As a For Sale By Owner (FSBO) seller, you're taking on a lot of responsibility, but it can be incredibly rewarding. You’re calling the shots – setting the price, negotiating with buyers – and that kind of control can feel empowering. Plus, you get to keep more of the profit, which is a nice bonus

However, part of calling the shots means that it’s your responsibility to learn more about the process, including key steps like closing. If you’re wondering what "closing on a house" actually means and how it impacts you, let’s break it down so it’s easy to understand.

Defining the Closing Process

Closing, also known as completion or settlement, is the final stage of your real estate transaction. This is when you officially transfer ownership of your property to the buyer. It begins after you've accepted an offer and signed the purchase agreement, and it culminates on the closing day when all necessary documents are signed, payments are made, and the keys are handed over.

But closing isn't just about transferring ownership—it's also about ensuring all legal and financial obligations are fulfilled. From clearing title issues to coordinating with escrow agents, every detail matters to successfully finalize the sale.

What Happens During the Closing

Whether you're selling your home yourself or navigating the process for the first time, understanding the steps of closing is key to keeping things smooth and stress-free.

Let’s break it down:

- Review of Closing Disclosure: A few days before closing (usually at least three business days in advance), the buyer will receive a closing disclosure from their lender. This document outlines all the final loan terms, including interest rates, monthly payments, and total closing costs. As the seller, you should also receive a version of this document. It shows what you’ll walk away with after all the debits (like taxes or title fees) and credits (like the buyer’s purchase funds) are tallied.

- Final Escrow Check: Before the actual closing appointment, the escrow officer or title company will do a final check on pending obligations, such as contingencies, bills, and liens. As the seller, you’ll need to confirm you've completed all agreed-upon repairs or other contractual obligations.

- Signing of Documents: On closing day, everyone will have to sign documents to finalize the sale. Sellers typically have to sign the deed, settlement statement, and affidavits or disclosures.

- Fund Transfer: Once everything is signed and double-checked, the escrow or title company will disburse funds to all relevant parties (you, any lienholders, agents, etc.), pay off your mortgage if you still owe a balance, and handle prorated expenses like property taxes or HOA dues. You’ll receive your net proceeds—what’s left after all costs and fees—usually by wire transfer or cashier’s check.

- Title is Transferred: The title company or attorney will then officially record the deed with your county’s recorder’s office. Once recorded, the buyer becomes the official owner.

The Role of Escrow

Escrow plays a vital role in safeguarding both you and the buyer during the transaction. An escrow agent or title company acts as a neutral third party to hold funds, documents, and other valuables until all conditions of the sale are met. For example:

- The buyer's earnest money deposit is placed in an escrow account.

- Loan documents and deeds are securely handled until they're ready for transfer.

Escrow ensures that neither party is at risk of losing money or property due to unmet conditions. This layer of protection is especially beneficial for you as an FSBO seller, who may not have professional representation throughout the process.

Key Parties Involved

Several players may be present at closing:

- Buyer: Signs mortgage documents and pays closing costs.

- You (Seller): Transfer ownership by signing the deed and other paperwork.

- Escrow Agent/Title Company: Manages funds and ensures legal compliance.

- Attorney (optional): Provides legal guidance if needed.

- Lender: Disburses funds for the buyer's loan.

Each participant has specific responsibilities, but your primary focus will be on signing documents accurately and ensuring that all agreed-upon terms are fulfilled.

The Final Walk-Through

As closing day approaches, there’s one last step before everything is finalized—the final walk-through. This is the buyer’s chance to ensure the home is in the agreed-upon condition, with all negotiated repairs completed and no unexpected surprises.

This step ensures that:

- Agreed-upon repairs have been completed: Any fixes negotiated during the inspection process should be finished, with receipts or proof of work if necessary.

- The property remains in its agreed condition: The home should be in the same state as when the offer was accepted, with no new damage, missing fixtures, or unexpected issues.

Beyond repairs, sellers should also ensure that:

- Appliances and systems are in working order: Run major appliances, check that faucets and toilets function properly, test light switches, and confirm the HVAC system is operating as expected.

- The home is completely cleared out: Remove all personal belongings and trash unless otherwise agreed upon with the buyer.

- Doors and windows are secure and functional: Ensure locks work properly and check for any broken seals or drafts.

- All agreed-upon fixtures and inclusions remain: Double-check that items included in the sale, such as light fixtures, curtains, or mounted TVs, have not been removed.

Unexpected issues may arise during the walk-through, such as incomplete repairs or new damage. Open communication with the buyer is key to resolving these problems quickly. Whether it's negotiating repairs or adjusting terms, maintaining goodwill can help prevent delays.

Costs and Fees at Closing

While these expenses can vary, both buyers and sellers will encounter certain standard fees that need to be planned for. Sellers should be aware of costs like title fees, transfer taxes, and agent commissions, and be prepared for any unexpected expenses that may pop up. Buyers will also need to carefully review their settlement statement to make sure everything is accurate.

Let’s break down the usual expenses for sellers and things to look out for in the settlement statement:

Common Expenses for You

Selling your home as an FSBO (For Sale By Owner) can save you a chunk of money on agent commissions, but there are still a few costs you’ll need to keep in mind. It’s good to be prepared so there are no surprises when closing day rolls around.

- Title Fees: These cover things like the title search to make sure there are no legal issues with the property’s title, and title insurance, which protects the buyer and lender in case any problems pop up down the road.

- Transfer Taxes: This is a tax you’ll pay to your local or state authorities for transferring the property to the new owner. The amount can vary, so be sure to check with your local government.

- Miscellaneous Costs: These could include prorated property taxes or any Homeowners' Association (HOA) fees. These are typically adjusted based on the closing date and can add up quickly, so it’s good to factor them in.

Understanding the Settlement Statement

The settlement statement is a document that lays out all the financial details of your sale. It shows everything you’ll be paying (debits) and everything you’ll be getting (credits).

The debits are your costs, like title fees, transfer taxes, and any other closing costs you’re responsible for. The credits are what you’ll receive from the buyer—usually the sale price minus any expenses.

Carefully go over this statement to make sure everything matches up with the estimates you received earlier in the process. If anything seems off or doesn’t add up, now’s the time to ask questions and get things sorted. Taking a little time to double-check everything will help you walk into closing day feeling confident and clear about the final numbers.

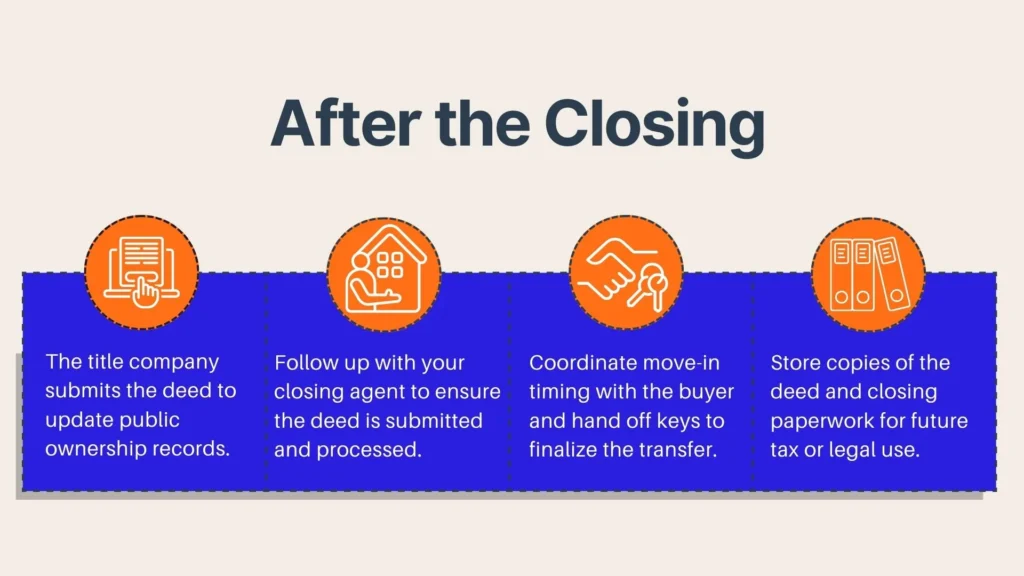

After the Closing

Once the closing is complete, there are a few final steps to officially close out the sale. While it may feel like the end, some tasks remain to ensure everything is properly recorded and the property is fully transferred. From recording the deed to handing over the keys, these steps wrap up the process.

Let’s take a look at the final steps of recording the deed and handing over the keys, both of which officially complete the transfer of ownership:

Recording the Deed

Once the closing is wrapped up, the deed needs to be recorded with your local authorities to officially update the ownership records. This step ensures the property is legally transferred to the buyer’s name, but it can take a few days or even weeks, depending on where you are.

To make sure everything is moving along, it’s a good idea to check in with your title company or closing agent to confirm that the deed has been submitted for recording. If you're eager to get things officially finalized, ask for an estimated timeline. Once everything is recorded, you’ll receive a copy of the deed for your records, so keep it in a safe spot.

Handing Over the Keys

Handing over the keys marks the official end of your responsibilities as a seller, but before you do, it’s good to make sure everything’s in order with the buyer. Confirm the possession date and when they want to move in so there’s no confusion. If you need some extra time after closing, make sure you and the buyer are on the same page about that.

Once the keys are handed over, that’s the end of your part in the process! But don’t forget about the paperwork; you’ll want to keep copies of all signed documents, like the closing agreement and the deed. It’s always a good idea to store these somewhere safe, just in case you need them later for tax purposes or legal reasons. Having everything organized will give you peace of mind, knowing you’re covered after the sale.

Conclusion

Closing on your house marks the end of one chapter and the start of another. As an FSBO seller, you want to navigate this process smoothly, and Propbox makes it easier. Our platform speeds up the selling process, saving you time and effort by automating tasks, sending reminders, and organizing everything from start to finish.

Say goodbye to hefty realtor commissions and hidden fees. Enjoy a faster, simpler, and more organized selling experience, all while protecting your interests better than any realtor. Start using Propbox today to streamline your home sale and maximize your profits.