Final Walk-Through and Inspection

Before escrow closes, the buyer typically conducts a final walk-through. Your responsibility is to make sure the property is clean, cleared of personal items, and in the condition agreed upon.

Address any repairs or issues outlined in the purchase agreement promptly, as unresolved problems may delay the escrow process. Providing receipts for repairs or services performed can further assure buyers and facilitate closing.

Financial Considerations Before Closing

If you have a mortgage, coordinate with your lender to confirm the payoff amount and ensure timely processing. Also, budget for seller-related closing costs, which might include agent commissions, transfer taxes, title insurance, escrow fees, and prorated property taxes. Settling outstanding obligations, such as utility bills or HOA fees, helps prevent unexpected costs on closing day.

Finally, review the closing disclosure provided by the escrow company or title agent carefully to ensure that all financial details are accurate. Address discrepancies immediately to keep the closing process on schedule. With proper planning and attention to these key details, your close of escrow and closing date will proceed smoothly.

What Happens if There Are Delays in the Close of Escrow or Closing Date?

Delays can occur, and they often stem from issues like loan approval problems, title issues, or inspections. If there’s a delay in the close of escrow or closing date, it can affect your financial timeline, particularly if you need to move out by a certain date or have already committed to a new home purchase.

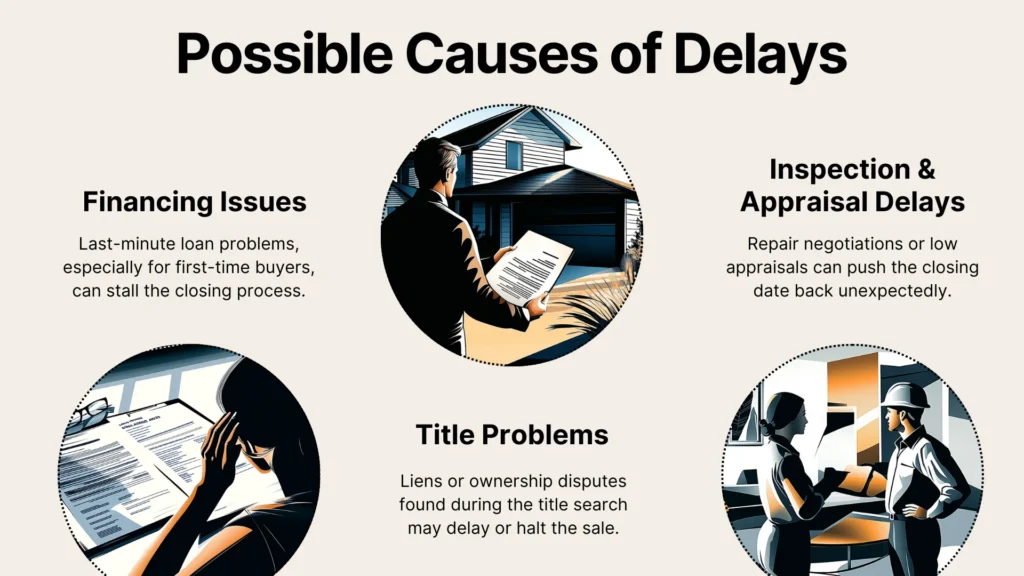

Possible Causes of Delay

Some common causes of delay include:

- Buyer’s Financing Issues: Sometimes, buyers’ lenders run into last-minute approval problems, which can push back the closing date. Even first-time buyers may experience extra scrutiny from lenders if they are younger or have less credit history.

- Title Problems: A title search can delay the closing if it uncovers any legal issues or claims against the property, such as liens or unresolved ownership matters.

- Inspection or Appraisal Issues: If the buyer’s inspection uncovers problems or if the appraisal comes in lower than expected, negotiations could delay the process as both parties try to come to an agreement.

Conclusion

For FSBO and first-time home sellers, grasping the difference between the close of Escrow and closing date is key to navigating the home-selling process. Armed with knowledge about final inspections, financial obligations, and potential delays, you’ll be well-prepared to handle each step, from opening escrow through to the day you hand over the keys.

Remember, selling FSBO means you have full control over the process, but it also puts the responsibility squarely on your shoulders. But doing it yourself doesn’t mean doing it the hard way. Propbox gives FSBO sellers the tools to succeed without the cost of a realtor. Organize, track, and automate every step of your sale with ease. From listing to closing, we help you move fast, stay informed, and maximize your profit.