When selling your home as a For Sale By Owner (FSBO), a financing contingency may come up in discussions with certain buyers. Known as a “fine print” clause, financing contingencies are pivotal in many real estate transactions. A financing contingency is a clause in the purchase contract that gives the buyer the option to back out of the sale if they are unable to secure a loan within a specified period.

A financing contingency protects the buyer from being locked into a deal if their mortgage application falls through. However, for a seller handling the sale independently, it is crucial to understand what this means, how it works, and how to manage it effectively.

Financing Contingency: What It Is & How It Works

A financing contingency is a clause that makes a sale contingent upon the buyer obtaining a loan to purchase your property. In other words, if the buyer can’t secure the necessary financing within the agreed-upon timeline, they have the right to cancel the contract without facing a breach or forfeiting their earnest money deposit. For FSBO sellers, this means the offer you accept might not be guaranteed, at least not until the buyer’s lender gives the green light.

Financing contingencies are designed to protect buyers from being financially obligated to a home they cannot afford under their lending conditions. They also establish clear expectations and deadlines within the process. These contingencies are especially useful for first-time buyers, who make up about 24% of the market and typically finance around 74% of the purchase price.

Typical Timeline and Deadlines

A key aspect of a financing contingency is establishing a clear timeline. The purchase agreement usually sets a deadline for the buyer’s loan application and approval period. During this time, the buyer applies for a mortgage, and the lender conducts all necessary verifications, such as assessing income, credit history, and the value of the home.

- Loan Application Period: From the date the contract is signed, buyers typically have between 21 and 45 days to complete their loan application. This period is often negotiable, and some sellers may agree to extend it if needed, especially in a buyer’s market.

- Approval Deadlines: After applying, buyers must secure a loan commitment from their lender. The agreement should specify when this commitment or, conversely, a termination notice must be delivered. For FSBO sellers, it’s essential to insist on these deadlines to avoid excessive delays.

- Finalizing the Contingency: Once a buyer receives the loan commitment, they must typically meet a “clear to close” status. This point signals that all conditions have been met and the financing contingency is effectively removed.

Conditions for Removing the Contingency

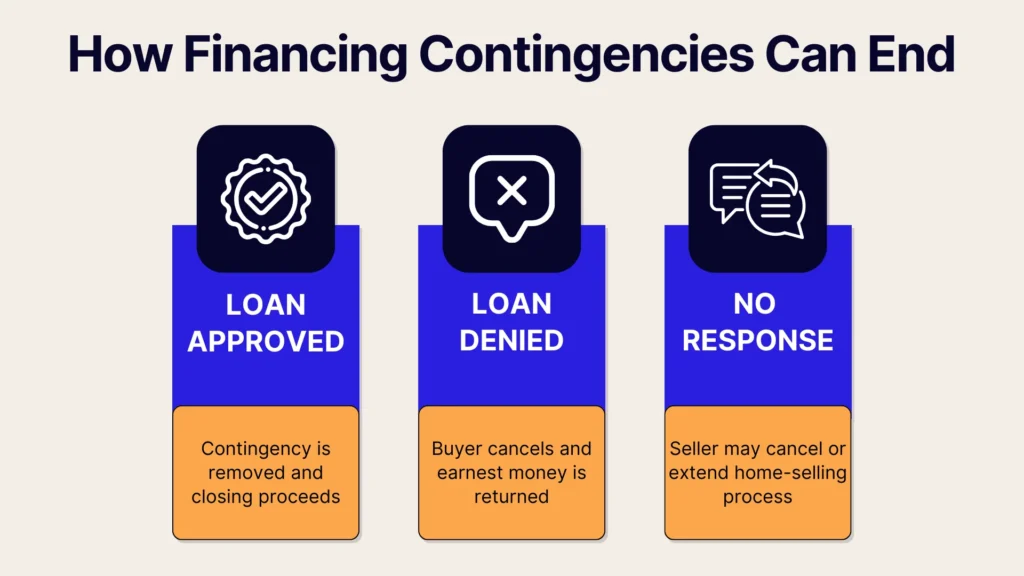

Removing the financing contingency depends on several conditions, the primary one being the buyer obtaining a “clear to close” status from their lender. Here are the conditions where the financing contingency can be removed:

- Clear to Close: This is essentially the green light from the buyer’s lender. When a property reaches this point, the lender has verified that all necessary documents, credit scores, and income sources meet their criteria. Receiving this confirmation means the financing contingency has been removed, and the transaction can proceed as planned.

- Buyer Cancellation: If the lender issues a termination notice or the buyer fails to provide sufficient evidence to reach the “clear to close” stage by the stated deadline, the buyer can legally cancel the contract. In such cases, the sale dissolves with minimal financial repercussions for the buyer, typically preserving their earnest money deposit.

- Required Notices: The purchase agreement should spell out the buyer’s responsibility to inform you, the seller, of any changes. This transparency is critical so you understand whether to hold out for a successful financing scenario or prepare to relist your home if the deal falls through.

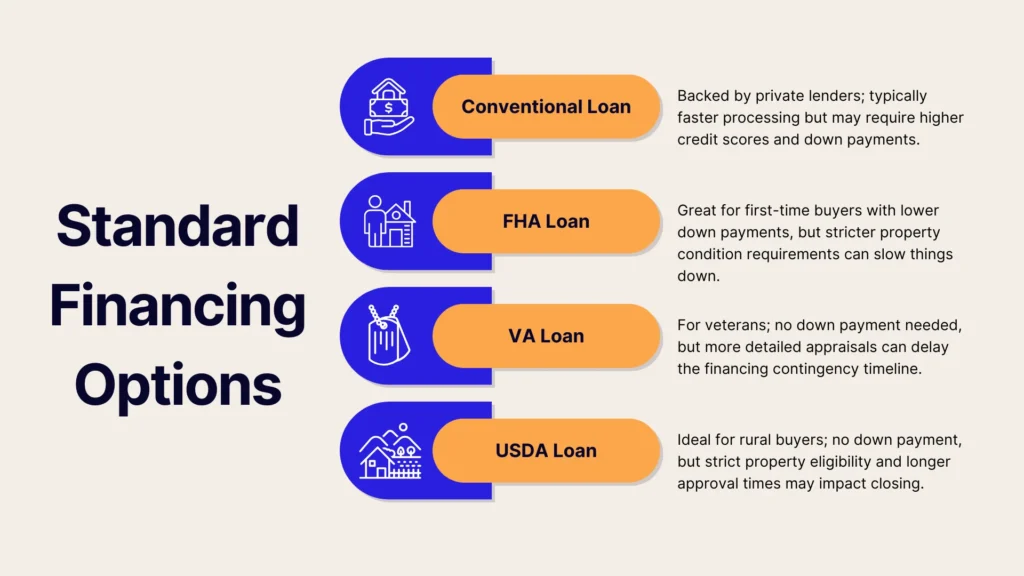

Common Financing Options

Buyers have several financing options available to them, and each type of loan can influence the financing contingency conditions. Here’s a quick breakdown of the most common types of loans and how they might affect your sale:

- Conventional Mortgages: These loans are typically provided by private lenders and do not have government backing. The processing times might be more predictable, but the loan amounts and down payment requirements can vary widely.

- FHA Loans: Insured by the Federal Housing Administration, these loans are popular among first-time buyers who might have lower down payment requirements. However, FHA loans come with specific guidelines regarding property conditions, which means the lender may require additional inspections or appraisals before issuing a commitment.

- VA Loans: Exclusively for eligible veterans and their families, VA loans offer unique benefits such as no required down payment and competitive interest rates. Despite these benefits, the appraisal process for VA loans can be stringent, and delays here might impact the contingency timeline.

- USDA Loans: Designed for rural and suburban buyers, USDA loans also provide attractive financing options with no down payment. As with FHA loans, these loans require the property to meet certain standards and might extend the timeline if additional approvals are needed.

Why Buyers Rely on Financing Contingencies

Financing contingencies are an important part of a buyer’s strategy that protects them from being locked intoa purchase if their loan application fall through. Here are some reasons why buyers use financing contingencies.

Mortgage Approval Uncertainties

Even buyers with stellar credit records can encounter issues, whether due to unexpected changes in their financial situation or shifts in lending policies. The contingency ensures that if the buyer’s mortgage is not approved, they are not legally bound to finalize the purchase. This prevents them from losing their earnest money deposit and facing further financial consequences.

Protecting the Earnest Money Deposit

The earnest money deposit is a show of good faith made by the buyer when they submit an offer. This deposit can be a significant sum, and buyers risk losing it if the sale falls through without a valid reason. The financing contingency protects buyers by allowing them to cancel the purchase contract and reclaim their deposit if they fail to secure the necessary financing on time.

Rate Shopping and Final Loan Terms

Mortgage rates can fluctuate, and buyers often use the contingency period to shop around for the best possible rate. This clause provides the flexibility needed to negotiate loan terms and ensure that the final commitment meets both their financial needs and their long-term goals. The contingency acts as a buffer, allowing buyers to lock in favorable financing that will ultimately affect their monthly payments and overall affordability.

Implications for FSBO and First-Time Sellers

If you’re an FSBO or first-time seller, the effects of a financing contingency may not be immediately clear. These contingencies can introduce some challenges you’ll need to consider.

Negotiation and Price Stability

One of the most important factors in any sale is achieving a stable and acceptable price. Accepting an offer with a weak or uncertain financing situation can lead to major headaches later. On one hand, you might face a higher offer from a buyer whose financing is in question, increasing the risk of last-minute cancellation. On the other, a slightly lower offer from a buyer with strong financial credentials might provide more security.

The decision becomes even more nuanced when appraisal values come into play. If the buyer’s lender appraises your home for less than the agreed sale price, the buyer might request a renegotiation of the price.

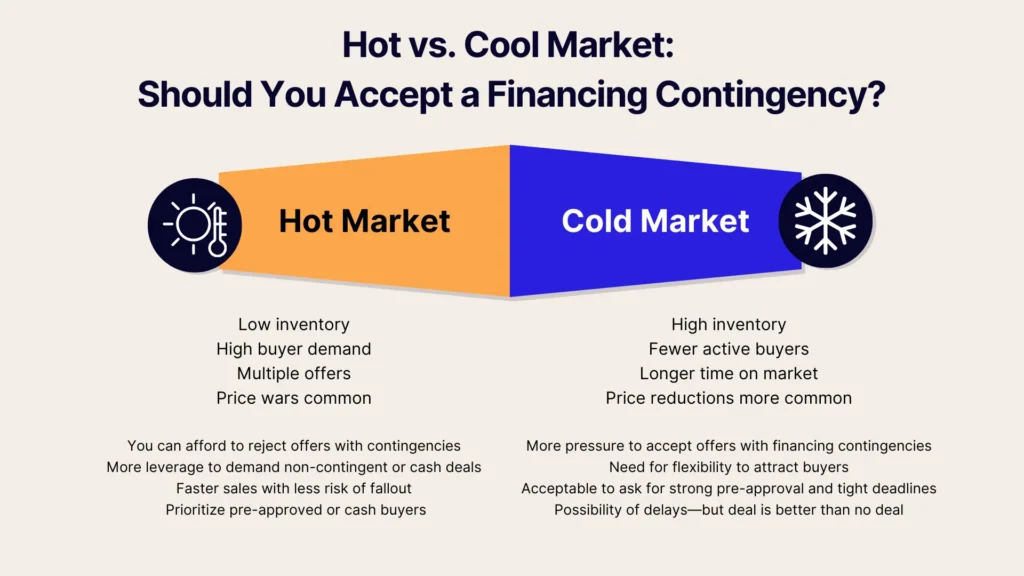

Market Conditions and Acceptance of Contingencies

Market dynamics can heavily influence your willingness to accept a financing contingency. In a hot market, where inventory is low and buyers are in competition, you can afford to be more selective, often seeing fewer contingencies requested. However, in a cooler market, you might have to accept contingencies to attract and secure potential buyers. Understanding the local market conditions and knowing how many FSBO sellers are successfully closing without many hitches can empower you during negotiations.

Timeline and Risk of Delays

One of the main challenges FSBO sellers face is the potential delay introduced by financing contingencies. If a buyer’s financing process takes longer than expected, your closing date could be postponed significantly. This is particularly concerning if you need the sale to fund another purchase or if you’re managing other time-sensitive projects.

Evaluating a Buyer’s Financial Stability

Before you accept an offer, it’s vital to ensure that the buyer’s financing is strong and reliable. Here are some key strategies to evaluate a buyer’s financial stability:

Pre-Approval vs. Pre-Qualification

It’s important to know the difference between pre-approval and pre-qualification. Pre-qualification is generally an initial estimate a lender provides, based largely on self-reported information. On the other hand, pre-approval is a more thorough assessment, as the lender reviews the buyer’s credit history, income, and other key financial details.

Pre-approval is considerably more reliable than pre-qualification because it indicates that a lender is willing to commit to financing the purchase up to a specific limit. As an FSBO seller, request a pre-approval letter to confirm that the buyer is serious and capable of following through on their loan.

Requesting Proof of Funds or Credit Score

In addition to a pre-approval letter, you may request proof of funds or an indication of the buyer’s credit score. These details help you gauge their overall financial capacity. However, it’s crucial to approach this request with sensitivity. Buyers might hesitate to divulge too much personal financial information, so strike a balance between ensuring you make a secure deal and respecting their privacy.

Communication with the Buyer’s Lender

A friendly conversation with the buyer’s lender can sometimes provide clarity and additional confidence. With the buyer’s consent, you might be able to verify the status of their loan directly. While respecting confidentiality, this step ensures that you have solid information on the buyer’s financing status, reducing the risk of surprises down the line.

Handling Financing Contingency Clauses

Financing contingency clauses can be standard parts of purchase agreements, but they can also be tailored to meet the unique needs of both parties. Here’s how you can manage these clauses effectively:

Standard vs. Custom Clauses

Most purchase agreements include boilerplate language for financing contingencies that is widely accepted in the industry. However, FSBO sellers sometimes find that these standard clauses do not fully address the nuances of their selling situation. Negotiating custom clauses, like shorter financing windows or stricter deadlines, can provide greater protection and clarity throughout the transaction.

Specific Conditions or Loan Types

In some cases, you might want to insert details about the minimum loan amount or interest rate that the buyer must secure. For example, if you’re aware of recent market trends or your property’s appraisal value, you might specify that the buyer must obtain a loan that meets certain criteria. Outlining such specifics in the purchase agreement minimizes ambiguity and protects your interests if the buyer fails to qualify for a sufficiently strong mortgage.

Contingency Extensions or Removal

Occasionally, unforeseen circumstances such as a temporary slowdown at the buyer’s lender might necessitate a financing contingency extension. While flexibility can keep the deal alive, any requested extensions must be documented in writing. This ensures that both parties remain aligned on expectations and avoids misunderstandings that could delay or jeopardize the sale.

Pros and Cons of a Financing Contingency for Sellers

Financing contingencies are meant to protect the buyer from committing to a home purchase they can’t afford. For sellers, a few pros and cons need to be considered if you or a buyer wants to introduce a financing contingency into the agreement.

Pros

- Attracting a Broader Pool of Potential Buyers: By accepting financing contingencies, you open your property to buyers who may not have immediate cash but can qualify for a mortgage. This increases the pool of potential buyers, especially in a diverse market.

- Clear Conditions to Exit if the Sale Is Unlikely to Close: The contingency clause provides a safeguard that lets you cancel the deal if the buyer’s financing falls through. This minimizes the risks of wasting time on a sale that isn’t likely to be completed.

- Enhanced Negotiation Leverage: If a buyer encounters difficulties with financing, it may allow you to negotiate better terms or even consider backup offers. This could sometimes lead to improved financial terms or a more secure closing process.

Cons

- Uncertainty and Risk of Wasted Market Time: If the buyer’s financing doesn’t come through, you may be left waiting or forced back to the market, potentially losing momentum, especially in time-sensitive situations.

- Delays to Your Selling Timeline: Financing contingencies can cause delays, especially if extensions are needed. Such delays can be particularly disruptive for sellers who depend on timely proceeds to fund another purchase.

- Potential for Multiple Renegotiations: With financing uncertainties, repeated negotiations might be necessary if the buyer’s lender revises the terms or if the property appraisal comes in lower than the agreed price. This can be time-consuming and may weaken your bargaining position.

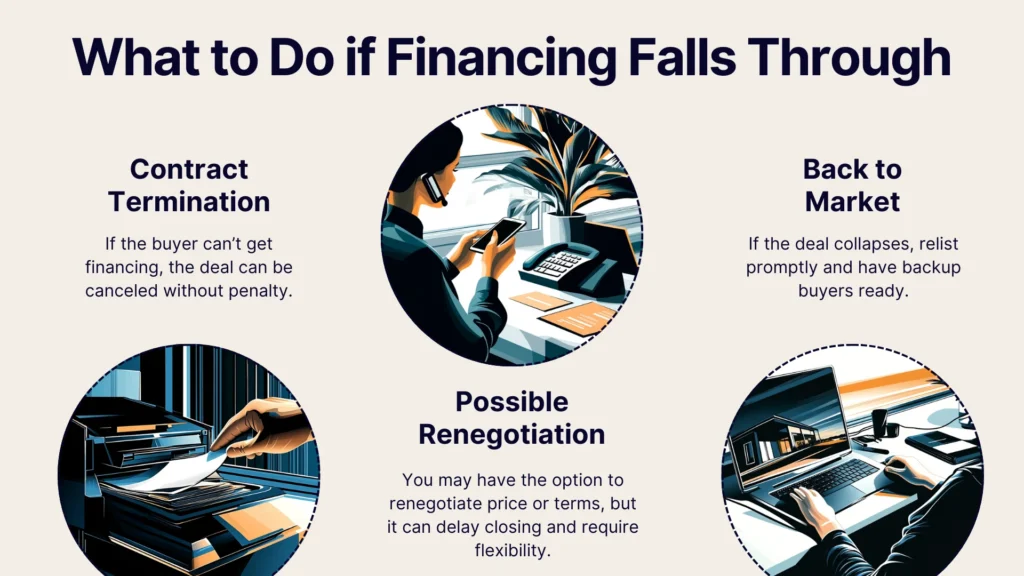

What Happens if Financing Falls Through

Despite your best efforts, financing issues can derail a real estate transaction. Knowing what to expect if the buyer’s financing falls through helps you prepare for all eventualities.

Contingency-Related Termination of the Contract

If the buyer is unable to secure financing within the designated period, the financing contingency allows them to terminate the contract without penalty. This scenario should be outlined clearly in your purchase agreement, specifying the steps for termination and the process for refunding the earnest money deposit.

Potential Renegotiation

Sometimes, if the buyer’s financing doesn’t fully meet the seller’s expectations, there may be room for renegotiation of price or terms. However, these discussions can delay the sale process and may require compromises. Knowing your bottom line and having alternative backup offers can help mitigate these risks.

Moving On with a New Buyer

In the unfortunate event that financing falls through, it’s important to keep your options open. Restarting your marketing efforts quickly can help you secure a new buyer. Although this situation might be disappointing, it’s sometimes part of the process in a competitive market.

Conclusion

Financing contingencies are an integral part of many real estate transactions and hold even greater significance for home sellers who handle every element of the sale process. For sellers, particularly those handling FSBO transactions, the challenges of financing contingencies are balanced by the opportunities they present. Still, it’s important to be aware of the risks, including potential delays and the possibility of multiple renegotiations if financing issues arise.

For FSBO and first-time sellers, keeping track of financing contingencies and other considerations in a home sale can be tedious without the help of Propbox. Our platform revolutionizes FSBO selling by automating reminders, organizing every step, and accelerating your sale—all while avoiding a 6% fee. Enjoy a simpler, faster process with full transparency, AI-enhanced valuations, and cost-effective tools that protect your interests better than a realtor. Get top dollar and simplify your home sale today with Propbox for lasting success.