While owning a home is a dream for many, financing issues and volatile housing markets can make it tricky to afford buying one. A healthy compromise that some buyers may be keen on is a rent-to-own agreement, which lets you collect rent today while setting clear milestones for a future sale. But is this the right option for your home sale?

In this article, you’ll see how rent-to-own differs from a lease option, what contract terms safeguard your interests, and how to tailor agreements to your goals. Read on to learn more and make an informed decision that works best for your finances and future housing plans.

Defining Rent-to-Own

A rent‑to‑own agreement combines a standard lease with a future purchase option. You rent your property to a tenant‑buyer who can purchase the home after a set period, and a portion of each monthly payment typically builds their down payment. This structure keeps your property occupied, shrinks vacancy gaps, and generates steady cash flow.

For FSBO sellers, rent‑to‑own expands your buyer pool by welcoming those still arranging traditional financing. You stay in the driver’s seat, guiding contract terms, timelines, and purchase price while giving motivated buyers a clear path to ownership. The result is predictable rental income now and a firm sale on your terms later, which is a win‑win for both sides.

Understanding Rent-to-Own vs. Lease Option

Before you decide which arrangement to offer, it’s important to see the distinctions between rent-to-own and lease options. Let’s break these details down:

Core Definitions

With rent‑to‑own, often called a lease purchase, you sign a binding agreement that locks in your tenant‑buyer’s future purchase. Once you set the terms, the path to ownership is clear: the buyer builds equity through rent credits, and you keep your sale price and timeline firmly in place.

A lease option takes a lighter touch. You grant the tenant the right, but not the obligation, to buy at the end of the lease. This flexibility lets the renter decide whether to move forward or walk away, while you still enjoy rental income and keep the door open for other offers.

Key Differences

The differences in these arrangements impact both seller and buyer responsibilities. Rent-to-own agreements oblige the tenant-buyer to complete the purchase, while a lease option gives them the freedom to decide without facing legal consequences.

Under a rent-to-own contract, failing to complete the purchase can trigger contractual penalties that may include forfeiture of fees and even legal action. Conversely, a lease option typically results in the tenant-buyer losing any fees or credits if they choose not to buy at the end of the lease term.

When to Choose One Over the Other

If you prefer a firm commitment from your buyer, a rent-to-own agreement may be a better choice. This strategy is particularly suited to sellers who want a guaranteed path to sale and a buyer who is confident about their future financing.

For situations where flexibility is more attractive, a lease option might be more beneficial. This model works well when you are open to a broader range of buyers, even if the final purchase is not assured.

How a Rent-to-Own Agreement Works

This section outlines the structure and associated responsibilities to help you grasp the workings of a rent-to-own model. Let’s look at the core elements of this agreement type and how financial credits and responsibilities are split between you and the tenant-buyer:

Basic Structure

The rent-to-own agreement comprises two main parts: the lease period and the purchase contract. During the lease period, you collect rent, a portion of which is applied toward the future purchase price of your property.

This structure allows you to enjoy a steady monthly income while setting the stage for a future sale. The final purchase agreement is established at the outset, giving both parties clarity on the future transaction.

Agreement Duration and Payment Breakdown

Typically, rent-to-own agreements span one to three years, which provides a reasonable timeframe for buyers to obtain financing. Alongside the periodic rent payments, an upfront option fee or deposit is collected, which may be partially or wholly non-refundable.

These deposits serve as a sign of the buyer’s commitment while offering you added financial security. During the term of the contract, the monthly rent payment may include a specific amount credited toward the eventual purchase price, eventually bridging the gap to full ownership.

Responsibilities of Tenant-Buyer vs. Seller

Responsibility for daily maintenance usually falls on the tenant-buyer during the lease period. However, you typically retain responsibility for major structural repairs and any issues not related to everyday upkeep.

This clear division helps prevent disputes and ensures that each party knows their obligations. By defining the roles in advance, you establish a transparent process that minimizes potential conflicts over repair costs and property care.

Key Components of a Rent-to-Own Contract

Now that you know the basic workings, it’s time to consider the crucial elements that make up the contract, from pricing to penalties. Let’s explore how you can lock in a future sale price and how monthly payments may contribute to the down payment:

Purchase Price and Option Fee

At the start of the contract, the purchase price is either locked in or determined based on a future appraisal. An upfront fee is collected in exchange for granting the buyer the exclusive right to purchase your property at a later date.

This option fee is usually non-refundable, providing you with additional compensation even if the sale does not close.

Monthly Rent and Rent Credits

A portion of the monthly rent may be credited toward the down payment when the buyer is ready to complete the purchase. The arrangement is designed to balance your need for consistent income with the buyer’s progress in acquiring financing.

Default and Penalties

If your tenant‑buyer misses payments or can’t line up financing by the agreed deadline, the contract spells out exactly what happens next. Option fees and rent credits may be forfeited, and you can pursue legal action to recover any losses.

These safeguards protect you by detailing penalties and remedies for non‑compliance. Clear rules keep both sides accountable, encouraging the tenant‑buyer to stay on track and giving you solid recourse if anything goes off course.

Comparing Benefits and Drawbacks

While rent-to-own arrangements can provide you with income and the possibility of a future sale, there are other benefits and drawbacks to this type of agreement. Use these insights to decide whether the strategy lines up with your finances and plans:

Advantages for Sellers

Rent-to-own agreements deliver steady income through monthly rent payments and typically help reduce prolonged vacancies. Additional benefits include the opportunity to reach a larger buyer pool, especially among those who are building their credit or savings.

Disadvantages for Sellers

The tenant‑buyer might decide, or be forced, to walk away before closing, leaving you to market and re‑list the property again. You also run the risk of extra wear and tear if the renter doesn’t treat the home with full owner‑level care.

Writing and policing a rent‑to‑own contract is more involved than a straight sale, so you’ll spend additional time and money on legal advice, oversight, and follow‑up to keep the deal on track.

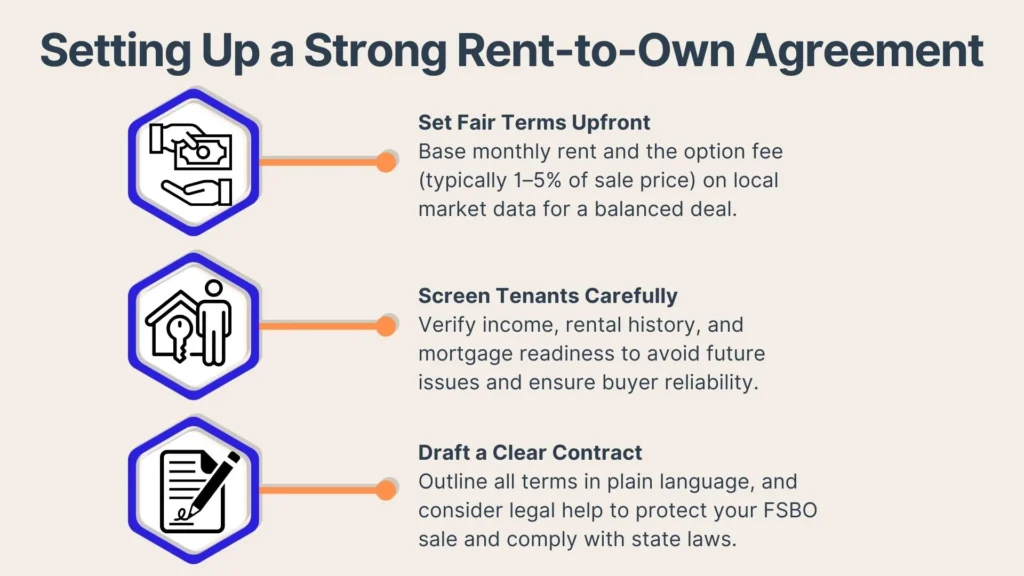

Setting Up a Rent-to-Own Agreement

Crafting a strong rent‑to‑own contract starts with thoughtful planning and clear paperwork. In the next section, let’s go through practical steps to build an agreement that protects your FSBO sale:

Determining the Option Fee and Monthly Rent

Begin by checking comparable rents in your area and noting the usual option‑fee range, which is often 1% to 5% of the sale price. Use that data to set monthly payments and an upfront fee that work for your tenant‑buyer without short‑changing you.

Striking this balance keeps the deal affordable for them and financially secure for you, laying a solid foundation for the entire agreement. A well‑priced offer attracts serious interest and boosts your chances of moving smoothly from lease to closing.

Screening Potential Tenant-Buyers

Verify each applicant’s employment stability and income, call past landlords to confirm on‑time payments and property care, and run background checks for any red flags. Ask for bank statements that show they can afford the option fee and monthly rent, and discuss their timeline for securing a mortgage. Thorough vetting protects your investment, reduces the odds of default, and sets clear expectations from day one.

A robust screening process benefits you by reducing unexpected complications later on in the agreement. It also helps cultivate a list of motivated buyers who have the financial discipline necessary for a successful transaction.

Drafting a Clear, Comprehensive Contract

Use clear, straightforward language when you draft the contract, spelling out the purchase price, rent credits, option expiration, and each party’s responsibilities. For additional guidance, you can hire a real estate attorney to ensure the document meets state laws and shields your interests at every step.

Conclusion

Rent-to-own agreements can be a smart, flexible option for both buyers and sellers, but if you’re an FSBO or first-time seller, navigating this process shouldn’t feel overwhelming. With Propbox, you get all the benefits of a full-service home sale, like faster timelines and better offers, but without the stress or 6% commission.

Our platform empowers you to stay in control while automating pricing, scheduling, organizing, and even listing in one place, regardless of which agreement type you choose for your home sale. Try Propbox today and experience how simple FSBO can really be.