Selling commercial real estate without an agent gives you more control over the process, but it also means you're responsible for handling intricate legal and financial details. Commercial transactions are typically more intricate, involving higher financial risks, zoning laws, and lease agreements.

While FSBO has gained popularity in residential real estate, accounting for 6% of transactions in 2024, it’s also gaining traction in the commercial sector. Many commercial property owners are now opting to sell independently to retain more of their profits.

At the heart of any successful sale is the commercial purchase agreement, a legally binding document that ensures both parties are protected and the terms are clear. This article will break down the crucial components of a commercial purchase agreement, helping you navigate this essential step in your FSBO commercial sale.

Defining a Commercial Purchase Agreement

A commercial purchase agreement is a legal contract for selling commercial property. It lists the terms, conditions, and responsibilities of the buyer and seller. Unlike residential real estate deals, commercial sales often involve more complex negotiations, financing terms, and property details, making a well-written contract essential.

Core Components of a Commercial Purchase Agreement

A clear and complete agreement protects both parties and reduces the chance of problems later. Here are the most important sections:

Buyer and Seller Details

It’s important to list the correct names of the buyer and seller. In many cases, businesses, not individuals, buy or sell commercial properties. The agreement should include the full business name, legal designation (LLC, corporation, etc.), and the name of a registered representative. Mistakes in these details can cause delays or even make the contract unenforceable.

Property Description

The agreement should clearly describe the property being sold, including:

- The full address

- A legal description

- Parcel identification numbers

- Any items included in the sale, such as equipment or tenant leases

Since commercial properties often include multiple parts (such as land, buildings, and rental spaces), the contract should specify exactly what is included to prevent confusion. If any leased equipment or tenant agreements are involved, they must be disclosed to avoid misunderstandings.

Purchase Price and Payment Terms

The agreement should clearly outline the total purchase price, the financing method (cash or loan), and details regarding the earnest money deposit. Commercial sales often involve unique payment structures, such as seller financing or installment payments, which must be explicitly detailed.

Additionally, financing terms can significantly impact the transaction. If the buyer is obtaining a loan, the contract should include a contingency clause specifying that the sale is dependent on loan approval. Sellers offering financing should outline the interest rate, payment schedule, and any collateral requirements.

Closing and Possession Dates

Clearly defining the timeline for closing and possession is vital. This includes the final settlement date and agreements about when the buyer can take possession of the property, particularly if the seller requires additional time to vacate or transfer operations.

Closing dates can impact property management, business operations, and tax liabilities. Sellers should ensure that possession timelines align with any lease agreements or existing obligations to tenants, as failing to coordinate these details could result in legal or financial issues.

Key Contingencies and Clauses

Contingencies are essential because they allow either party to back out of the transaction or renegotiate terms under specific conditions, reducing financial risk. Without well-defined contingencies, sellers and buyers can be left vulnerable to costly surprises. Knowing which contingencies to include and how they impact the agreement is vital for a smooth negotiation process, such as:

Inspection Contingency

Buyers usually include an inspection clause to check the property’s condition. This allows them to back out or renegotiate if major issues are found, such as structural problems or zoning violations.

Unlike home inspections, commercial property inspections often require specialists, such as environmental engineers and legal experts. Sellers should be prepared for buyers to request repairs or a lower price if issues arise.

Appraisal and Financing Contingencies

If the buyer is getting a loan, an appraisal clause protects them if the property is worth less than expected. A financing clause allows the buyer to cancel the contract if they can’t secure a loan. Alternative financing options, such as SBA 504 loans or bridge loans, should also be considered, as they can impact the timeline and terms of the sale. Furthermore, a title contingency should be included to ensure the property has a clear title before the transaction is finalized.

Banks typically require an appraisal before approving a loan. If the property appraises for less than expected, buyers may need to renegotiate the price, increase their down payment, or seek a different lender.

Additional Clause Examples

Additional clauses may include:

- Seller disclosures about environmental hazards or defects

- Agreements about existing tenant leases

- Rules from a property owners’ association (if applicable)

These clauses help clarify responsibilities and reduce conflicts.

Drafting and Reviewing the Agreement

Once you've understood the core components and contingencies, it's time to focus on the importance of drafting and reviewing the agreement to ensure everything aligns with state-specific laws and regulations. Getting it right the first time minimizes legal risks and ensures both parties are fully protected.

Many FSBO sellers struggle with pricing their property accurately, completing paperwork, and ensuring the sale goes according to plan. Research shows that 17% of sellers have trouble with pricing, while 10% find the paperwork challenging. Leveraging the right tools can help ease these difficulties, but understanding these common issues is key to a successful FSBO experience.

Using Templates and State-Specific Forms

Many FSBO sellers use standardized contract templates, but these must align with state laws. Local real estate associations or legal professionals can provide approved templates for commercial transactions.

Each state has unique legal requirements regarding disclosures, contract wording, and mandatory clauses. Using a generic template without modifications can lead to compliance issues or contract disputes.

Consulting Professionals

FSBO sellers should consider consulting a real estate attorney or title company to review the agreement. While hiring an attorney or title company involves upfront costs, it’s a small price to pay compared to the potential financial and legal risks of mishandling an agreement.

Attorneys can identify potential loopholes or ambiguous wording that could cause problems later. A legal review is especially important for high-value properties or transactions with complex lease agreements.

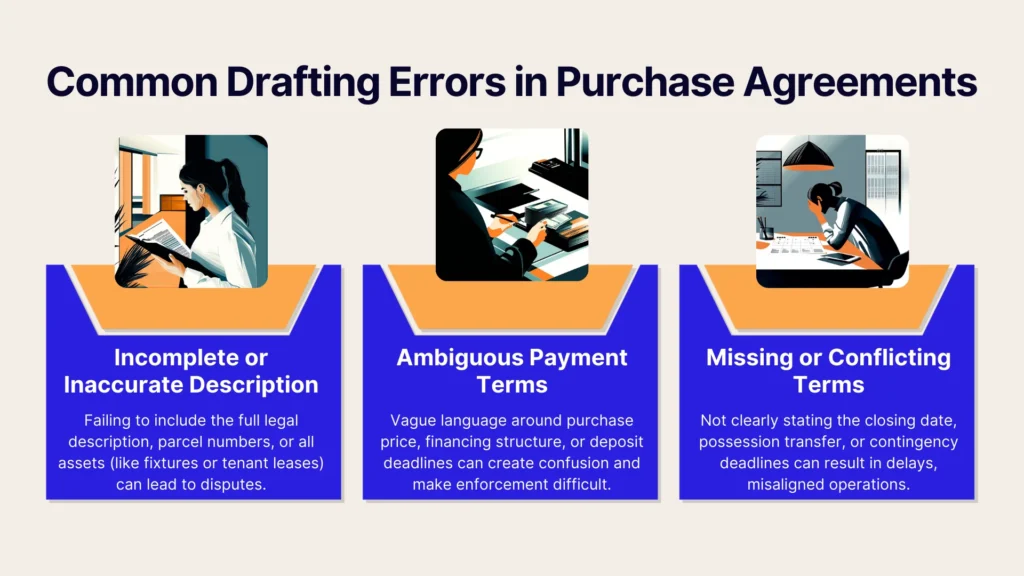

Common Drafting Errors

Common drafting mistakes include vague language, omitted deadlines, or contradictory clauses. Without an agent to guide you, drafting a commercial purchase agreement correctly can mean the difference between a smooth transaction and costly legal disputes.

FSBO sellers should be particularly careful with contingencies, ensuring that deadlines and action steps are clearly defined to avoid misunderstandings between parties.

Negotiating the Terms

Negotiation is the heart of the commercial sale process, where both sides must find a middle ground on price, contingencies, and other important terms. Mastering this step will help sellers achieve a fair and mutually beneficial agreement. Here are a few negotiations to look into:

Making Counteroffers

Sellers should anticipate negotiations on price, contingencies, or closing costs. Counteroffers should be clear, professional, and structured to maintain transparency in the transaction.

Rather than simply rejecting an offer, sellers can propose adjustments that make the deal more favorable while still appealing to the buyer. For instance, if a buyer requests a price reduction after a commercial property inspection reveals necessary repairs, you can counteroffer with a reduced price or offer to complete specific repairs yourself. Strategic counteroffers can help secure better terms without losing a potential buyer.

Concessions and Incentives

Offering incentives, such as covering closing costs or including certain property fixtures, can attract buyers and facilitate a quicker sale.

For example, a seller might offer a credit for necessary repairs instead of completing them before closing. These incentives can make the property more appealing without significantly reducing the sale price.

Execution and Enforcement

Once you’ve reached an agreement, it’s time to make it official. Proper execution and enforcement of the contract ensure that the deal stays legally binding and minimizes the risk of disputes post-signing.

Signing and Storing Copies

For an agreement to be legally valid, all required parties must sign and initial the document. Some contracts may require witnesses or notarization, depending on state laws.

Both buyers and sellers should retain identical, fully executed copies of the contract for legal reference. Storing digital copies in a secure location can also help with future record-keeping.

Deposit of Earnest Money

Earnest money must be deposited within the agreed-upon timeframe, typically with an escrow or title company. This deposit demonstrates the buyer’s commitment and is applied toward the purchase price at closing.

If the deal falls through due to a contingency, the earnest money may be refunded. However, if the buyer defaults without cause, the seller may retain the deposit as compensation for lost time and opportunities.

Monitoring Contingency Deadlines

Tracking deadlines for inspections, financing approvals, and other contingencies is crucial. If deadlines pass without action, the contract could become void or force the deal to move forward under less favorable terms.

Closing and Final Steps

As your deal progresses to the final stages, it’s essential to keep everything on track for a smooth closing. This includes handling the final paperwork, addressing any last-minute issues, and ensuring everything aligns for a seamless transaction.

Pre-Closing Walk-Through

Before closing, the buyer should conduct a final walk-through to confirm that agreed-upon repairs have been completed and the property remains in the expected condition.

Any new issues that arise before closing should be addressed promptly to avoid delays or disputes.

Settlement and Paperwork

The closing process involves signing the final settlement statement and ensuring that all funds are properly transferred. The Closing Disclosure should be carefully reviewed to confirm that fees, taxes, and other costs align with expectations.

Recording and Post-Closing Considerations

After closing, the deed transfer must be recorded with the appropriate government office to make the sale official. Buyers and sellers should retain copies of all key documents for tax purposes, potential disputes, or future transactions.

Conclusion

Understanding commercial purchase agreements is key to securing a successful FSBO sale. If you’re ready to take control of your commercial sale, Propbox offers tools that streamline your listing, scheduling, and transaction management. No hidden fees, no surprise costs—just a smarter way to sell and keep more of your profits.