If you’re selling your home on your own, it’s easy to get lost in the sea of real estate terms and concepts. One of the most important of these is proration, a process that ensures financial fairness between you and the buyer at closing.

Below, we’ll explore what proration is, why it matters, and how to handle it so you can finalize your FSBO deal with confidence.

Defining Proration in Real Estate

Proration in real estate refers to splitting certain costs and financial responsibilities according to how long each party (buyer or seller) owns or resides in the property during a specific billing period. Because most real estate expenses like property taxes, HOA fees, or utilities are billed monthly or annually, proration ensures that neither party pays more (or less) than their fair share when ownership changes hands.

Imagine your house as a subscription service that’s already been paid for part of the month or year. Proration is how you and the buyer decide who should be responsible for the days leading up to closing (that’s your portion) and who should pay for the days after closing (the buyer’s portion).

Common Expenses Subject to Proration

Sellers and buyers often share certain ongoing costs based on how long each party owns the property during the billing period. Let’s look at three key expenses and why precise proration matters for a fair and accurate closing:

Property Taxes

Property taxes are one of the most common items to be prorated. Because taxes are often billed annually—or in some areas semi-annually or quarterly—the exact dates of ownership become crucial. If you, the seller, have already paid taxes for the year, you’d normally expect the buyer to reimburse you for the period after they take over the property. Conversely, if the tax bill hasn’t been paid yet, you might only owe a portion based on how many days of the year you’ve owned the home.

The billing cycle in your municipality or county determines the proration method. In many places, taxes are assessed at the start of the year and paid later in installments. Wherever you’re located, make sure you confirm local tax dates and procedures so you can accurately factor them into your closing statement.

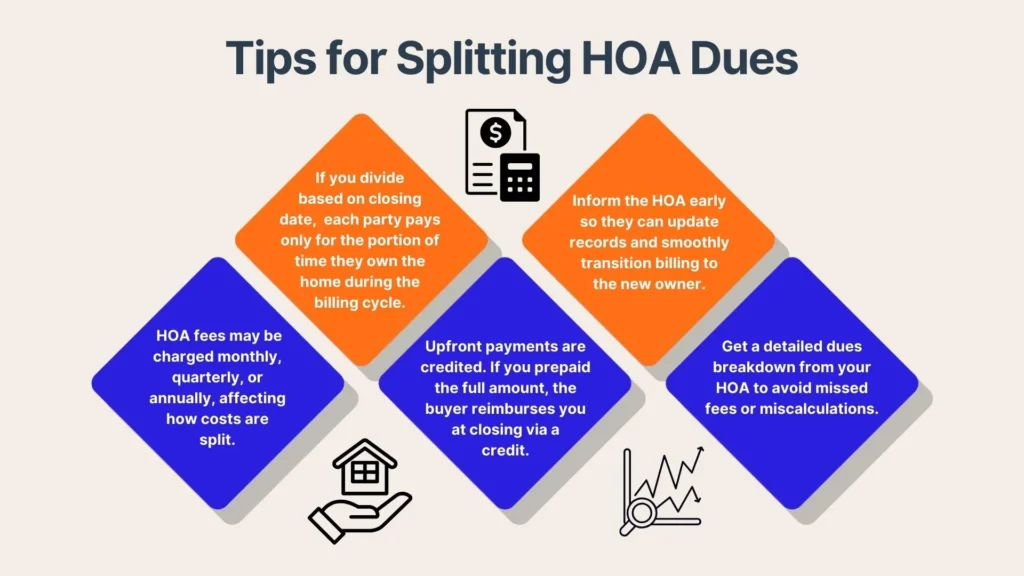

Homeowner Association (HOA) Fees

If your property is part of a community with a Homeowner Association (HOA), you may owe monthly or annual dues. These fees often cover shared amenities like a clubhouse, community pool, or landscaping. When you sell mid-cycle, the buyer might need to reimburse you if you have prepaid fees beyond the closing date. On the other hand, if you still owe unpaid HOA dues, you’ll be responsible for clearing that balance.

It’s wise to notify your HOA that you’re in the process of selling. Confirm any outstanding fees or special assessments, and request detailed statements to keep everything transparent.

Utilities and Other Bills

Utilities such as water, electricity, and gas are also commonly prorated. You don’t want to pay for the buyer’s electricity usage after you move out, and they certainly don’t want to cover your final week of water consumption. To manage this, schedule a final meter reading close to the closing date. That way, you can generate an accurate final bill for your usage.

Keep in mind that some local services may have a different billing schedule. Always double-check these to ensure all utility costs are accurately split.

How Proration is Calculated

Proration calculations generally follow either a daily or monthly method, though irregular billing cycles or year-end closings can introduce extra complexity. Let’s explore these approaches and tips for handling unique scenarios so both parties stay on the same page:

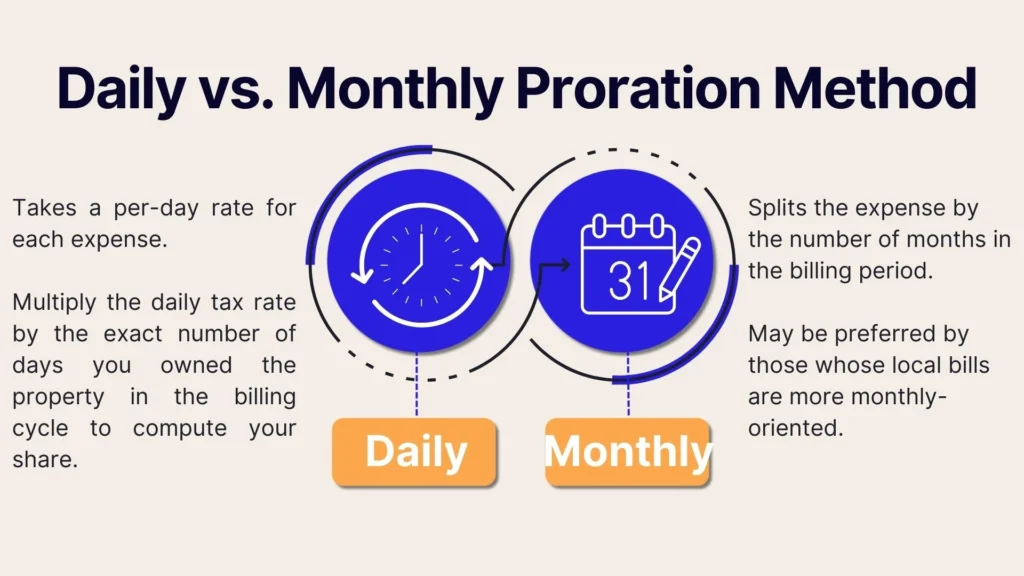

Daily vs. Monthly Method

There are two main methods to calculate proration:

- Daily Method: This approach takes a per-day rate for each expense. If your annual property taxes are $3,600, the daily tax rate would be $3,600 ÷ 365 = $9.86 per day (approximately). Multiply that by the exact number of days you owned the property in the billing cycle to figure out your share.

- Monthly Method: Here, you split the expense by the number of months in the billing period. For instance, with annual property taxes of $3,600, the monthly rate would be $300. If you sold your home on the 15th of the month, you might owe roughly half of that month’s share, depending on how your purchase agreement is structured.

Either method aims to reflect real usage. However, some sellers and buyers prefer one method over the other for simplicity or because their local bills are more monthly-oriented. Be sure to confirm which method is in your contract.

Using a Proration Calendar

Many real estate professionals use a proration calendar to keep everything precise. This calendar breaks down the year into daily segments. For example, if you sell on June 10, you’d count the days from January 1 to June 10 (that’s 161 days in a non-leap year) and multiply that by the daily rate.

This system is straightforward but requires careful attention when certain months have different days or there are leap years to consider. For irregular billing schedules (such as quarterly or semi-annually) a proration calendar can prevent confusion and help each party pay exactly what they owe.

Negotiating Special Cases

Some closings happen under unique circumstances. Maybe you’re finalizing the sale right after you’ve paid a large tax bill, or the local water department has an odd three-month billing cycle. In these cases, the buyer and seller can negotiate how to handle those costs fairly. For instance, if your closing lands on December 31 (year-end) and the next tax cycle starts January 1, you might decide the buyer should pay the full bill while crediting you for the days you owned the home.

Special cases also arise when there’s an overlapping payment or an unexpected bill, such as a one-time HOA assessment. Address these in good faith, and document your agreement clearly in the closing paperwork to avoid future disputes.

Role of the Purchase Agreement

In any real estate deal, the purchase agreement lays the foundation for splitting costs. By documenting the exact method of calculation and adding protective clauses for unexpected changes, you minimize confusion and keep the sale running smoothly:

Documenting the Proration Method

Your purchase agreement should clearly specify how proration will be handled, whether you’re using a daily or monthly method, or how to handle irregular billing. By stating the chosen method upfront, you minimize confusion and ensure both parties know what to expect.

Adding Contingencies or Clauses

To protect both you and the buyer, you can include contingencies or clauses in the contract that address these possibilities. A common example is a clause stating that if there’s a sudden increase in property taxes before closing, the proration should be recalculated based on the updated amount. Having these protections ensures that the contract can adapt without derailing the sale.

Practical Examples of Proration

The purchase agreement serves as the foundation for outlining how costs will be split and what happens if expenses change unexpectedly. Below, we go into more detail about the proration method, adding protective clauses, and practical examples:

Prorating Property Taxes

Imagine your property taxes are $3,600 annually, and you sell on June 30, which is exactly halfway through the year. If using the daily method:

- $3,600 / 365 ≈ $9.86 per day

- You owned the home for 181 days (January 1 through June 30)

- Your share would be 181 × $9.86 ≈ $1,785.66

If you’ve already paid $3,600 for the entire year, you’d be credited $1,814.34 (the remaining portion) by the buyer at closing. Alternatively, if the tax bill is due after closing, you’d pay $1,785.66, and the buyer would cover the rest when the bill comes.

Splitting HOA Dues

Let’s say your HOA charges $300 per quarter, and the next payment cycle starts on October 1. If you’re closing on October 15, half of that quarter is your responsibility, and the other half is the buyer’s. So, you would pay $150 for the first half of the quarter, and the buyer would pay $150 for the second half. If you had paid the full $300 upfront, you’d receive a $150 credit on your closing statement.

HOA fees can also be monthly or yearly. The principle remains the same: each party pays only for the portion of the billing cycle that corresponds to their ownership period.

Utilities and Final Readings

For utilities, suppose your water bill arrives monthly, and you sell your home on the 20th of that month. If the water bill is typically $60 per month, and you close before the statement date, you can estimate the pro-rated cost:

- $60 / 30 days = $2 per day

- You owe 20 days × $2 = $40

You’ll arrange a final meter reading around the 20th. The buyer then sets up service in their name and covers the rest of the month’s usage. This straightforward approach prevents overlap on bills and ensures a clean break.

Ensuring Smooth Proration at Closing

To avoid last-minute snags in your prorations, it’s often wise to enlist professional help and stay meticulously organized. Let’s discuss why you should review documents thoroughly and how title companies or attorneys can streamline the settlement process:

Working with Title Companies or Attorneys

Even if you’re managing the sale yourself, you might decide to hire a title company or real estate attorney to handle the closing paperwork. These professionals often prepare a detailed settlement statement outlining the prorated charges, reducing your risk of calculation errors. They also ensure each line item is accounted for and can mediate if there’s a disagreement about how much you or the buyer should pay.

Reviewing the Settlement Statement

Before you sign on the dotted line, carefully review your settlement statement to confirm all prorations are correct. Check that you’re credited for any prepaid taxes or HOA fees, and confirm you’re only paying for the days you actually owned the property. If you spot any discrepancies, raise them immediately with the title agent or attorney.

Keeping Organized Records

Organization is your best friend when it comes to proration. Keep digital or physical folders containing your tax receipts, HOA statements, and utility bills, especially for the months leading up to closing. Having a complete paper trail simplifies the proration process and can serve as evidence if any issues arise after closing.

Conclusion

Proration can sound intimidating, especially for first-time FSBO sellers. Yet, at its heart, it’s about fairly splitting financial obligations between you and the buyer based on each party’s actual time in the home. By understanding what costs are typically prorated—like property taxes, HOA fees, and utilities—and how to calculate each person’s share, you’ll be well-prepared for closing day.

Keep detailed records, confirm your proration method in the purchase agreement, and consult a title company or attorney if you have questions about the math. Avoiding miscalculations now can save you from headaches, disputes, or unexpected bills in the future. By taking the time to understand proration, you’ll streamline your FSBO sale and set yourself up for a smoother, more confident transition into your next home.