You're almost there with your sale! The final step? Transferring the title. It's the official handoff, and we'll make sure it's done right. This guide simplifies the process, whether it's a gift, inheritance, or sale. Read on to learn how to transfer your title like a pro.

Understanding the Importance of a Real Estate Title

A real estate title represents legal ownership of a property. It confirms the owner’s rights and responsibilities and protects against ownership disputes, and a clear title is necessary for selling, refinancing, or transferring property to another person.

Without a properly documented title, proving rightful ownership can become challenging.

Title vs. Deed – Clarifying the Terms

Understanding the distinction between a title and a deed can head off legal misunderstandings. While they are interrelated, each serves a unique purpose in real estate transactions, affecting property rights and their transfer..

Key Differences

The title is an abstract legal concept representing ownership of the property. Meanwhile, the deed is the tangible document that formally records and enables the transfer of this ownership. Someone can possess title to a property even without holding the physical deed, but a deed is necessary to legally document the change in ownership.

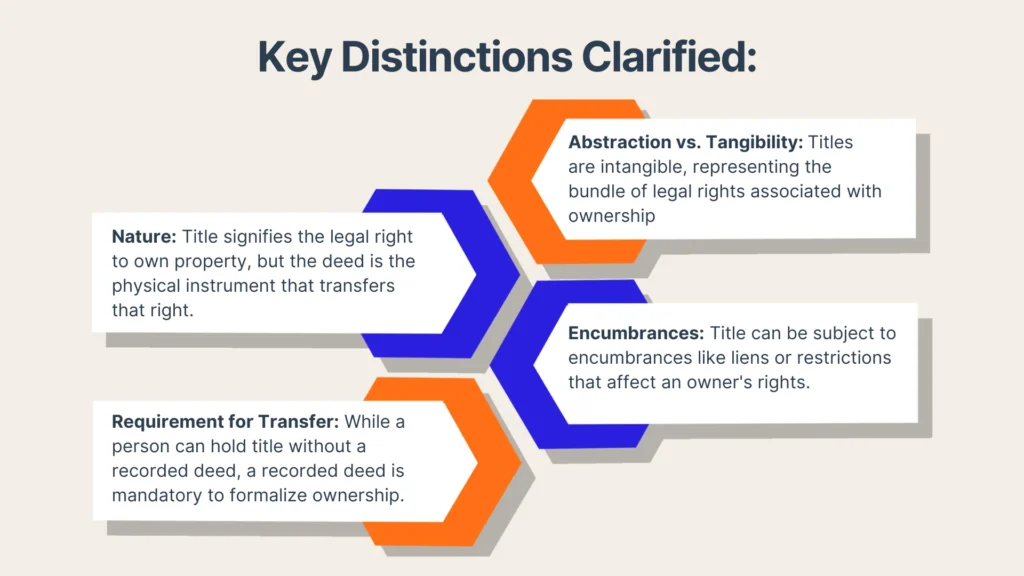

Key Distinctions Clarified:

- Nature: Title signifies the legal right to own property, but the deed is the physical instrument that transfers that right.

- Requirement for Transfer: While a person can hold title without a recorded deed, a properly executed and recorded deed is mandatory to formalize the transfer of ownership.

- Abstraction vs. Tangibility: Titles are intangible, representing the bundle of legal rights associated with ownership. Deeds are concrete legal documents containing specific property details and the specifics of the transfer.

- Encumbrances: Title can be subject to encumbrances like liens or restrictions that affect an owner's rights. A deed itself does not define ownership rights beyond its explicit statements.

- External Factors: Title can be influenced by legal challenges, inheritance matters, or prior claims, necessitating title searches before transactions. The deed serves as the legal verification that a transfer has occurred and is legally binding upon proper recording with the relevant government body.

Why Both Are Essential

A title grants ownership, but the deed serves as legal proof of that ownership change. Without a valid deed, ownership disputes may arise. Titles establish long-term ownership rights, while deeds provide the necessary documentation for any transfer or sale. Without a properly recorded deed, ownership claims may be challenged, and the transfer might not be legally recognized.

Additionally, different types of deeds offer varying levels of protection for buyers. Some deeds guarantee a clear title, while others transfer ownership with little or no warranty.

Preparing to Transfer Title

Before a title can be transferred, you need to carefully review all the relevant records. Missing paperwork or unresolved claims can cause delays or even jeopardize the transfer process.

Reviewing Current Title Records

Before transferring a title, reviewing current records is necessary. This includes locating existing deeds and checking for any liens or encumbrances. A title search, often conducted by a title company, confirms that there are no outstanding claims against the property that could complicate the transfer.

Verifying Ownership and Clearing Liens

All liens, mortgages, and legal disputes must be resolved before transferring a title. If a property has unpaid debts attached, the new owner may inherit those obligations. Paying off outstanding balances and obtaining a lien release ensures a smoother transfer process.

Choosing the Right Type of Deed

Selecting the appropriate type of deed is a key part of the title transfer process. Different deeds provide different levels of protection for both buyers and sellers.

General Warranty Deed

A general warranty deed offers the most protection for buyers. The seller guarantees that the title is free from defects, even those that may have existed before their ownership. This type of deed is standard in traditional real estate sales.

Special Warranty Deed

A special warranty deed only covers title defects or claims that arose during the seller’s ownership. This deed is common in commercial transactions and when properties are sold by trusts or estates. Unlike a general warranty deed, a special warranty deed does not protect against title defects that existed before the seller took ownership. Instead, it guarantees that the seller has not caused any title issues during their period of ownership.

This type of deed is commonly used in real estate transactions where the seller, such as a builder, corporation, or trustee, does not want to assume responsibility for unknown title defects that may have occurred before they owned the property. For example, if a bank sells a foreclosed property, it may use a special warranty deed to limit liability for title issues that arose before the foreclosure.

Quitclaim Deed

A quitclaim deed transfers ownership interest without any guarantees. It is often used between family members, during divorces, or to correct title errors. While it simplifies transfers, buyers should be cautious, as it does not assure a clear title.

Quitclaim deeds are commonly used in scenarios where there is an existing relationship between the parties involved, and the recipient is willing to accept the property as-is. For example, in a divorce settlement, one spouse may use a quitclaim deed to remove their name from the title and transfer full ownership to the other spouse. Another common use is correcting clerical errors in a title, such as misspellings or incorrect legal descriptions.

However, since quitclaim deeds do not provide warranties against title defects, they are not typically used in standard real estate sales where buyers expect a clean and insurable title.

Grant Deed

Promises that the property hasn’t been transferred to anyone else and is free from undisclosed encumbrances. While not as comprehensive as a general warranty deed, it still offers more protection than a quitclaim deed.

Steps to Transfer Real Estate Title

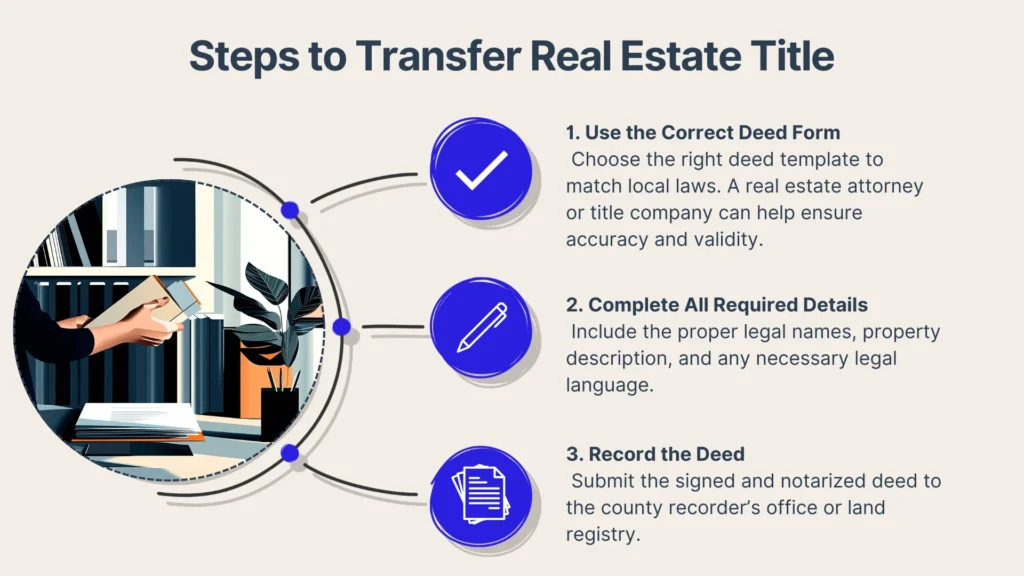

Once the right deed has been chosen, the next step is completing the transfer process. Proper documentation and legal formalities must be followed to avoid delays or rejections.

Drafting or Obtaining the Correct Deed Form

Many states offer standard deed templates that align with local laws. Using the correct form is necessary for a valid transfer. A real estate attorney or title company can help prepare the deed to avoid mistakes.

Completing the Deed with Accurate Details

The deed must include the full legal names of the grantor (seller) and grantee (buyer), a complete property description, and any required legal language. Mistakes such as misspelled names or incorrect property details can invalidate the transfer. Signatures must meet state requirements, often requiring a notary or witness.

Recording the Deed

Once signed and notarized, the deed must be submitted to the county recorder’s office or land registry. Recording the deed makes the transaction public and confirms the ownership change. Fees vary by location, so checking local requirements is recommended.

Working with Professionals

Legal and administrative procedures can be complex, and professionals help ensure everything is done correctly. Attorneys, title companies, and notaries each play a role in a successful transfer.

Real Estate Attorneys

Real estate attorneys provide legal guidance and ensure compliance with state and federal laws. They can resolve complex issues such as title defects, unknown heirs, and boundary disputes that could jeopardize a sale.

If a property has an unclear title due to a previous owner's unpaid debts, an attorney can facilitate a quiet title action to remove any clouds on the title, ensuring the buyer receives a legally valid and marketable title.

Title Companies and Escrow Agents

Title companies play an essential role in verifying a property's ownership history, identifying encumbrances, and issuing title insurance to protect buyers and lenders against unforeseen claims.

For example, if an undisclosed lien surfaces after a property purchase, title insurance shields the buyer from financial liability. Escrow agents act as neutral third parties who ensure all contract terms are met before the deed transfer is completed, preventing fraudulent transactions.

Notaries and Witnesses

Notaries authenticate signatures and prevent fraudulent property transfers. Some states require multiple witnesses in addition to notarization to validate the transaction.

For instance, if a property owner is out of state, a mobile notary can verify their identity and facilitate the signing remotely. Notaries and witnesses add an extra layer of security by confirming that all parties are willingly and legally executing the transfer.

Potential Pitfalls and How to Avoid Them

Mistakes in the title transfer process can lead to legal disputes or financial losses. Understanding common pitfalls helps prevent unnecessary complications.

Incorrect or Incomplete Information

Misspelled names, wrong legal descriptions, or missing signatures can invalidate a deed. Double-checking details before submission prevents costly errors.

Unresolved Liens or Title Claims

If liens or claims remain on a title, the transfer may be delayed or contested. Conducting a title search and resolving any outstanding issues before finalizing the transfer is necessary to avoid legal troubles.

Common scenarios that may result in unresolved liens or title claims include:

- Unpaid Property Taxes: If the previous owner has unpaid taxes, the government may place a lien on the property, which must be cleared before the sale.

- Mechanic’s Liens: Contractors or service providers who performed work on the property but were not paid may have filed a lien.

- Judgment Liens: If a property owner loses a lawsuit, the court may place a lien on the property to ensure debt repayment.

- Mortgage Liens: If a previous mortgage was not properly discharged, it may still appear on the title, complicating the transfer.

- Heirs with Claims: In inherited properties, multiple heirs may claim ownership, leading to disputes that prevent a clear title transfer.

- Easements or Restrictions: Previously undisclosed rights-of-way, easements, or zoning restrictions could affect ownership rights.

- Errors in Public Records: Mistakes in the property’s legal description, owner names, or past transactions may result in title defects.

Timing and Deadlines

Delays in recording the deed can create complications in ownership rights. Some states impose deadlines for recording to maintain the priority of claims. Understanding local rules helps avoid unexpected issues.

Post-Transfer Considerations

Once you’ve transferred the deed, you still need to take care of other key tasks related to ownership like updating important paperwork. Let’s take a closer look at what a home seller will have to do post-transfer:

Updating Insurance and Tax Records

After transferring a title, the new owner must update homeowners insurance and property tax records. Failing to update these records may result in billing or coverage issues.

Confirming Successful Transfer

A certified copy of the recorded deed should be obtained for records. Verifying the deed’s public record entry confirms that the transfer was completed correctly.

Retaining Documentation

Safely storing the original deed and related paperwork is important for future transactions. In the event of disputes, having proof of transfer protects both parties.

Conclusion

Transferring a real estate title requires attention to detail and adherence to legal procedures. Understanding the process, working with the right professionals, and ensuring proper documentation help prevent complications. For sale by owner (FSBO), transactions make up 6% of all home sales, and while they save on commission costs, they also require proper organization and legal accuracy.

70% of FSBO sellers say paperwork is their biggest challenge. If you need a helping hand, PropBox's user-friendly platform organizes your title transfer documents, making the process effortless. Try it for yourself and start your smooth, hassle-free sale now.