Selling your home can be an exciting yet overwhelming process, especially if you're managing the sale on your own as a For Sale By Owner (FSBO) seller. Two important steps in closing a home sale are the inspection and appraisal processes. While they might seem similar, they serve entirely different purposes.

In this guide, we’ll walk you through the key differences between inspections and appraisals, how they impact the home-selling process, and strategies for handling any challenges that come up.

A Brief Overview of the Closing Process

The closing process is the final step in selling your home – it’s where paperwork is completed, finances are settled, and ownership transfers to the buyer. Although 88% of buyers use agents, FSBO sellers can easily navigate the process with the right preparation. Here's what it involves:

- Accepting an Offer: Once a buyer makes an offer and terms are agreed upon, both parties sign a purchase agreement.

- Home Inspection: The buyer hires a professional inspector to examine the home’s condition.

- Appraisal: The buyer’s lender orders an appraisal to assess the home’s value.

- Negotiations: Based on the inspection and appraisal results, both parties may renegotiate repairs or price adjustments.

- Finalizing Financing: The buyer’s lender completes underwriting and issues final loan approval.

- Closing Day: The buyer and seller sign the final paperwork, and ownership is officially transferred.

Note: Inspections and appraisals play a big role in your sale. If major issues come up, they could delay the process or even cause the deal to fall through.

Inspection vs. Appraisal: What’s the Difference?

As a first-time home seller, you might be wondering what the difference is between an inspection and an appraisal. While both assess your property, an inspection checks its condition, while an appraisal determines its value. Let's take a closer look at why they matter in closing a sale.

Purpose of a Home Inspection

A home inspection is a deep dive into your property’s overall condition. The goal is to spot any defects, safety concerns, or maintenance issues that could impact the sale. With 9% of FSBO sellers struggling to prepare their homes, inspections often reveal necessary fixes.

For buyers, it’s a way to make sure they know exactly what they’re getting into—and if needed, they can use the inspector’s assessment to negotiate repairs or even adjust the sale terms. Generally, the purpose of a home inspection includes:

- Identifying structural, electrical, plumbing, and HVAC issues

- Helping the buyer request repairs or credits before finalizing the purchase

- Providing leverage for renegotiation, potentially affecting the final price

Purpose of a Home Appraisal

A home appraisal is an evaluation of the property's market value conducted by a licensed appraiser. Lenders require an appraisal to make sure the home is worth the amount being borrowed. The purpose of a home appraisal includes:

- Determining the fair market value of the home

- Reassuring the lender that the loan amount is justified

- Protecting the buyer from overpaying for the property

Why Both Matter in the Closing Process

Pricing a home correctly is a top challenge for FSBO sellers, with 17% struggling to get it right. A professional appraisal ensures your home is valued fairly, while an inspection uncovers potential issues that could affect the sale, from structural damage to outdated systems.

A low appraisal can jeopardize financing since lenders won’t loan more than the appraised value, leaving buyers to cover the difference or renegotiate. Similarly, issues found in inspections can lead to tough negotiations or even break a deal. Both play a critical role in shaping the final sale price and ensuring a smooth closing process.

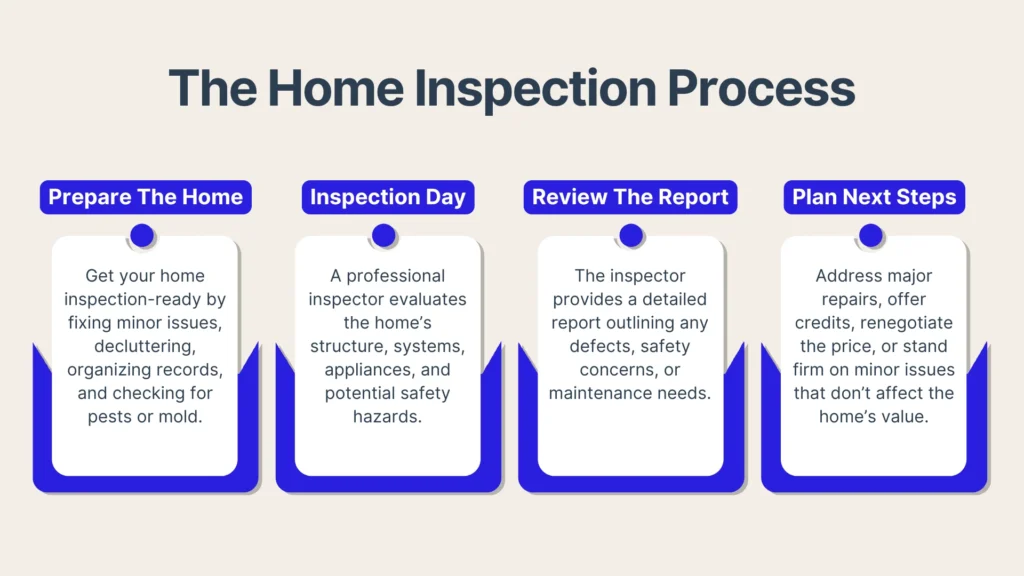

The Home Inspection Process

A home inspection gives buyers a clear picture of any potential issues before they commit to purchasing the property. Here’s a quick rundown of the step-by-step process:

Preparing for the Inspection

As an FSBO seller, preparing for the home inspection can help minimize surprises. Start by taking care of minor repairs, such as fixing leaks or replacing broken fixtures, to address small issues upfront. Cleaning and decluttering will also make it easier for the inspector to access all areas.

Additionally, organizing maintenance records adds transparency and builds buyer confidence. Don't forget to check for pests or mold too – catching these early can help you avoid unexpected issues in the inspection.

What the Inspector Checks

A home inspector evaluates the property’s structure (foundation, walls, roof, and attic), plumbing and electrical systems, and HVAC. They also check appliances for safety and performance and look for environmental hazards like mold, radon, or pests.

Common Issues Discovered

Inspectors often find common problems such as HVAC malfunctions, water damage, electrical code violations, roof damage, and plumbing problems like leaks or low water pressure. While sellers can often handle minor fixes, major issues may require professional repairs or negotiation with the buyer.

Post-Inspection Steps for FSBO Sellers

Once you receive the inspection report, your next step is to decide how to move forward. Here are the initial steps you can take:

- Make repairs to address significant issues and keep the deal on track, especially if the buyer is concerned about safety or functionality.

- Offer repair credits if you’d rather not handle the fixes yourself, giving the buyer funds at closing to manage the repairs on their own.

- Renegotiate the sale price to account for repair costs, which can be a fair compromise if major issues are uncovered.

- Stand your ground on minor issues that won’t impact the sale, especially if your pricing already accounts for them.

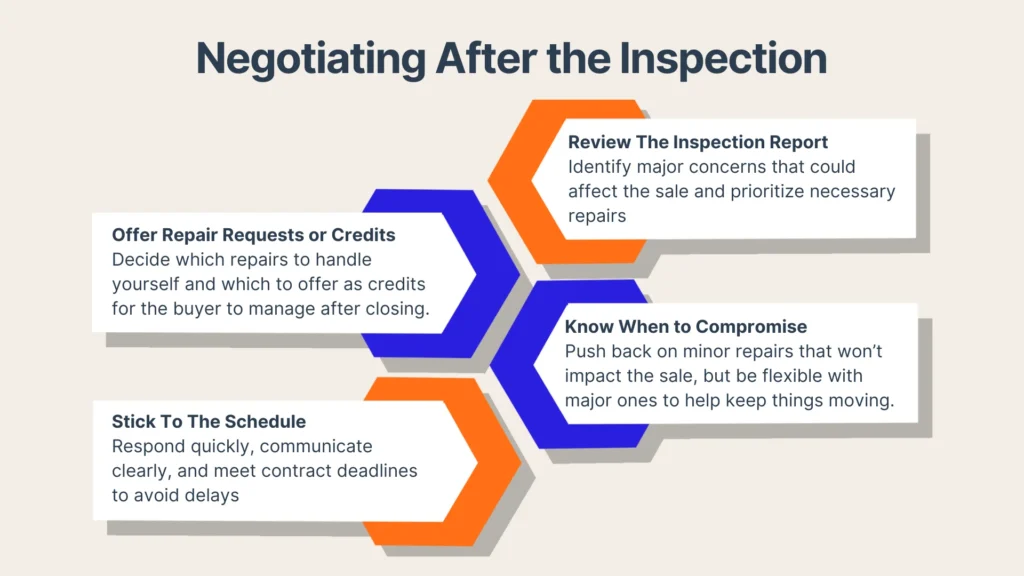

Negotiating After the Inspection

After the inspection, buyers may request repairs or credits, and as the seller, you will decide whether to handle the fixes yourself or offer repair credits so the buyer can handle them after closing.

Repair Requests vs. Repair Credits

Repair requests require the seller to handle fixes before closing, ensuring a move-in-ready home but potentially increasing costs and delays.

Pros

- Helps prevent deal cancellations by addressing buyer concerns upfront.

- Increases buyer confidence, reducing last-minute negotiations.

- Creates a smoother closing process, especially if the home is move-in ready.

Cons

- Can be expensive, especially if repairs require professional contractors.

- May delay the closing process if repairs take longer than expected.

- Buyers may be dissatisfied with the repair quality or choices made by the seller.

On the other hand, repair credits allow the seller to offer the buyer financial credit at closing instead of completing repairs themselves. This option is often preferred when repairs are minor or when the seller wants to close quickly.

Pros

- Easier for the seller, as it eliminates the hassle of coordinating repairs.

- Gives buyers the flexibility to choose their own contractors and materials.

- Can speed up the closing process by avoiding lengthy repair timelines.

Cons

- Requires agreement on the credit amount, which can lead to further negotiation.

- Buyers may request a higher credit than the actual cost of repairs.

- Lenders may have restrictions on how credits are applied, limiting flexibility.

FSBO Strategies for Successful Negotiation

Remaining level-headed and focused on the facts is essential when negotiating after an inspection. Use the inspection report as an objective guide rather than letting emotions drive your decisions. Research repair costs to support your position and be willing to offer flexible solutions when needed.

Knowing when to stand firm and when to be flexible is key. Focus on addressing serious issues that could risk the sale, but don’t feel pressured to agree to minor fixes that won’t affect the home’s value. Highlighting your home’s strengths can also help reassure buyers and ease concerns from the inspection.

Timing Considerations

Meeting deadlines and responding quickly to inspection-related decisions keeps the deal moving smoothly. Delays can frustrate buyers and even jeopardize the sale, so communicate clearly and stay proactive. By handling negotiations efficiently, you build trust and help the sale stay on schedule.

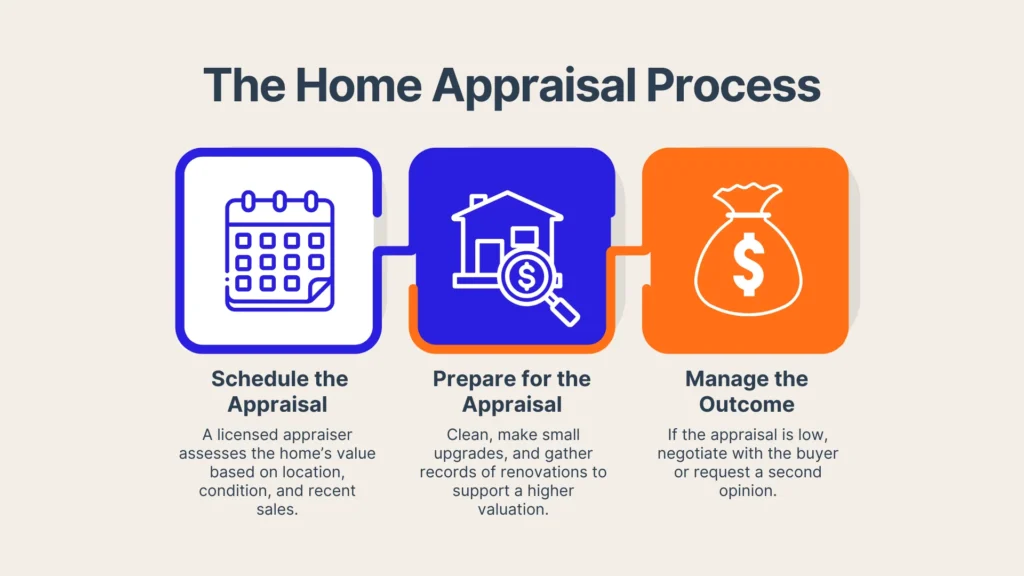

The Home Appraisal Process

The home appraisal process involves a licensed appraiser evaluating the property’s condition, features, and recent sales of similar homes to determine its value. Here’s what you need to know about it:

What Appraisers Look For

Appraisers assess a home's value by considering its location, size, condition, and any recent upgrades. Renovations such as kitchen remodels, updated bathrooms, or new flooring can increase the home's value by making it more desirable. Appraisers also compare similar recently sold homes, known as "comps," to determine fair market value. These factors help ensure the home is priced appropriately.

Preparing for the Appraisal

A clean, well-maintained home leaves a better impression on the appraiser. Simple upgrades like fresh paint, landscaping, and decluttering can make it look more inviting, while documents such as past appraisals, renovation receipts, and permits help showcase value-adding improvements. Staying organized can support a higher valuation.

Possible Outcomes and Their Impact

If the appraisal meets or exceeds the agreed price, the sale continues without issues. But if it’s lower, the lender may not approve the full loan amount. This means the buyer might ask for a price reduction, pay the difference, or get another appraisal. A low appraisal can slow down or even disrupt the sale, so it’s important to be prepared.

Managing Appraisal Challenges

Appraisals don’t always go as expected, and challenges like low valuations or disputed assessments can complicate the sale. Knowing how to handle these issues can help keep everything on track.

Dealing with a Low Appraisal

As a first-time seller, a low appraisal can be frustrating, but there are ways to handle it. If the buyer’s loan won’t cover the full price, you may need to lower the price or offer to help with closing costs.

The buyer or lender might also request a second appraisal, but this usually requires proof that the first appraisal was inaccurate, such as outdated comps or overlooked home improvements. Being flexible and prepared for these situations can help you avoid delays.

Rebuttal Strategies for Disputed Appraisals

If you believe the appraisal is too low, you can challenge it by providing evidence of recent home sales that support a higher value. Highlight any upgrades or renovations the appraiser may have missed.

If needed, the buyer or lender can hire another appraiser for a second opinion. A strong case can sometimes lead to a revised valuation.

Timing and Closing Delays

A low appraisal can delay closing if price negotiations or a second appraisal are needed. If this happens, communicate any changes or extensions with the buyer, lender, and agents to keep the sale on track. Clear and prompt updates help prevent misunderstandings and closing complications.

Conclusion

Selling your home independently gives you the freedom to call the shots and lets you keep more of your hard-earned money, saving up to 6% in commission fees. Understanding inspections, appraisals, repairs, and negotiations is exactly what you need to stay in control and keep the sale moving.

With the right approach, you can overcome challenges, maximize your home’s value, and close the deal with confidence. Consider PropBox, the ultimate FSBO platform that simplifies the process and empowers you to sell on your terms.