Selling a home doesn’t always go as planned. Maybe the buyer backs out, financing falls through, or an inspection uncovers major issues. Whatever the reason, when a deal falls apart, it’s important to have a clean, legal way to move on. That’s where a real estate release agreement comes in.

In this article, we’ll explain what a release agreement is, when to use one, what to include, and how to handle sensitive matters like earnest money. If you’re selling on your own without an agent, understanding how this agreement works is essential because it’s up to you to protect your interests and tie up any loose ends.

Defining Real Estate Release Agreements

A real estate release agreement is a legal document used to formally end a real estate transaction before closing. Sometimes called a release of contract or mutual cancellation, these agreements go by a few names depending on where you live. It’s typically signed by both the buyer and seller to acknowledge that neither party will pursue further legal action related to the terminated contract.

Release agreements are used to:

- Cancel a sale that’s no longer proceeding

- Resolve mutual mistakes or disagreements

- Clarify how earnest money will be handled

- Protect both parties from future legal claims

By signing a release, both parties agree to walk away from the deal—and each other—with no lingering obligations.

When and Why a Release Agreement Is Needed

There are several common scenarios where a release agreement becomes helpful and necessary. Understanding these can help you recognize when it’s time to pivot and protect yourself.

Canceling a Pending Sale

Sometimes, a home sale can fall through even with the best intentions. Financing might not come through. A home inspection might reveal costly repairs, or the buyer may have a change of heart. A release agreement allows both parties to cancel the transaction without stepping into legal quicksand.

This can help avoid costly litigation, especially if both sides agree that ending the deal is the best option.

Resolving Mutual Mistakes or Contract Disputes

Not every disagreement needs to end in a lawsuit. Sometimes, both the buyer and seller realize that continuing the sale isn’t in either party’s best interest. Maybe there was a misunderstanding about the property’s condition or an unresolved contract clause. A release agreement lets both sides part ways on good terms—and in writing.

Legal Obligations and Liabilities

One of the key benefits of a release agreement is the clarity it brings to financial and legal matters. Earnest money disputes are common when deals fall through. A well-crafted release specifies whether the deposit is refunded, split, or forfeited. It also prevents breach-of-contract claims by setting clear boundaries that protect everyone involved.

Core Components of a Release Agreement

If you're selling your home on your own and the deal falls through, having a proper release agreement is essential; it protects you legally and financially. This isn't just paperwork; it’s your safety net. A well-written release ensures everyone is on the same page about why the sale is ending, who’s involved, and what happens to any money already on the table. Let’s walk through the key parts you’ll want to include to move forward with confidence and clarity.

Identifying Parties Involved

Start with the basics, and don’t skip over them. A release agreement must clearly name all parties tied to the transaction—you as the seller, the buyer, and anyone involved, like attorneys, real estate agents, or escrow companies. Be sure to include:

- Full legal names

- The property address

- A reference to the original purchase agreement (like date and contract ID)

Why it matters: This ensures there’s no confusion about who agrees to walk away from the deal. It also protects you if questions or disputes come up later.

Watch out for: Incomplete or incorrect names. Make sure everything matches what's on the original purchase agreement.

Terms and Conditions for Termination

This section should explain why the contract is being canceled. Was the buyer denied financing? Did the inspection reveal serious issues? Did the buyer back out for a contingency reason (or no reason at all)?

Why it matters: Being clear about the reason for termination makes the agreement stronger and more defensible, if there are any disputes down the line.

Watch out for: Vague explanations. Write the reason in plain terms and match it to any applicable contingency clauses in the original contract.

Mutual Release of Claims

This is the part that protects both sides from future legal action. It should clearly state that neither party can come back and sue the other over this sale once the agreement is signed.

Why it matters: This gives you peace of mind. Once the release is signed, you’re done—you can move on without worrying that the buyer might come back demanding repairs or deposit money.

Watch out for: Loopholes. Make sure the language includes claims related to earnest money, inspections, repairs, and any terms from the original contract.

Settlement of Earnest Money or Deposits

This section handles what happens to the money already put down—usually the buyer’s earnest money deposit. Options might include refunding it to the buyer, splitting it between both parties, or forfeiting it to the seller.

Why it matters: This is often the most sensitive part of the agreement, so it’s crucial to be crystal clear about how the money will be handled—who gets what, how much, and when.

Watch out for: Missing payment details.

Quick Checklist: What to Include About Earnest Money

- Who gets the money? Buyer, seller, or split?

- How much? Exact dollar amount

- When? Deadline for the transfer or refund

- How? Method of payment (check, wire, escrow release)

Creating a clear, detailed release agreement can save you a lot of stress down the road. As a first-time or FSBO seller, it’s one of those behind-the-scenes steps that protects your interests and helps you move forward confidently, even when a deal doesn’t go as planned.

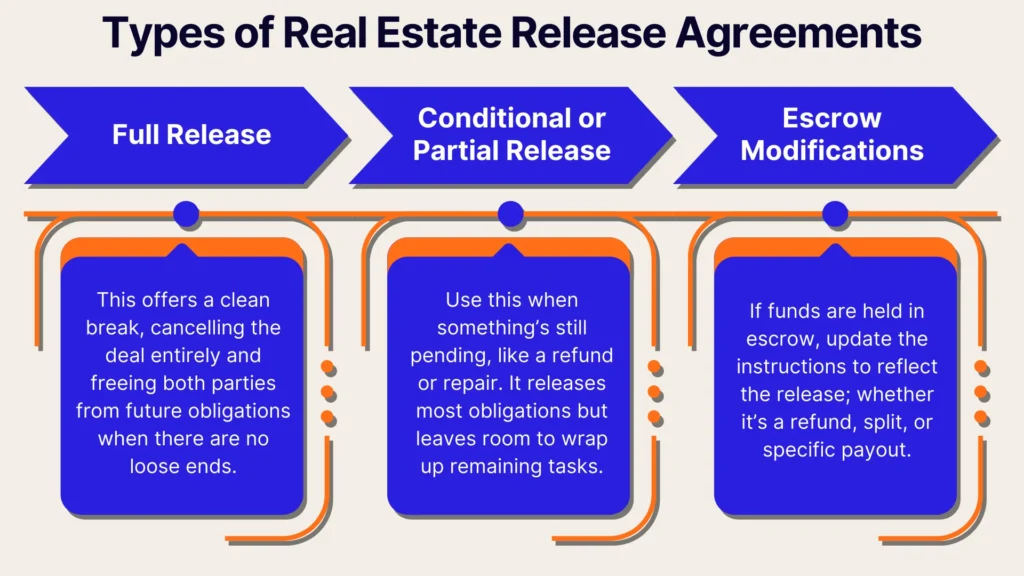

Types of Real Estate Release Agreements

Not all release agreements are one-size-fits-all. The type you use depends on how your deal is ending and whether there are still loose ends to tie up. Some provide a full legal break, while others leave space for certain terms to be resolved later. Understanding the difference helps you choose the right agreement for your situation.

Full Release Agreement

A full release agreement is the cleanest, most straightforward option. It fully cancels the contract and releases both the buyer and seller from any future claims or obligations. This type is commonly used when both sides agree to walk away early and there are no outstanding issues to resolve.

Conditional Release or Partial Release

A conditional release, or partial release, is used when the deal isn’t ending with a clean slate. For example, you might still owe the buyer a refund or wait for a repair or deposit adjustment. This type of agreement allows the contract to be primarily released, while still outlining any remaining responsibilities.

Escrow Agreement Modifications

When a deal falls apart and money is being held in escrow, the escrow instructions need to be updated to reflect the release agreement. A modified escrow agreement tells the escrow agent or title company how to handle those funds, whether that means issuing a refund, splitting the money, or applying it in a specific way.

Choosing the right type of release agreement depends on how your sale is ending and whether any details still need to be resolved. Whether you’re walking away clean or tying up a few final items, knowing your options helps you protect your interests and move forward with clarity.

Drafting a Release Agreement

Creating a release agreement doesn’t have to be overwhelming, but it does need to be done right. As an FSBO or first-time seller, you might be tempted to handle it yourself, and in simple cases, that might work. However, even small mistakes can lead to big headaches if the agreement isn’t legally solid. Let’s break down how to make sure your release is both accurate and enforceable.

Using Templates vs. Professional Drafting

Standard release forms are often available through real estate associations, title companies, or online legal platforms. These templates can be helpful if your situation is straightforward, like no disputes, no money left in escrow, and mutual agreement to cancel.

However, if there’s earnest money at stake, unmet contingencies, or any disagreement, it’s worth having a professional draft or review the document. Real estate attorneys or closing agents can tailor the agreement to your specific situation and ensure all legal bases are covered.

Essential Clauses and Language

A solid release agreement should go beyond generalities. Be sure it includes:

- Release of liability: States that neither party can sue the other for anything related to the canceled deal.

- Indemnity clauses: Protects each party from future legal claims that could arise from third parties.

- Payment and refund terms: Clearly defines how any money (like deposits or reimbursements) will be handled.

- Contingency wrap-ups: Addresses any unresolved contract contingencies or actions tied to the termination.

Skip vague phrases like “to the best of our knowledge” or “as needed.” Instead, use clear, direct language so there’s no room for misinterpretation later.

Execution and Witness Requirements

Depending on where you live, your release agreement may need to be notarized or signed in the presence of a witness to be legally valid. Even if your state doesn’t require it, having all parties sign in writing and giving everyone a final copy is a smart move.

This extra step creates a clear paper trail that can help resolve any future misunderstandings or legal questions.

Handling Earnest Money in a Release Agreement

Earnest money is often the sticking point when deals fall apart. Understanding how to handle it reasonably can make or break your release negotiations. Among buyers who financed their purchase, 74% typically financed the majority of the home’s price. That level of dependency on financing means deals are often fragile, and if funding falls through late in the game, the earnest money becomes the battleground.

Buyer’s Perspective vs. Seller’s Perspective

From the buyer’s side, a refund is usually expected if the sale falls through due to contingencies like inspection or financing. From the seller’s view, if the buyer backs out without a valid reason, keeping the deposit may feel justified.

Negotiating a Partial Refund

When both parties bear some responsibility for the deal falling apart, splitting the deposit can be a fair solution. Set clear terms for the amount, payment deadline, and who sends or receives the funds.

Documenting Final Payment Arrangements

Include final instructions for how and when any money will change hands. This could be a bank transfer, check, or escrow release. Confirm these steps in writing and keep proof of payment.

Tips for Drafting an Effective Release Agreement

A strong release isn’t just a formality. It’s a legal shield for both parties. Here are a few best practices to make sure yours holds up.

Be Thorough and Specific

Don’t leave room for interpretation. Spell out all responsibilities, remaining costs, and what’s being waived. Specificity prevents future arguments.

Double-Check Contingencies

Go back to your original purchase contract and confirm which contingencies were and weren’t met. Your release terms should align with these, especially regarding earnest money or inspections.

Seek Legal Review

Even if you're handling the sale yourself, a quick review from a real estate attorney can prevent big headaches. They can spot local legal quirks or missing clauses that you might overlook.

Conclusion

Cancellations happen, but they don’t have to derail your FSBO sale. A real estate release agreement helps you walk away cleanly while protecting key elements like earnest money, which nearly 10% of FSBO sellers report as a challenge.

Propbox makes it easier. Our platform helps you draft, track, and finalize the right forms quickly, while keeping your listing, timeline, and documents organized. Skip the 6% commission, stay in control, and sell smarter; start with Propbox today.