Selling your home without a real estate agent means handling every transaction detail yourself—including reviewing key financial documents. One of the most important documents you’ll encounter is the Closing Disclosure (CD). This five-page form lays out the final terms of the sale, including the buyer’s loan details, closing costs, and the exact amount you’ll receive at closing.

Understanding the Closing Disclosure is crucial because errors or unexpected charges can delay or even derail the sale. This guide will explain what this document includes, why it matters, and what FSBO sellers should look for before signing the dotted line. Let’s dive in!

Evolution from HUD-1 to the Closing Disclosure

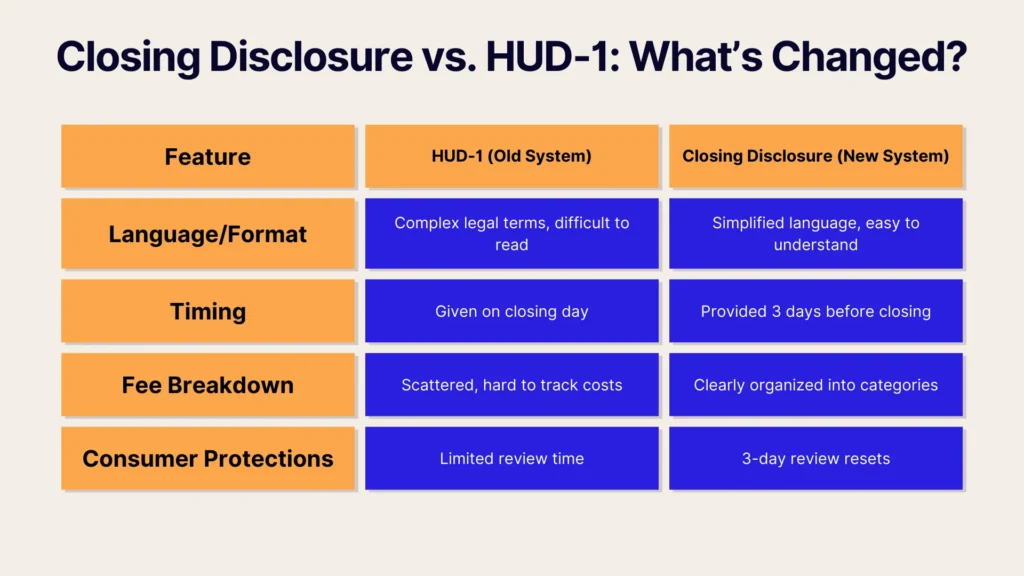

If you’ve ever sold a home in the past, you might remember the HUD-1 Settlement Statement, a dense, jargon-filled document that was used for decades in real estate transactions. While it contained all the essential details of a closing, it was notorious for being complex and challenging for sellers and buyers to understand.

TILA-RESPA Integrated Disclosure Rule

Closing Disclosures changed in 2015, when the TILA-RESPA Integrated Disclosure (TRID) Rule went into effect, replacing the HUD-1 with the more consumer-friendly Closing Disclosure. This shift was designed to improve transparency, simplify real estate transactions, and ensure that buyers and sellers fully understood their financial obligations before closing day.

This change is particularly important for FSBO sellers. Since you’re handling the sale without an agent, having a clearer, more structured document makes verifying the numbers easier and ensuring you’re receiving the correct proceeds.

The TILA-RESPA Integrated Disclosure Rule (TRID) was introduced by the Consumer Financial Protection Bureau (CFPB) to merge two major federal disclosure laws:

- Truth in Lending Act (TILA): Ensured borrowers received clear loan information.

- Real Estate Settlement Procedures Act (RESPA): Governed how lenders and closing costs were disclosed.

Before TRID, buyers received multiple separate documents, including the Good Faith Estimate (GFE) and HUD-1 Settlement Statement, which often contained overlapping and sometimes confusing information. Many buyers wouldn’t see their final costs until the last minute, giving them little time to review and understand the terms before signing.

Combining these disclosures into the Closing Disclosure made the process more streamlined and consumer-friendly. Now, buyers receive the Closing Disclosure at least three business days before closing, giving them time to review the terms, compare them to their initial loan estimate, and ask questions if anything seems off.

For FSBO sellers, this means fewer surprises at closing. You’ll know exactly how much you’re paying in seller-related closing costs and what you’re walking away with before sitting down at the closing table.

Key Differences from the HUD-1

The Closing Disclosure isn’t just a replacement for the HUD-1—it’s a major improvement in terms of clarity, accessibility, and consumer protection. Here’s how:

Simplified Layout & Language: The Closing Disclosure is designed for easy reading, using plain English instead of complex legal jargon. It’s structured much like a credit card statement, with clear sections for loan terms, payments, and closing costs.

For example:

- On the old HUD-1, fees were scattered across multiple lines with vague labels like "Line 1101: Title Services and Lender’s Title Insurance."

- The Closing Disclosure now clearly states who pays what, using straightforward categories like "Loan Costs" and "Other Costs."

Better Timelines & Consumer Protections: One of the biggest complaints about the HUD-1 was that it was often handed to buyers on the closing day, leaving no time for review. With the Closing Disclosure:

- Buyers get the form at least three business days before closing, ensuring they have time to review it.

- If there are major changes (like a new loan rate or unexpected fees), the three-day review period restarts—giving consumers more control.

Breaking Down the Closing Disclosure: A Page-by-Page Overview

The Closing Disclosure is a five-page document that outlines the final details of a home sale, including the buyer’s loan terms, closing costs, and the exact amount each party pays and receives. As an FSBO seller, understanding this document ensures you get the correct proceeds from the sale and prevents last-minute surprises at closing.

Here’s a page-by-page breakdown of what you’ll find in the Closing Disclosure and how to interpret it.

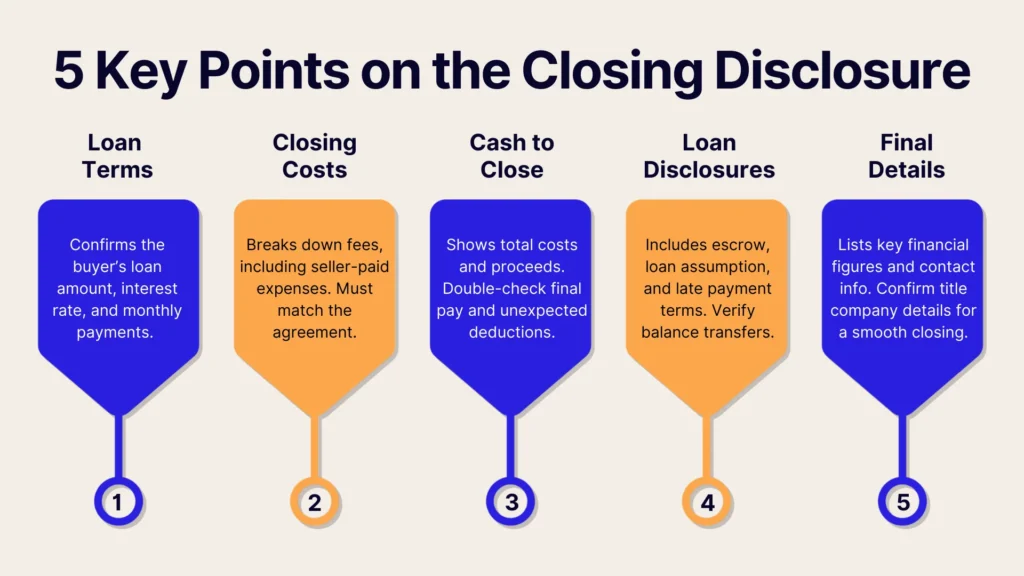

Page 1: Loan Terms & Projected Payments

The first page provides an overview of the buyer’s loan and their expected mortgage payments. Key sections include:

- Loan Amount: The total amount the buyer is borrowing. This should match what was agreed upon in the purchase contract.

- Interest Rate: The percentage the buyer is paying in interest. If this differs from what was initially agreed upon, it could impact their ability to close.

- Principal & Interest: The fixed portion of the buyer’s monthly mortgage payment that covers the loan balance and interest.

- Estimated Taxes, Insurance & Assessments: Includes property taxes, homeowner’s insurance, and possible homeowners association (HOA) dues. Some of these may be held in escrow (more on that in Page 4).

What FSBO Sellers Should Check:

- Confirm the purchase price matches your agreement.

- If there are seller concessions (such as paying part of the buyer’s closing costs), ensure they’re accurately reflected.

Page 2: Closing Cost Details

This page breaks down every fee, service charge, and closing cost involved in the sale. These fees are divided into:

- Loan Costs: Charges from the buyer’s lender, such as origination fees, discount points (if they paid to lower their interest rate), and appraisal fees.

- Other Costs: Additional expenses like homeowner’s insurance, property taxes, and recording fees.

- Seller-Paid Costs: Any portion of the closing costs that the seller has agreed to cover. This might include:

- Agent commissions (if you agreed to pay the buyer’s agent).

- Title insurance (often a seller expense, depending on local customs).

What FSBO Sellers Should Check:

- Review your closing costs and ensure you’re only paying what you agreed to.

- Verify that any credits to the buyer (such as repairs or seller-paid closing costs) are listed correctly.

Page 3: Calculating Cash to Close

This section determines exactly how much the buyer needs to bring to closing and how much you will receive as the seller after all costs and deductions.

Key figures include:

- Total Closing Costs: The combined total of all buyer and seller costs.

- Seller Credits: Any concessions or repairs you agreed to cover.

- Cash to Close: The amount the buyer needs to bring to finalize the sale.

What FSBO Sellers Should Check:

- Your final proceeds. This is the total amount you’ll receive after subtracting closing costs, mortgage payoffs, and any credits to the buyer.

- Ensure there are no unexpected deductions that you weren’t aware of.

Page 4: Additional Loan Disclosures

While this section is more relevant to the buyer, it’s still useful for sellers to understand. It includes:

- Escrow Account Information: If the buyer is using an escrow account for property taxes and homeowner’s insurance, those details will be listed here.

- Assumption Terms: Indicates whether the buyer’s loan can be transferred to someone else (most loans cannot be assumed).

- Late Payment Policies: The lender’s penalties for late mortgage payments.

What FSBO Sellers Should Check:

- If you agreed to transfer an escrow balance (for example, if you prepaid property taxes and the buyer is reimbursing you), make sure it’s listed correctly.

Page 5: Loan Calculations & Contact Information

The final page provides key loan calculations and important contact details. It includes:

- Annual Percentage Rate (APR): The true loan cost, including interest and fees.

- Total Interest Percentage (TIP): The percentage of the loan amount that the buyer will pay in interest over the life of the loan.

- Lender, Settlement Agent & Contact Info: Lists the names and contact details for the lender, title company, and any attorneys involved.

What FSBO Sellers Should Check:

- Ensure the title company’s contact information is correct, as they will handle your proceeds.

- This page provides the correct people to contact before closing if you have any questions about the final numbers.

Where to Focus for Accuracy

Before closing day, you’ll want to triple-check the numbers on the CD. While the document is designed to be clear, errors can still happen. Here’s where FSBO sellers should focus:

- Final Loan Amount and Interest Rate (if offering seller financing): If you are financing part of the sale (offering seller financing), ensure the loan amount, interest rate, and payment schedule match the agreed-upon terms. Any discrepancy could lead to legal or financial complications.

- Fees Matching the Initial Agreement: Review the itemized fees on Page 2 of the CD. These should align with the estimates provided earlier in the process (such as from the Loan Estimate if the buyer uses financing). Any unexpected or inflated fees should be flagged and discussed with the title company.

- Proceeds Calculation: The final “Cash to Seller” amount should reflect what you expect to receive after deducting title insurance, transfer taxes, and any seller-paid closing costs. If the number is off, request a breakdown to identify the discrepancy.

When and How You Receive the Closing Disclosure

The Closing Disclosure isn’t handed over at the last minute. Lenders are required by law to provide it well in advance. Here’s what to know:

The Three-Day Rule

By law, buyers must receive the Closing Disclosure at least three business days before closing. This review window ensures they have time to check for errors or unexpected changes.

- If any major adjustments occur, such as a significant change in loan terms, an increase in fees beyond legal tolerances, or the addition of a prepayment penalty, the three-day period restarts to give the buyer time to review.

- As a seller, you typically receive the Closing Disclosure around the same time so you can verify your numbers.

- If errors are found, contact the title company or closing agent immediately to resolve them before closing day.

Paper vs. Electronic Delivery

Paper Delivery:

- Some title companies or lenders may provide a physical copy of the CD.

- This method ensures you have a tangible document to review, but it may take longer to receive and process corrections if needed.

Electronic Delivery:

- Many lenders and title companies send the CD electronically via secure email portals.

- Faster delivery and the ability to instantly compare it to previous estimates.

- However, some electronic systems require confirmation of receipt before the three-day clock starts. The closing could be delayed if you don’t acknowledge the document in time.

Comparing the Closing Disclosure to the Loan Estimate

A key step before closing is comparing the CD to the Loan Estimate (LE) the buyer received earlier. Here’s how to ensure consistency:

Consistency Checks

Some costs cannot increase beyond what was disclosed on the Loan Estimate, while others can change within certain limits. Review these key areas:

- Interest Rate & Loan Terms: If the buyer’s interest rate changed unexpectedly, confirm whether it was a locked rate or if they accepted an adjustable-rate mortgage (ARM) shift.

- Origination & Lender Fees: Fees from the lender (such as underwriting or processing fees) cannot increase from the Loan Estimate. If they did, this could be an error.

- Third-Party Services: Certain costs, like title insurance or appraisals, can increase by up to 10%, but not beyond that.

Spotting Unanticipated Changes

Some fee changes are legitimate, but others could signal errors or unnecessary charges:

Legitimate Cost Changes:

- Property Appraisal Issues: If the buyer’s home appraisal came in low, their lender may have required additional reviews or inspections, leading to higher fees.

- HOA Fees: Some homeowners associations charge a resale certificate fee that wasn’t originally included in the Loan Estimate.

Red Flags:

- Surprise Administrative Fees: Watch out for vague or unexpected "document preparation" or "funding" fees that weren’t disclosed earlier.

- Inflated Title Insurance Costs: While title insurance is standard, its cost should align with previous estimates. If it’s higher, ask for clarification.

Interpreting Fees and Costs for FSBO Sellers

Even without a real estate agent, selling a home comes with certain costs. Understanding these fees ahead of time will help you avoid surprises when you receive your CD.

Typical Costs on the Seller Side

As an FSBO seller, you’ll typically be responsible for:

- Real Estate Transfer Taxes: Many states, counties, and cities charge a transfer tax when property ownership changes hands. The exact amount varies by location, so check with your title company.

- Attorney Fees: If you hired a real estate attorney to review contracts or assist with closing, their fee will be listed in the CD.

- Title Insurance (Owner’s Policy): In many states, the seller is expected to pay for owner’s title insurance, which protects the buyer from title issues. However, this cost can sometimes be negotiated.

- Prorated Property Taxes: If you’ve paid property taxes for the year, you may be reimbursed for the buyer’s portion. If taxes are still due, they’ll be deducted from your proceeds.

- HOA Transfer Fees (if applicable): Some homeowners associations charge a transfer or resale fee when a property changes ownership.

Negotiated vs. Standard Fees

Some fees are standard seller expenses, while others are open to negotiation, including the following:

- Seller-Paid Closing Costs: If you agreed to cover part of the buyer’s closing costs, make sure the amount is correctly reflected.

- Title Insurance Costs: In some states, buyers and sellers can negotiate who covers title insurance.

- HOA Transfer Fees: Depending on your contract, either party may be responsible for HOA transfer fees.

Here are some ways you can minimize seller costs:

- Ask the buyer to cover their own closing costs instead of negotiating a seller credit.

- Compare rates for title insurance and closing services.

- Ensure no unnecessary fees are added at the last minute.

Ensuring Accuracy and Avoiding Pitfalls

To prevent costly mistakes, review your Closing Disclosure carefully before signing.

Double-Checking Each Line Item

Errors on closing documents are more common than you think. Scrutinize every line to ensure:

- Fees match what was agreed upon in your contract.

- Names and details are correct (mismatched seller/buyer names or incorrect property descriptions can delay closing).

- The “Cash to Close” calculation adds up correctly.

Escrow and Payoff Verification

If you have an existing mortgage or lien on the property, make sure it’s:

- Listed correctly on the CD: Your payoff statement should match what the lender provided.

- Paid off in full at closing: Mistakes here could result in a lingering balance even after the sale is finalized.

If you paid property taxes or HOA fees in advance, confirm that the correct prorated reimbursement is included in your proceeds.

Handling Last-Minute Changes

If you spot an error in your Closing Disclosure, notify the title company or closing attorney immediately. If the changes are minor (e.g., typo, small fee adjustment), they can usually be fixed quickly. But if the changes affect the buyer’s loan terms (e.g., increased closing costs, loan amount change), the lender may require a new three-day review period, potentially delaying closing.

Conclusion

Selling a home FSBO gives you control, but managing the CD, closing costs, and deadlines can be overwhelming. Ensuring accuracy, spotting discrepancies, and coordinating with the title company requires careful attention.

PropBox simplifies the entire process by organizing key documents, tracking deadlines, and facilitating communication with buyers, attorneys, and title companies—all in one platform. With automated reminders, secure document storage, and transaction management tools, PropBox helps you close smoothly and confidently. Don’t navigate FSBO sales alone—streamline your closing with PropBox and ensure a hassle-free real estate transaction from start to finish.