Taking the plunge by selling your home by yourself means learning a lot of new things, especially when it comes to understanding commission fees. You may have heard of the traditional 6% fee charged by real estate agents and wondered if there’s a better way to handle the process.

In this article, we’ll explain how state and federal regulations shape the way commission fees are determined and how these rules are designed to keep things transparent and fair. Let’s dive into the key legal guidelines behind real estate commission fees so you can navigate the home-selling process with confidence.

Understanding Real Estate Commission Fees

Commission fees are the payments made to real estate agents for their help in selling your property. These fees are usually calculated as a percentage of the final sale price and are split among the listing agent, the buyer’s agent, or sometimes shared in dual agency scenarios where one agent represents both parties. This basic structure is designed to compensate the professionals for marketing, negotiating, and facilitating the sale.

Commission Fee Basics

Commission fees are a core part of real estate transactions. Here’s a brief look at the fundamentals that underlie these fees and what they mean for you as a seller:

Standard Commission Structures

Most homes are sold using the traditional agent model, where a total commission of about 5–6% of the sale price is split between the seller’s agent and the buyer’s agent. This fee covers the work both agents do to market the home, find buyers, and handle negotiations.

But there’s another option: a flat-fee MLS listing. Instead of paying a percentage, you pay one fixed fee to get your home listed on the Multiple Listing Service (MLS), which is the same platform that real estate agents use. It gives your home exposure to buyers without all the extra commission costs, which could mean more money in your pocket.

Who Pays What

Sellers have traditionally shouldered the cost of both their own agent’s fee and the buyer’s agent’s fee, which is a structure that’s been standard practice in most U.S. real estate deals for decades. The idea behind this model is that by covering both sides, sellers can attract more buyers and keep the process moving smoothly. However, this long-standing approach is starting to shift in certain markets.

Some areas now allow or even encourage buyers to take responsibility for paying their own agent’s commission. For sellers, it can reduce overall costs, but for buyers, it adds a new financial consideration. As a result, buyers may adjust their offers or negotiate differently, which can ultimately impact how deals are structured and closed.

Negotiability of Fees

It’s important to understand that commission fees are entirely negotiable. As an FSBO seller, you can use tactics like requesting itemized service agreements, comparing fee structures with different agents, or even offering incentives based on performance to reduce or restructure these fees in a way that aligns with your goals.

Federal and State Laws Governing Commission Fees

Federal and state regulations exist to ensure that commission fees are transparent and fairly negotiated in every transaction. Here are the legal guidelines that govern how agents charge commissions to protect both buyers and sellers:

No Legal Mandate on Percentage

There’s no federal law that states agents have to charge a certain percentage when selling a home. What the law does care about is keeping the market fair so agents can’t do backroom deals to set fixed rates. Instead, fees are meant to be discussed openly, allowing sellers to find terms that match the level of service they’re getting.

Antitrust Laws and Agent Behavior

The Sherman Antitrust Act and related regulations are in place to protect competition among real estate brokers. These laws prevent agents from conspiring to set commission fees artificially high or from refusing to work with sellers who choose alternative methods, like FSBO listings.

Watch out for signs like an agent who consistently discourages alternative selling methods or refuses to market your property unless you agree to a traditional fee. This behavior can suggest a resistance to fair competition, especially if they’re unwilling to negotiate or embrace more flexible, modern approaches.

Commission Fees in FSBO Sales

When you sell your home FSBO, commission fees can vary widely compared to traditional sales. Here’s a brief overview of how FSBO transactions differ from traditional agent-assisted sales.

Can You Avoid Paying a Commission Entirely?

If no agent is involved on either side of the transaction, then yes, you can complete your sale without paying any commission fees at all. This scenario is most common when buyers search independently and make direct contact with you, eliminating intermediary costs entirely.

However, if the buyer happens to have an agent, you may need to negotiate an appropriate fee. It may not have to be as high as the conventional 6%, but it should be enough to compensate the agent for their role in the transaction. For example, offering 2–3% is common and can help ensure the agent is motivated to bring their client to the table.

Offering Buyer Agent Commission as FSBO

Many FSBO sellers opt to include an incentive for buyer agents in their listing. By offering a commission, you encourage more agents to show your home, potentially expanding your pool of serious buyers. Just remember: if you advertise a commission and an agent brings a buyer, you’re legally obligated to honor that amount.

Flat-Fee and Discount Brokerage Alternatives

Using flat-fee multiple listing service (MLS) listings or discount brokerage services offers a smart alternative to traditional fee structures. They give your home exposure on the MLS for a one-time fee, keeping you in control without the expensive costs of full-service agents. Plus, automation and streamlined communication lighten both the mental and financial load of selling your home.

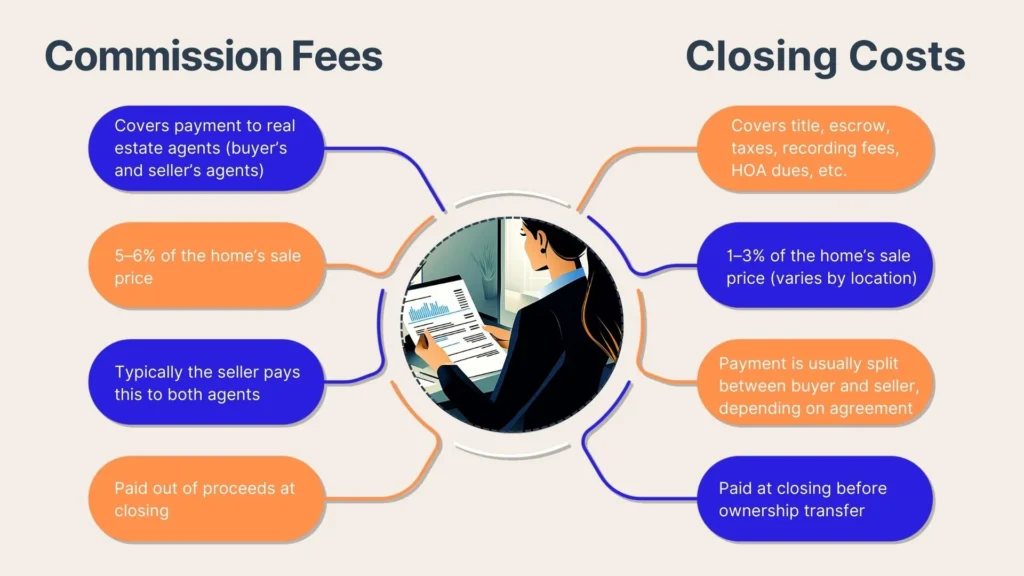

Commission Fees vs. Closing Costs

Understanding the difference between commission fees and closing costs can help you plan your budget more effectively. Here’s a breakdown of how they influence your home sale:

Differentiating the Two

Commission fees are paid directly from your sale proceeds to compensate agents for their work, while closing costs are separate charges covering legal fees, taxes, and administrative tasks needed to finish the sale.

For example, if you sell your home for $400,000, the commission might come out of that amount, while closing costs could include additional fees like a title search and processing paperwork. Knowing this difference helps you plan and budget accurately for your sale.

Who Pays at Closing

In most transactions, the seller pays the commission fees at closing, which are deducted from your sale proceeds. Meanwhile, buyers may be responsible for other specific closing costs such as:

- Appraisal fees

- Inspection fees

- Loan processing charges

In some competitive markets, you might even offer credits at closing to help offset these expenses for the buyer instead of lowering your list price, a strategic move that can attract more interest.

Legal Risks and Misunderstandings

Misunderstandings or miscommunications about commission agreements can expose you to legal risks during and after the sale. Here’s how you can safeguard your interests: clear, written documentation of every agreement is key to avoiding disputes later on.

Failing to Disclose Commission Agreements

If any agent is involved in your home sale, all details regarding commission fees must be disclosed in writing. Even if you are selling on your own, failing to properly document any prior agreements or understandings regarding commissions can leave you vulnerable to legal challenges or claims from agents who believe they contributed to the sale.

Procuring Cause Disputes

One common source of disputes is the concept of “procuring cause,” where an agent might claim credit for introducing a buyer that leads to a sale. Without proper records and clear agreements, it can be difficult to determine who deserves a commission. Keeping thorough documentation, such as emails and signed agreements, is your best defense in these situations.

Dual Agency and Conflict of Interest

Dual agency occurs when one agent represents both the buyer and the seller. While legal in many states, this arrangement can lead to conflicts of interest if the agent is not careful. For example, if an agent prioritizes closing the deal quickly over negotiating the best price for you, you may end up with less favorable terms.

To protect your interests, ask your agent if they can assign a designated representative solely for you, or consider using a transaction brokerage service where different agents handle each side of the deal.

How to Structure Commission Terms

A well-structured commission agreement can save you time, money, and potential disputes. Here’s how you can set up clear, fair terms that protect your interests while incentivizing agents to work for you:

Writing a Commission Agreement (Even as FSBO)

Even if you’re managing your home sale on your own, drafting a clear commission agreement is essential if a buyer’s agent becomes involved. This agreement must include the fee amount (fixed or percentage), the scope of services provided, the payment timing, and clear terms outlining each party’s responsibilities to fully protect your interests.

Negotiating Terms with a Buyer’s Agent

Remember, everything is negotiable with a buyer’s agent, so don’t hesitate to counter their initial proposal if it seems too high. Protect your net proceeds while still offering enough incentive to attract buyer traffic by proposing terms that reward performance and benefit both parties.

Working with Attorneys for Protection

Having a real estate attorney review any commission or contractual agreements can protect you from unexpected issues later. Legal counsel ensures that your documents align with state and federal laws, providing an extra layer of security and peace of mind as you finalize your transaction.

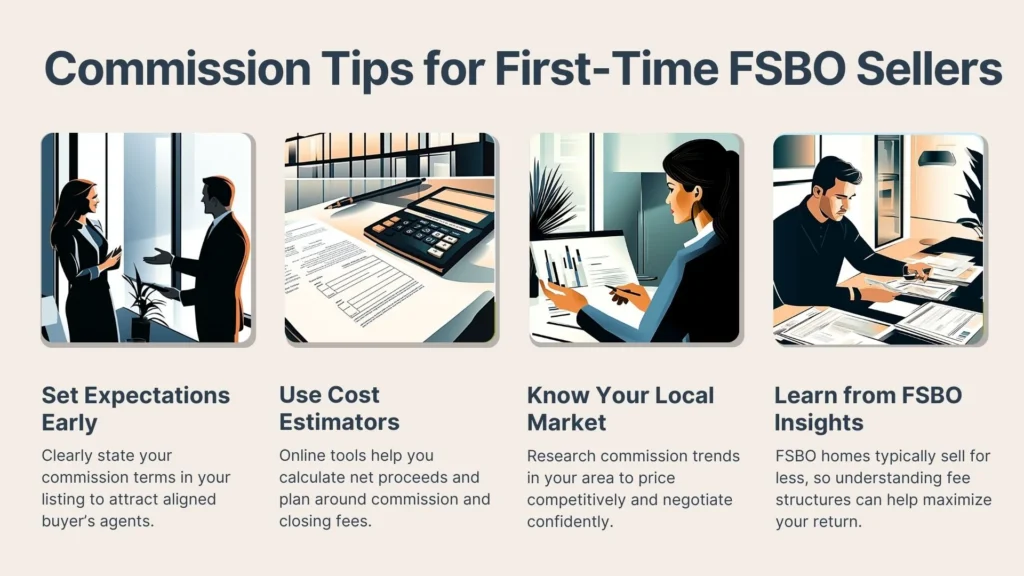

The world of commission fees can seem daunting to anyone selling their home independently. Here’s some guidance to help you set realistic expectations and avoid common pitfalls in your FSBO journey:

Set Expectations Early

Right from the initial listing—whether on the MLS, Zillow, or another platform—be explicit about your commission offerings. When a potential buyer’s agents know your expectations upfront, it saves both your time and theirs and ensures that only compatible parties engage in your sale.

Use Tools to Estimate Costs

Take advantage of online calculators and budgeting tools that help you project your net proceeds after factoring in commission fees and closing costs. These tools enable you to set a realistic price for your home and negotiate confidently with prospective buyers and agents.

Educate Yourself on Market Norms

Invest time in researching the common commission practices in your local market by talking to other FSBO sellers or using online forums and trusted resources. For example, in 2024, the typical FSBO home sold for about $380,000 compared to $435,000 for agent-assisted sales, showing that a clear understanding of commission structures can help you secure competitive offers and achieve a better return.

Conclusion

Navigating the laws on real estate commission fees gives you the power to control your home sale, whether you choose a traditional route or an FSBO approach. Being aware that these fees are negotiable, knowing your rights under federal and state laws, and exploring alternatives like flat-fee MLS listings empower you to keep more money in your pocket, as 88% of buyers typically work with an agent.

Propbox offers an innovative solution designed for sellers seeking an easier, faster, and more organized way to sell their home. By automating reminders, organizing paperwork, and efficiently listing your property, Propbox helps you streamline the selling process and protect your interests; try it today!