Selling your home on your own can feel like a big leap, especially when every document and deadline seems designed for real‑estate pros. A solid FSBO agreement acts as your roadmap that details responsibilities, key milestones, and financial details—helping ensure a smoother sale and allowing you to retain more of your equity.

In this article, you’ll see how a clear, well‑structured agreement speeds up the sale, reduces stress, and minimizes surprises. We’ll walk you through each section to highlight common mistakes first‑time sellers make and share straightforward tips to help you save time and money.

Defining an FSBO Agreement

An FSBO (For Sale By Owner) agreement is a written contract between you and the buyer when you sell your home without a real estate agent. Since you're handling the sale on your own, this agreement needs to clearly cover all the important details, from the purchase price to responsibilities and timelines, so both sides know exactly what to expect.

Unlike standard contracts used by agents, your FSBO agreement isn’t backed by professional guidance or pre-made templates. That’s why it’s important to craft one that protects your interests, avoids confusion, and helps the sale go smoothly from start to finish.

Basics of an FSBO Agreement

An FSBO agreement serves as the foundation of your independent home-selling process. Let’s explore the essential points you need to include in this comprehensive document.

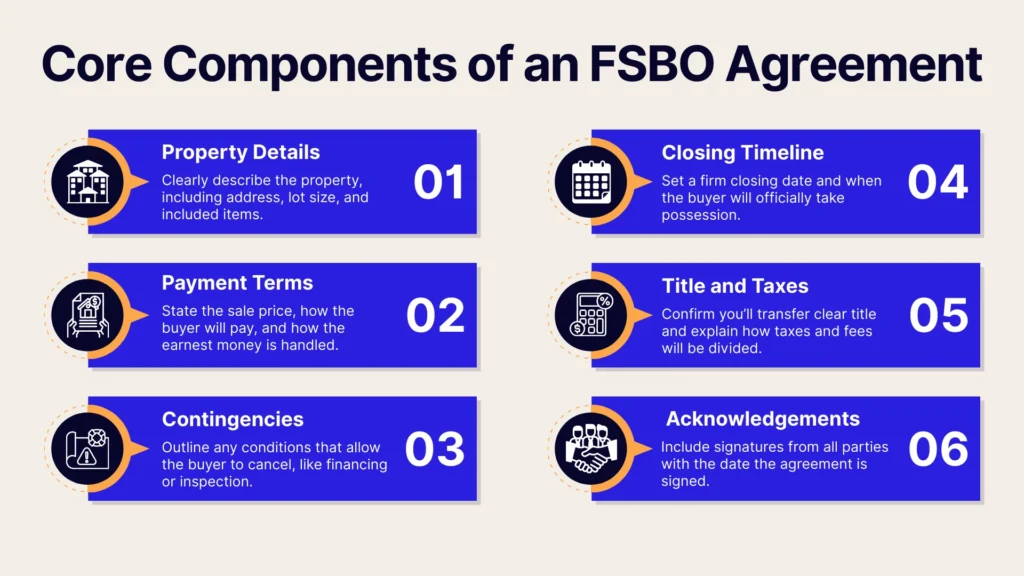

Core Components to Include

When drafting your FSBO agreement, include the basics that protect both you and the buyer. Start with your legal names, a detailed property description, and the agreed-upon price. Be sure to outline financing terms, inspection and appraisal contingencies, and the closing timeline. These details help set clear expectations and keep the sale on track from start to finish.

State and Local Requirements

Before finalizing your FSBO agreement, keep in mind that real estate laws and required disclosures vary widely by region. In California, for instance, sellers may need to disclose things like earthquake retrofitting or potential hazards such as lead paint. In Texas, local rules might focus more on flood zones or environmental concerns.

This isn’t just about checking a legal box; it’s about making sure your contract reflects local regulations and includes the necessary disclosures. Depending on where you are, that could mean sharing details about lead paint, HOA rules, or environmental risks. Covering these essentials helps protect you legally and builds trust by showing buyers you're being upfront and thorough.

Balancing Simplicity and Completeness

When you write your FSBO agreement, you should keep the document clear and understandable while still providing all essential legal protections. Avoid using overly complex legal jargon that could overwhelm you as a first‑time seller; instead, opt for straightforward, concise language that covers every necessary detail.

You should also remember to include all important clauses without making the document too dense. This is where official templates or state-provided real estate forms can be helpful. By using these pre-approved resources, you create a document that’s easy to navigate but still thorough enough to protect your interests.

Key Clauses Every FSBO Agreement Should Have

Certain key clauses are non-negotiable when drafting your FSBO agreement as they form the backbone of the transaction. Here are the essential parts that every FSBO agreement should include to keep the process transparent and legally secure.

Purchase Price and Payment Structure

One of the most crucial parts of your FSBO agreement is outlining the financial arrangement. It is essential to clearly define the total purchase price along with the breakdown of payments by specifying the down payment, earnest money deposit, and any financing details. You should detail how much the buyer will pay upfront, what portion will be subject to financing, and the timeline for obtaining credit approvals.

For example, you might state that the buyer is expected to provide a 10% down payment, with an earnest money deposit of 2% of the total sale price, and that any required financing must be approved by a specific date to ensure a smooth transaction. This clear definition of each component in the payment structure helps prevent misunderstandings regarding the flow of funds and reduces the possibility of disputes later in the process.

Contingencies and Deadlines

No home sale is complete without contingencies, which are conditions that allow either party to cancel or renegotiate if certain criteria aren’t met. Typical contingencies include requirements for financing approval, a satisfactory appraisal, and a comprehensive home inspection. It is also important to set specific deadlines and potential penalties for each contingency, ensuring that neither party can unduly delay the process.

Property Condition and Disclosures

Your FSBO agreement should clearly outline the current condition of the property, noting any recent repairs or known issues. Detail any improvements you’ve made and be upfront about any defects that might affect the home’s value or require further work by the buyer. Providing honest, comprehensive disclosures in your agreement builds trust with the buyer and protects both parties from future legal complications.

Closing Date and Possession Details

A critical aspect of your FSBO agreement is the specification of the closing date, a.k.a. the day when the property ownership officially transfers from you to the buyer. Equally important is the clarification of possession details, which may include provisions for early move-in or a rent-back scenario if needed.

Drafting an FSBO Agreement Step by Step

Taking the time to draft your FSBO agreement step by step ensures that no crucial detail is overlooked. Here are the practical steps to guide you—from gathering necessary documents to obtaining final signatures.

Gathering Documentation

Before you draft your agreement, gather all the documentation that supports the details of your sale. This includes recent mortgage statements, property tax records, insurance history, and any previous inspection reports or receipts for major improvements. Having all this information readily available enables you to accurately fill in the details of your FSBO agreement, ensuring that everything from financial figures to property descriptions is correct.

Creating a First Draft

Once you’ve prepared all documents, you can create the first draft of your FSBO agreement. Many state-specific online templates can serve as an excellent starting point, offering a framework that already includes many necessary legal components. Make sure to include any unique aspects of your property that might set it apart from others, as well as relevant details pertinent to your local regulations.

Reviewing and Revising

After drafting your agreement, the next step is to review and revise it carefully. Read through the document multiple times, checking for clarity, consistency, and completeness of every clause. It’s a good idea to have a trusted advisor or real estate attorney review your draft so they can spot any potential issues or ambiguities that might cause problems down the line.

Finalizing and Signing

Finally, make sure every section—from payment structures to disclosures—is complete and accurate before securing all necessary signatures, including a notary if needed. You should also make sure that both you and the buyer receive identical copies of the agreement to officially finalize the sale.

Pros and Cons of Using an FSBO Agreement

Using an FSBO agreement can be a double‑edged sword; while it offers many benefits, it also presents certain challenges. Here are some of the key advantages and potential hurdles to help you determine if this route is right for you.

Advantages

- Control over negotiations and terms: You decide the price and conditions without relying on a realtor’s agenda—this lets you tailor every detail to suit your specific needs.

- Direct communication with buyers: Handling negotiations yourself can lead to clearer, more personal interactions, which might speed up the decision-making process.

- Savings on commission fees: Avoiding the traditional 6% commission can save you thousands of dollars, leaving more profit in your pocket.

- Flexibility to customize clauses: You can add or remove contract clauses based on what works best for you and the buyer, ensuring the agreement is a perfect fit for your situation.

- Enhanced financial transparency: When you manage your own sale, you have direct oversight of every cost and financial term, giving you a complete understanding of where your money is going.

Challenges

- Lack of professional guidance: Without a realtor’s expertise, you’re responsible for navigating complex legal language and details, which can be daunting for a newcomer.

- Time-intensive management: Overseeing every aspect of the sale—from documentation to deadlines—requires a significant time investment that might feel overwhelming.

- Higher risk of oversight: Without professional review, there’s a greater possibility of missing crucial clauses or legal requirements, which can lead to disputes later on.

- Limited marketing exposure: FSBO sales may not reach as wide an audience as listings managed by full-service agents, potentially reducing your pool of interested buyers.

- Emotional stress and responsibility: Managing the entire sale process on your own, including negotiations and potential post-contract issues, can be stressful and emotionally taxing.

Working with Professionals (Optionally)

While many sellers choose to handle FSBO agreements entirely on their own, working with professionals can provide an added layer of security and peace of mind. Here are some optional ways to get expert guidance while still keeping control of the process.

Real Estate Attorneys

A real estate attorney can be a helpful partner when reviewing your FSBO agreement, especially if you're unfamiliar with legal terms or local regulations. Their job is to spot issues in your contract that could lead to misunderstandings or delays.

For example, if a buyer adds an unusual contingency or if your home is part of a complex HOA, an attorney can make sure your agreement protects your rights and follows local laws. Having this kind of legal backup gives you peace of mind before signing.

Title Companies and Escrow Agents

Title companies and escrow agents handle some of the most important behind-the-scenes work in a home sale. They verify that the property has a clear title, file the necessary documents, and safely hold funds until the sale closes. These professionals help you balance a DIY sale with expert support, giving you confidence that every legal and financial step is handled properly—especially useful when you’re managing the rest of the sale on your own.

Partial Agent Assistance

As an FSBO seller, you’re not limited to going it alone: you can get professional help without giving up control. One popular option is hiring a flat-fee listing agent. For a one-time payment, they list your home on the MLS, which helps your property appear on major sites like Zillow and Realtor.com. From there, you still handle showings, answer buyer questions, and negotiate offers yourself.

For example, if you pay a $300 flat fee to get your home listed on the MLS, you're not paying a percentage-based commission, and you’re still the one leading the sale. This setup is often called “Assisted FSBO” and helps you reach more buyers while saving thousands in listing agent fees.

Conclusion

Selling your home on your own starts with the right agreement; when it's written clearly, it gives you more control, more confidence, and potentially more profit. While it's helpful to ask experts for guidance when needed, you can still lead the process and make informed decisions when the steps are easy to follow and well-organized.

Propbox was built to help FSBO sellers like you keep everything on track. With automated reminders, smart tools, and a clear step-by-step setup, you can manage your sale with less stress and fewer surprises. Ready to take the next step? Propbox makes it easier to do it your way.