Considering going the FSBO route? Selling your home on your own without an agent means you’re wearing all the hats. It’s empowering, sure, but once you hit the closing stage, things can start to unravel. This is where a smooth sale can suddenly feel like a game of whack-a-mole, with last-minute issues popping up out of nowhere.

Closing delays are more common than most expect, and they’re often the biggest source of stress for FSBO sellers. But the good news? A little foresight goes a long way in keeping things on track. Read on to learn how you can prevent common home closing delays for a smooth, stress-free home sale.

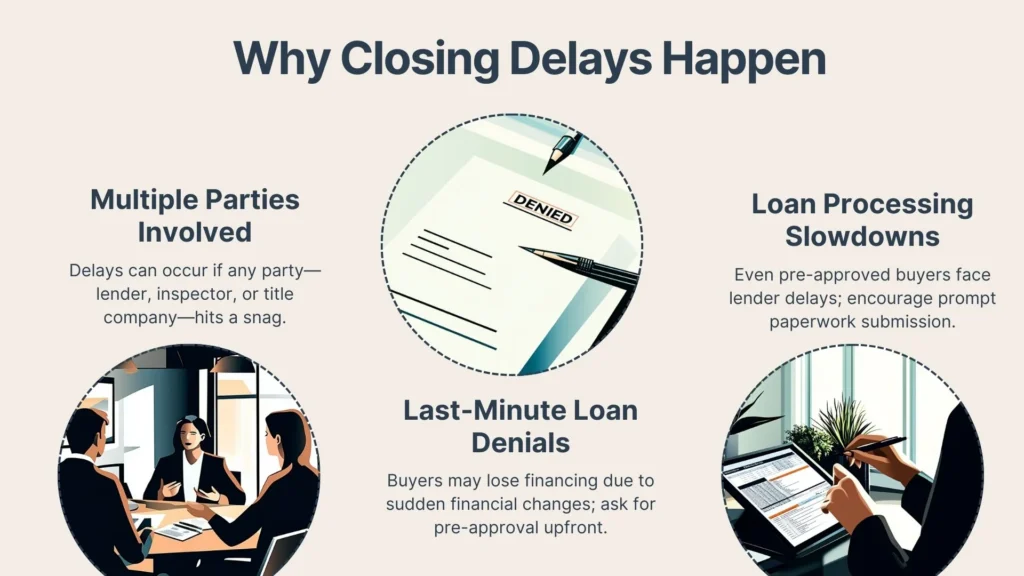

Why Closing Delays Happen

The closing phase is the final step in your home sale, but it’s also where things can stall. This part of the process involves multiple parties such as buyers, lenders, title companies, inspectors, appraisers, and if even one of them hits a snag, the entire timeline can be thrown off.

For FSBO sellers, these delays can be particularly stressful because you’re managing everything yourself. Financial impacts are also a concern; delays might mean paying extra mortgage payments or utilities while waiting for the sale to finalize. According to the National Association of REALTORS® (NAR), 23% of contracts experience delayed settlements, and 7% are terminated altogether, so it’s important to be aware of the most common causes of delays and how to avoid them.

Let’s get into why they happen and how you can prevent them:

Financing and Mortgage Issues

Financial setbacks are one of the biggest reasons closings get delayed, and many of them are beyond the seller’s control. Even when a buyer seems financially secure, unexpected issues can arise at the last minute, derailing the sale:

Last-Minute Financing Denials

One of the top reasons for closing delays is last-minute financing denials. Buyers might lose loan approval due to changes in their financial situation, like losing their job or taking on new debt, or because their lender discovers something during a final review. For FSBO sellers, this can be a nightmare scenario that requires relisting the home and starting over with a new buyer.

To avoid this, always require buyers to provide proof of pre-approval before accepting their offer. Pre-approval shows that their lender has already verified their financial qualifications, reducing the risk of surprises later on. Additionally, maintaining open communication with buyers throughout the process can help identify potential red flags before they become major obstacles.

Loan Processing Delays

Even when buyers are pre-approved, loan processing can still cause bottlenecks. Lenders often request additional paperwork or face backlogs during busy periods, which can push back closing dates.

These delays are common, with NAR data showing that financing issues account for 37% of delayed contracts. You can help by encouraging your buyer to stay proactive with their lender and submit requested documents promptly.

Title or Legal Complications

Beyond financing, legal issues related to your home's title can cause frustrating delays. Even if you’ve owned your home for years, hidden problems like these can surface and stall the process:

Title Search Discoveries

Title issues are another common reason for delays. Problems like liens, unpaid taxes, judgments, or disputes over ownership can surface during the title search and must be resolved before closing. These issues can take weeks or even months to fix if left unaddressed, pushing your home sale back even further.

As an FSBO seller, conducting a title search before listing your home is one of the smartest moves you can make. This allows you to identify and resolve any problems early on, avoiding surprises that could derail your sale later in the process.

Missing or Incorrect Paperwork

Paperwork errors—like missing signatures or incomplete forms—are surprisingly common causes of delays. According to NAR data, 10% of FSBO sellers find understanding and completing paperwork one of their biggest challenges. To avoid these pitfalls, create a detailed checklist of all required documents, and review everything carefully with a qualified attorney or title company before submitting. Taking this extra step can help prevent last-minute surprises that could derail your timeline.

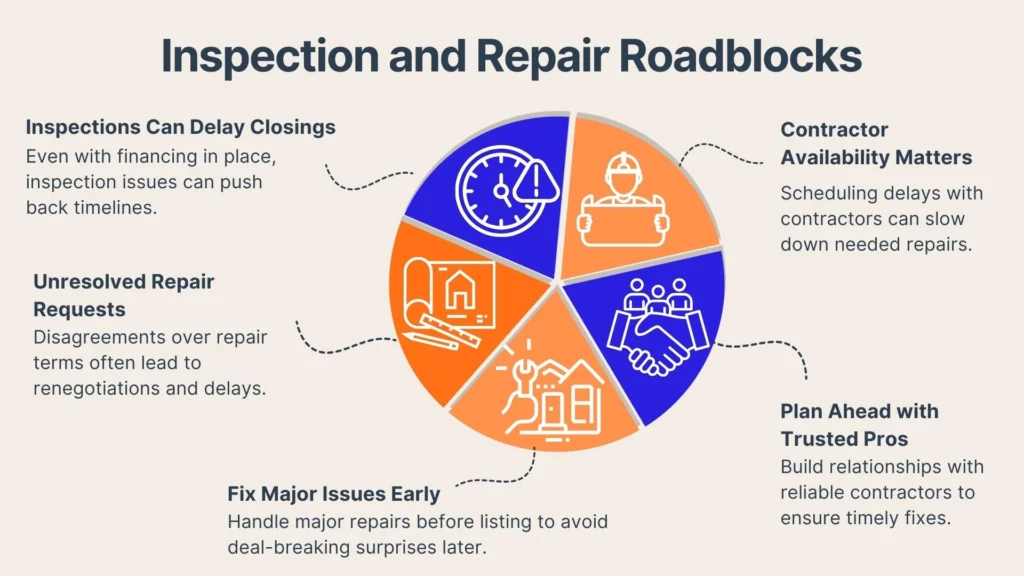

Inspection and Repair Roadblocks

Even if financing and legal matters are in order, home inspections can still throw a wrench in your closing timeline. Keep these inspection issues in mind so you can swiftly resolve them:

Unresolved Repair Requests

Home inspections often lead to renegotiations when buyers request repairs based on inspection findings. If both parties can’t agree on terms or if repairs take longer than expected closing dates can get pushed back significantly.

Nip this in the bud by taking care of major repair issues before even listing your home. This gives buyers fewer reasons to negotiate later and helps the transaction move forward smoothly. If inspection-related requests come up during escrow, address them promptly by working with dependable contractors who can meet deadlines.

Scheduling & Contractor Delays

Finding qualified contractors on short notice is another challenge that can delay repairs flagged during inspections. If repairs take longer than expected due to scheduling conflicts or unforeseen complications, your closing date could be postponed significantly.

To avoid unexpected delays, schedule inspections early in the process and establish relationships with trusted contractors ahead of time so they’re available when needed.

Appraisal Setbacks

Another potential obstacle to closing is the home appraisal, which can impact financing and purchase negotiations. These are the most common problems that crop up during the appraisal process:

Low Appraisal Results

A low appraisal happens when your home’s appraised value comes in below the agreed-upon sale price. This discrepancy can derail financing if your buyer’s lender won’t approve a loan for more than what the property is worth.

Make sure you price your home realistically based on comparable sales in your area rather than aiming too high. This prevents creating a huge gap between the two values (your home’s appraised value and the set sale price) that could potentially delay your sale.

Reappraisal Requests

Sometimes buyers or lenders request reappraisals due to disputes over initial valuations or changes in market conditions. This process adds more time to an already tight timeline. To avoid delays, make sure your home looks its best during appraisals by addressing cosmetic fixes beforehand and providing documentation for any upgrades.

Paperwork and Communication Gaps

Even when all major hurdles are cleared, small missteps in paperwork and communication can still throw off your closing schedule. Usually they’re the most minute details that tend to derail the sale:

Missing Signatures or Final Documents

It might sound simple, but missing signatures or overlooked documents are surprisingly common causes of closing delays! As an FSBO seller managing everything yourself, it pays off big-time to stay organized here. Create a checklist for all required documents and review them thoroughly before submission.

Poor Coordination Among Parties

Miscommunication between buyers, lenders, title companies, inspectors, and even contractors often leads directly into missed deadlines (or worse—deal cancellations altogether). Staying proactive about communication ensures that everyone stays aligned throughout the escrow period.

Tips To Prevent Delays

Now that you know what can go wrong, let’s talk about how to keep your closing on schedule:

Thorough Pre-Listing Preparation

If you want to avoid last-minute surprises and stressful delays, the best place to start is with solid preparation. Before listing your home, gather all the key documents you’ll need—like the deed, your mortgage payoff amount, property tax info, and any HOA paperwork. It’s also a good idea to run a preliminary title search to catch things like liens or ownership issues early, instead of letting them pop up later and stall the sale.

You might also consider getting a pre-listing home inspection. It can help you spot any major repair issues before a buyer’s inspector does. Fixing these things ahead of time not only makes your home more appealing but also gives buyers fewer reasons to negotiate or back out.

Setting Realistic Timelines

There are plenty of reasons a closing can get delayed—some predictable, some completely out of left field. That’s why setting realistic timelines is so important. Giving yourself some wiggle room in the contract to address issues helps prevent last-minute panic when things don’t go exactly as planned. Whether it’s a financing holdup, an inspection surprise, or a paperwork mix-up, having a little extra time built in can make all the difference.

Staying Organized and Proactive

Stay on top of documents and deadlines by checking in regularly with buyers, lenders, and inspectors. You don’t need to be pushy, but a simple, “Hey, how’s everything coming along on your end?” can help keep things moving smoothly.

Conclusion

Closing delays can derail your timeline, but with the right approach, you can keep things moving smoothly. From financing snags to paperwork mistakes, potential obstacles are everywhere, but staying organized and proactive helps ensure a seamless closing.

Propbox gives you the tools to stay on top of the process, offering automated updates, AI-powered pricing, and a streamlined FSBO experience. By using Propbox, you can avoid the 6% commission fee, sell faster, and protect your interests better than a realtor. Don’t let delays cost you time and money; sell smarter with Propbox!