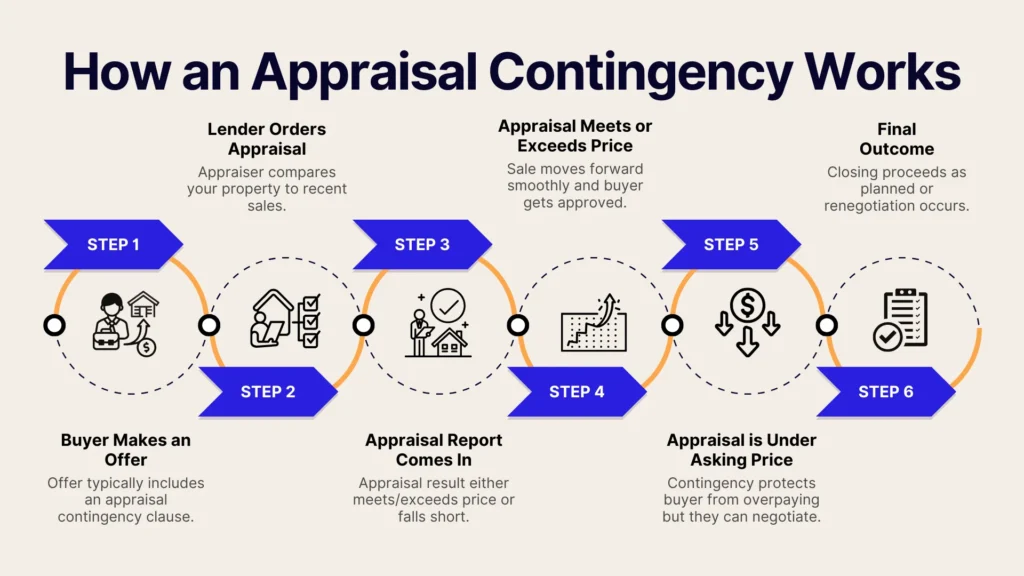

When you sell your home on your own, you take charge of everything, from showing the house to setting the price and talking to buyers yourself. One important part of the process is the appraisal contingency. This contract clause lets a neutral appraiser confirm a fair price.

While an FSBO sale has its perks, there are still some key steps to understand, such as requesting an appraisal, reviewing the report, and possibly renegotiating the price. In this guide, you’ll learn how appraisal contingencies are different from other contract terms and why they matter in protecting both the buyer’s and your interests.

Defining an Appraisal Contingency

An appraisal contingency is a common clause in real estate contracts that lets the buyer confirm the property’s market value before completing the sale. If the appraisal matches or exceeds the agreed price, the deal moves forward; if not, the buyer can renegotiate or cancel without penalty. This clause protects both the buyer and the lender by ensuring financing is based on fair market value.

For first-time sellers in an FSBO (For Sale By Owner) process, understanding this clause is key. Around 74% of buyers use financing, and their lenders must confirm that the property is worth the price. Knowing this helps you price realistically and prepare if the appraisal comes in low.

Understanding the Appraisal Contingency Clause

Understanding how the appraisal contingency works will help you feel more confident during the selling process. Here’s what it means, how it’s written in a contract, and what happens if the home doesn’t appraise for the expected amount.

Standard Language in Real Estate Contracts

Most real estate contracts use clear, standard phrases to explain how the appraisal fits into the deal. You might come across phrases like “sale is contingent on the home appraising at or above the purchase price,” “buyer can cancel if the appraisal is too low,” or “loan approval depends on appraised value.” Wording it this way helps avoid confusion and makes sure both sides understand that the sale depends on a fair, third-party valuation.

This language protects everyone involved. It boosts lender confidence and gives buyers a way out if the home’s value falls short. About 17% of FSBO sellers say that “getting the price right” is their biggest challenge, so a solid appraisal helps keep the numbers in check.

Conditions for Removal or Cancellation

If the appraisal comes in low, the buyer usually gets about five business days to respond. They can ask for a price cut, add cash to cover the gap, or walk away without losing their deposit. The clause protects buyers from overpaying and sets a clear clock for fixing appraisal issues. As the seller, knowing these rules helps you steer talks. Missing a deadline could sink the sale, so stay organized.

Negotiation Leeway for Sellers

Even if the appraisal is lower than expected, all hope is not lost. A low appraisal opens up a space for negotiation between you and the buyer. In some cases, you might agree to adjust the sale price or ask the buyer to increase their down payment to meet the lender’s requirements.

Maintaining an open dialogue and being ready with supporting documentation can help secure a fair result. Remember, while the appraisal contingency provides a safety net for the buyer, it also gives you the opportunity to negotiate terms that protect your financial interests.

Potential Outcomes of an Appraisal Contingency

Appraisals don’t always go as expected, and that can shift the deal. Let’s explore how you can prepare for different scenarios and keep things moving.

Appraisal Meets or Exceeds Sale Price

When the home appraises at the agreed price, the sale moves forward without issue. The buyer’s loan stays on track, and both sides head toward closing with confidence. This result tells everyone your price was fair, and it often means a quick closing—helpful when you’re handling the sale yourself.

Appraisal Falls Short of Sale Price

A low appraisal means you may need to renegotiate. The buyer might ask for a lower price or add extra cash to cover the gap. For example, on a $400,000 deal with a $390,000 appraisal, you could lower the price slightly while the buyer contributes additional funds.

If you've made renovations or home improvements, you can use documentation like permits and invoices to support keeping your price closer to the original asking price. However, lenders may not fully adjust the appraisal value, so if an agreement isn’t reached, the buyer still has the option to walk away.

Appraisal Above Sale Price

Sometimes, the appraisal is higher than the sale price, showing the buyer is getting a bargain. This rarely changes the contract but makes both the lender and buyer feel good. It can also boost your confidence, proving the market values your home. Still, focus on closing the sale instead of chasing a higher number.

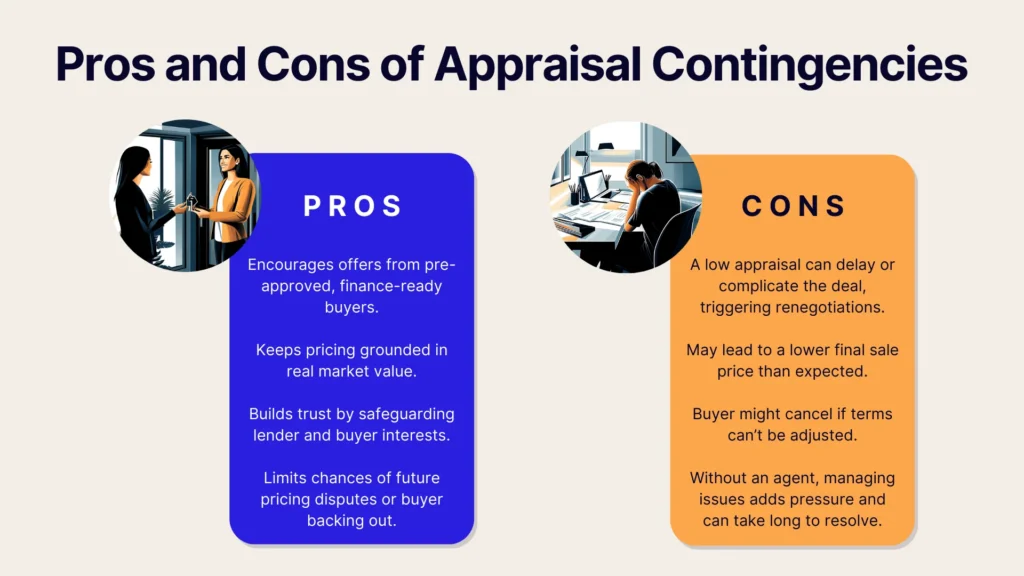

Pros and Cons of Appraisal Contingencies for Sellers

Appraisal contingencies can be a double-edged sword for home sellers—they offer essential protection but can sometimes slow down your timeline. Here’s a breakdown of the benefits and drawbacks to help you decide whether to include this clause in your deal.

Pros

- Attracts Qualified Buyers: An appraisal contingency tends to attract buyers who are serious about financing their purchase. Pre-approved buyers who secure financing are less likely to back out unexpectedly.

- Promotes Transparency: This clause helps ensure that the sale is based on the home’s actual market value, reducing the risk of overpricing and subsequent price adjustments.

- Protects the Lender and Buyer: It safeguards the interests of both the buyer and the lender, ensuring that financing is not provided for an overvalued property. This mutual protection builds trust and credibility in the transaction.

- Reduces Financial Risk: By verifying the home’s value, the clause protects you from potential disputes and ensures that the offer reflects realistic market conditions.

Cons

- Potential for Last-Minute Renegotiations: If the appraisal is lower than expected, you might be forced into reducing the sale price or face renegotiations that can delay the closing.

- Uncertainty in Sale Proceeds: A low appraisal means you might end up receiving less money than anticipated, which could affect your future plans if you were counting on a certain sale value.

- Risk of Deal Collapse: In some cases, buyers may prefer to cancel the transaction rather than engage in lengthy negotiations. This risk could leave you back at square one in a competitive market.

- Added Stress: Managing appraisal-related issues without professional help can increase the mental load for FSBO sellers, potentially complicating an already challenging process.

Weighing Risk vs. Reward

Choosing an appraisal contingency is a trade‑off. Keeping it gives you a safety net if prices dip, but it can slow things down. Dropping it may lure stronger offers yet shifts the risk to the buyer.

If you’re sure about your price and recent upgrades, a firm contract can work. If the market feels shaky, keeping the clause adds peace of mind.

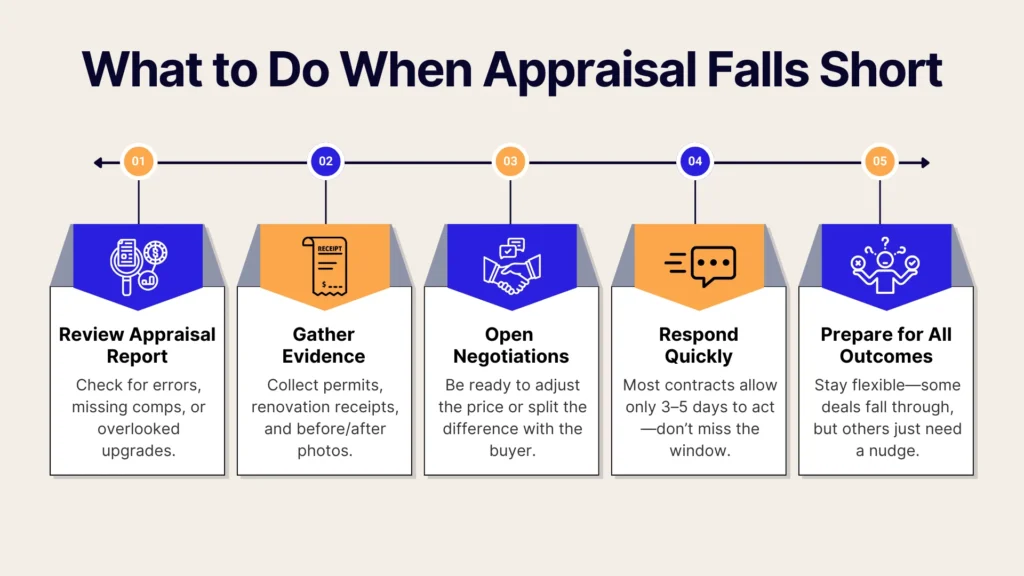

Handling Low Appraisals

Handling a low appraisal can be tricky, but there are ways to work around it. Here’s how you can navigate the situation and turn a potential setback into something more manageable.

Negotiating with the Buyer

If the appraisal is low, talk openly with the buyer. You can trim the price, have them add cash, or split the gap. Clear, quick communication keeps the deal alive. Remember, a buyer’s agent may expect a commission, so sort out commission details early.

Providing Additional Information

If you believe that the appraisal didn’t fully capture your home’s value, gather evidence to support your case. Collect recent sales data, comparable market analyses, and receipts for any upgrades or renovations you’ve made. Submitting this extra documentation can prompt a review or even a second appraisal.

Walking Away from the Deal

Sometimes, the numbers just don’t work. If the appraisal stays far below your price and talks stall, it’s okay to walk. Use what you learned to fine‑tune your price or make small fixes before relisting. Knowing when to move on is part of smart FSBO selling.

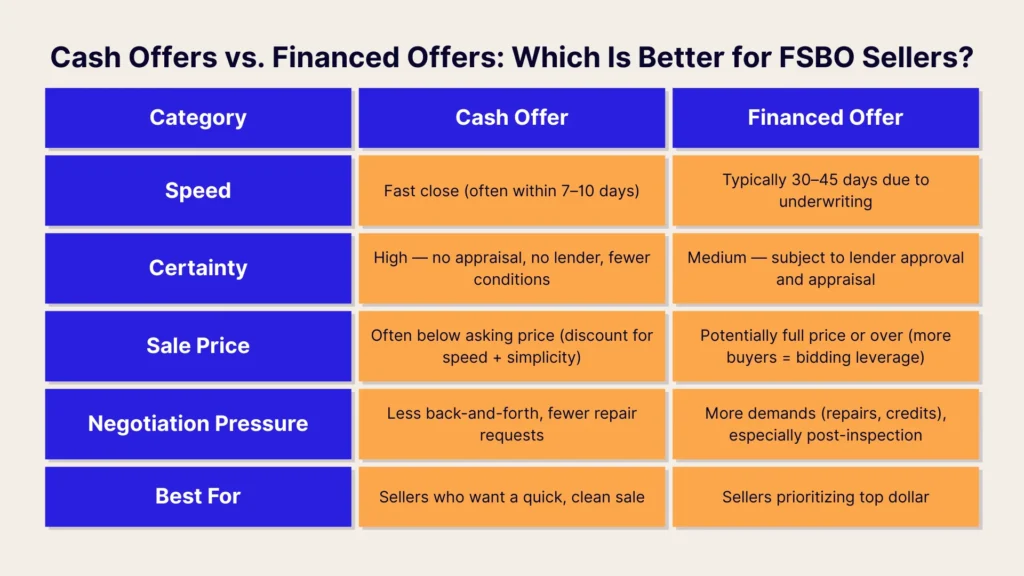

Contingency Waivers and Alternatives

Appraisal contingencies aren’t your only option when selling. Let’s go over some smart strategies that can help you with your home sale.

Appraisal Gap Coverage

Some buyers promise in writing to pay any gap if the appraisal comes in low. This “gap coverage” is handy in hot markets and lets the sale keep moving. It moves much of the risk to the buyer, giving you peace of mind by knowing your final price is safe.

Cash Offers and No-Appraisal Deals

Cash buyers often skip appraisals because no bank is involved, so closing can wrap up in a week instead of a month. Imagine an investor offering $385,000 cash on your $400,000 list price and promising to close in seven days—no lender, no extra paperwork. The good news: you finish fast, face fewer repair demands, and avoid loan surprises.

The trade‑off is that cash bids usually land a bit lower than financed offers, so decide if speed and certainty are worth a slightly smaller check.

Non-Contingent Financing Clauses

Some buyers try to shine in a hot market by limiting or waiving the appraisal contingency, even though they still need a loan. Picture a $410,000 offer on your $400,000 home, 25 % down, plus a $20,000 non‑refundable deposit.

Strong savings and a big deposit show commitment, but remember: the bank can still order an appraisal and shrink the loan if the value comes in low. That forces the buyer to add cash—or back out. Always check proof of funds and be sure the higher headline price outweighs any last‑minute risks.

Conclusion

In home selling, every choice matters. Whether it’s handling an appraisal, facing tough negotiations, or knowing when to walk away, how you manage these moments shapes success. With a clear grasp of appraisal contingencies and a solid plan, you can move the sale forward in a way that reflects both market value and your financial goals.

Tools like Propbox simplify things by automating reminders, organizing documents, and keeping you updated throughout. By cutting down admin tasks, Propbox helps you avoid surprise costs and delays, so you can close faster with more confidence. Try Propbox today for a smoother FSBO experience with less stress.