Selling a home without an agent places you in charge of marketing, negotiation, and paperwork. Among the many responsibilities of an FSBO (For Sale By Owner) seller, one item that often receives too little attention is the set of expenses due on settlement day: seller closing costs.

Though they rarely dominate conversations about price or strategy, these charges can reduce your net proceeds by several thousand dollars if you are unprepared. In this article, we’ll unpack every common (and not‑so‑common) expense, show you how to estimate your total bill, and offer practical ways to shrink it without shortchanging the buyer.

What Are Seller Closing Costs?

On closing day, ownership of the property transfers from the seller to the buyer. Before that deed is recorded, several professionals—lenders, title companies, local governments, and occasionally attorneys—present invoices for the services that make the transfer possible. Those invoices comprise your seller closing costs.

Seller closing costs are paid from the sale proceeds and are distinct from the buyer’s expenses, which often include loan‑related fees such as an appraisal or origination charge. For sellers, most costs are tied to conveying clear title and settling outstanding obligations on the property. Estimating these amounts in advance can help you confidently evaluate offers and avoid last‑minute surprises.

Types of Seller Closing Costs

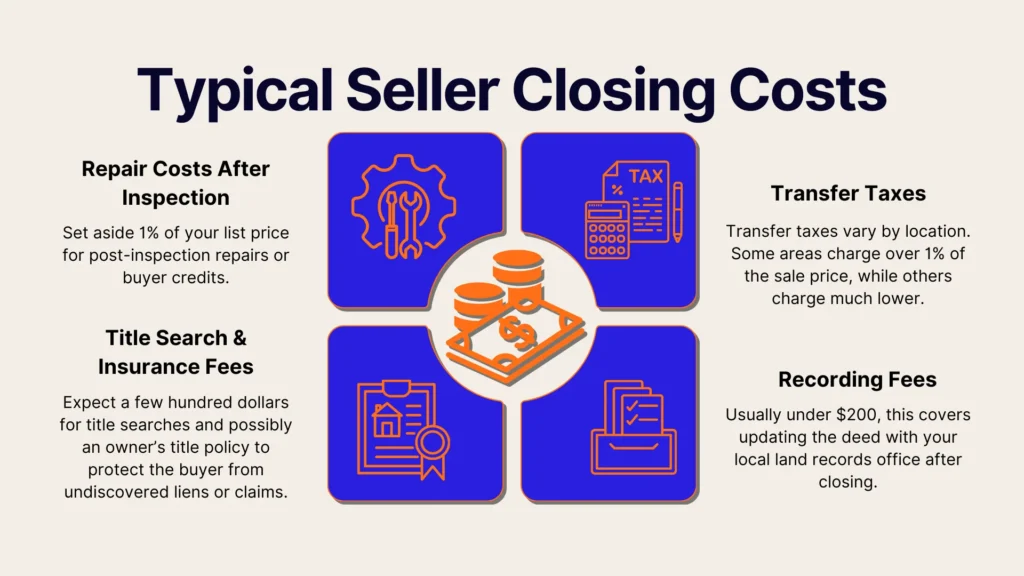

Closing costs fall into two broad categories: those that appear in nearly every transaction and those that arise only in specific jurisdictions or circumstances. Common examples include:

- Title‑related fees (title search and owner’s title insurance)

- Transfer taxes and recording fees

- Mortgage payoff and prorated interest

- Attorney or escrow charges (in attorney‑close states)

- Repair concessions or home‑warranty premiums

- Courier, wire, and miscellaneous settlement fees

Each individual fee is modest, but the combined total can drastically affect your bottom line. Knowing how much each charge will cost allows you to properly account for it in your budget and negotiate for reductions where possible.

Common Seller Closing Costs for FSBO and First-Time Sellers

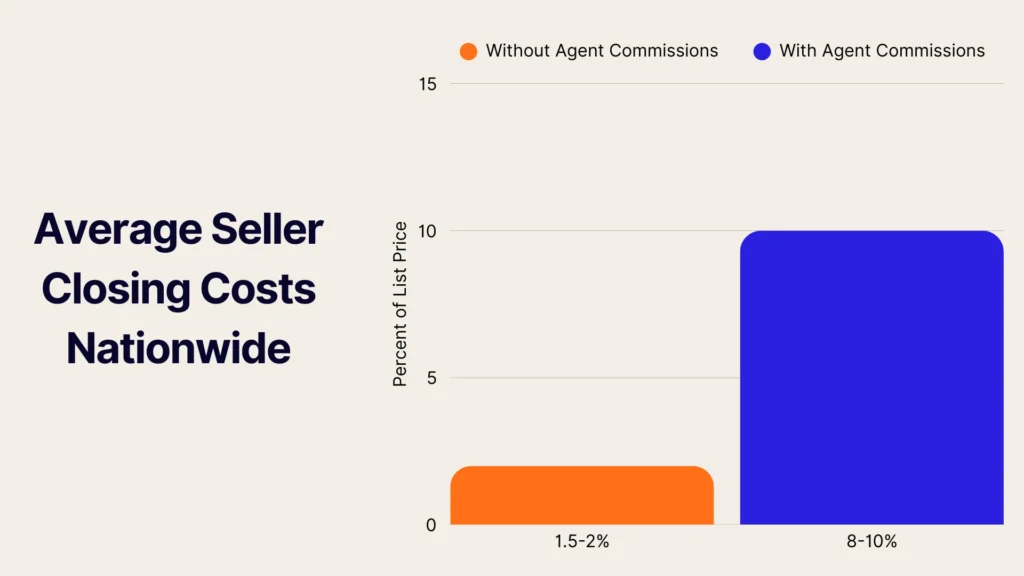

While selling your home FSBO can eliminate the 6% commission charged by real estate agents, closing costs can catch many first-time sellers off guard and eat into your bottom line if not accounted for. Below are some common expenses that appear on most settlement statements.

Repairs and Improvements

Very few properties pass inspection without comment. Buyers rely on inspection reports to request repairs or monetary credits, even in a competitive market. A well-maintained home is a priority for many buyers, and 9% of FSBO sellers see preparing and fixing up the home as their greatest challenge.

After a contract is signed, the buyer typically commissions a professional inspection. If any issues are spotted, the buyer might request that the seller complete repairs before closing, ask for a credit applied at closing, or negotiate the purchase price of the home. A good rule of thumb is to reserve around 1% of the list price for potential repairs.

Title Insurance and Title Search Fees

Defects such as unreleased mortgages or unpaid contractor liens can delay closing. Ordering a preliminary title report shortly after listing allows sufficient time to correct any discrepancies. This search fee typically costs a few hundred dollars.

When you order a title search, a title company examines public records to confirm your legal ownership and to verify that no liens are there to burden the buyer. In many states, sellers also purchase an owner’s title policy that protects the buyer—and, in some cases, the lender—against undiscovered claims.

Transfer Taxes and Recording Fees

Transfer tax is a levy assessed by the state, county, or municipality when real property changes hands. Rates can range widely between states, and some jurisdictions impose additional “mansion” taxes on high‑value transactions. Recording fees, generally under $200, cover the cost of filing the new deed with the appropriate land records office. Both charges depend on location, so look up the applicable rates in your area early in the selling process.

As an example, let’s look at the sale of a $500,000 house. In Washington, D.C., this sale would be subject to a 1.1% transfer tax, leading to a payment of $5,500. However, in many counties in Virginia, the same transaction would only be subject to a tax of 25 cents per $100, totalling $1,250.

Less Common Seller Closing Costs

We’ve discussed some of the closing costs required for nearly every home sale. However, some closing costs apply only under certain conditions or only in particular states. Researching and considering the fees and taxes specific to your location is essential to accurately estimate and plan for your total seller closing costs.

Attorney Fees

An attorney must oversee the closing in states such as New York, New Jersey, and Georgia. Hourly rates average $150–$400, while flat fees for a simple FSBO transaction fall between $500 and $1,500. If you live in an escrow‑close state, hiring an attorney is optional but can be wise if you’re juggling complex paperwork on your own.

Home Warranty and Closing Costs Assistance

Some sellers sweeten the pot by paying $400–$700 for a one‑year home warranty that covers the buyer’s appliances and systems. Offering to cover part of the buyer’s closing costs is another incentive, though it directly reduces your bottom line. Limit concessions to an amount you can comfortably absorb—many lenders cap seller‑paid costs at 3% of the price for conventional loans.

Mortgage Payoff

If you have an existing mortgage, your lender will send a payoff statement showing the exact balance plus daily interest through the scheduled closing date. Because interest accrues in arrears, the number may be slightly higher than your last statement.

If market conditions force you to accept a price below what you owe, you’ll need to bring certified funds to closing in order to clear the lien before the buyer can take title.

How Much Should FSBO and First-Time Sellers Expect to Pay in Closing Costs?

Without the commission costs of a real estate agent, the national average for seller closing costs is approximately 1.5-2% of the sale price. For the median 2024 FSBO sale price of $380,000, non‑commission closing costs are roughly $7,000. Expenses rise in high‑tax states or when substantial repairs are required. These can include:

- Local tax structure: State and municipal transfer taxes can represent the largest single line item.

- Attorney‑close mandates: Some states require legal representation, which increases total fees.

- Association obligations: Homeowners’ associations may demand payment of outstanding dues or special assessments at settlement.

- Mortgage balance: A higher principal translates into more significant prorated interest due at closing.

Ways to Minimize Seller Closing Costs

Although many fees are fixed, there are several strategies an FSBO or first-time seller can employ to reduce the overall amount paid at closing.

- Compare settlement service providers: Title companies establish their own pricing, so obtaining multiple quotes can lower costs.

- Negotiate transfer‑tax allocation: In some jurisdictions, buyers and sellers may divide the tax. Proposing a 50/50 split during negotiations can work, depending on how agreeable the buyer is to the terms.

- Offer monetary credits in lieu of repairs: Credits eliminate the need to manage contractors and can be less expensive than performing the work yourself.

- Schedule closing near month‑end: This will reduce the number of per‑diem interest days owed to your lender and may decrease prorated property taxes.

Preparing for Seller Closing Costs: A Checklist

Advance planning is the most reliable way to avoid delays and unexpected charges. Having a detailed checklist handy can be incredibly useful when you’re trying to keep track of a variety of expenses at the same time. Here’s a step-by-step guide to planning for seller closing costs:

- Request a mortgage payoff quote immediately after accepting an offer.

- Order a preliminary title report to identify and resolve liens early.

- Consider a pre‑listing inspection for older properties or those with known issues.

- Collect homeowners’ association documents and verify any outstanding obligations.

- Compile warranties, receipts, and manuals for recent repairs or upgrades.

- Obtain multiple title and escrow quotes to secure competitive pricing.

- Review the settlement statement (ALTA or HUD‑1) at least 24 hours before signing, and question unfamiliar fees.

- Bring government‑issued identification and any required certified funds to closing.

- Maintain digital and paper copies of all documents for future reference.

Conclusion

Closing costs may not be the headline number in your FSBO sale, but they still matter. If you want to protect your profit and avoid surprise costs on closing day, it’s a good idea to learn the typical fees, plan for location-specific taxes, and shop around for services like title reports that align with your needs. With a clear budget and a little negotiation savvy, you can hand the keys to the buyer knowing exactly where every dollar of your hard‑earned equity is going.

With so many moving parts, it pays to stay organized and informed throughout the process. FSBO sellers who anticipate these costs early are better positioned to make confident decisions and avoid last-minute delays. That’s where Propbox comes in. We’re simplifying the flat-rate FSBO process by giving you real-time control, AI-driven pricing tools, and automated reminders that take the stress out of selling. Skip the 6% commission and gain transparency, speed, and smarter tools—so you sell faster, keep more, and stay in charge. Try Propbox today and experience a streamlined way to sell your home on your terms.