If you’re selling your home on your own as a For Sale By Owner (FSBO) seller, one of the most critical documents you’ll encounter is the residential purchase agreement. While this contract might seem intimidating and complicated at first, it essentially sets the framework for how you and the buyer will handle the sale from start to finish.

Without the help of a real estate agent, you’ll need to keep track of this type of agreement’s key components, terms for negotiation, and clauses and contingencies all on your own. But fret not; by keeping the info in this guide in mind, you’ll be ready to enter one confidently without forking over a hefty commission to an agent.

Defining a Residential Purchase Agreement

A residential purchase agreement is a legally binding contract that lays out the terms and conditions for buying or selling a home. Think of it as the blueprint for your transaction, covering everything from the agreed-upon price to what happens if an inspection reveals serious issues.

For FSBO sellers, understanding this contract is vital, especially since you won’t have a listing agent guiding you through every clause. The agreement’s goal is to protect both parties, ensuring buyers get the property as promised and sellers receive payment under fair terms.

Key Components of a Residential Purchase Agreement

A residential purchase agreement includes critical details that guide the entire transaction. Let’s break down these key elements, from basic identifying information to contingency clauses and closing timelines, so you can structure a smooth and successful sale:

Buyer and Seller Information

At the most basic level, your purchase agreement will include identifying details for both parties. This might seem obvious, but it’s crucial to ensure everyone’s legal names are spelled correctly. If there’s more than one seller or buyer such as a married couple or joint owners, each party needs to be included. Accurate, consistent information helps avoid headaches later, such as issues with title transfer or financing approvals.

Purchase Price and Payment Terms

This section spells out how much the buyer will pay and how they’ll pay it. Will it be an all-cash deal, or will the buyer finance a certain percentage of the purchase price? According to the 2024 Profile of Home Buyers and Sellers, those who financed typically covered about 74% of the home price through a mortgage.

As a seller, you’ll want to confirm the buyer’s financing status, especially if you’re concerned about delays or last-minute loan denials. The purchase price and payment terms also set the stage for any earnest money deposit and clarify the final amount due at closing.

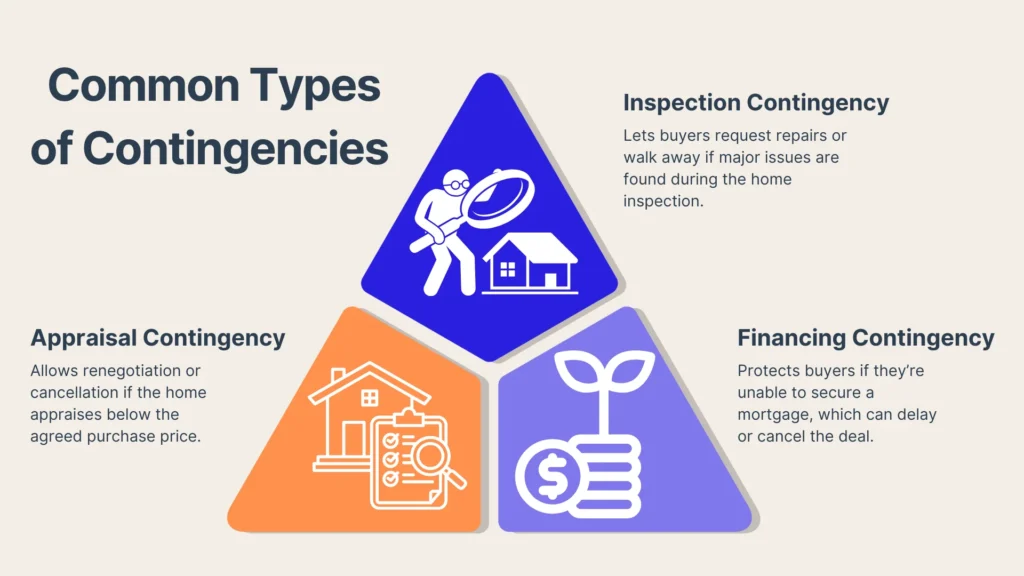

Contingencies and Deadlines

Contingencies are conditions that must be met for the sale to move forward. For instance, an inspection contingency might allow the buyer to back out or renegotiate if the home inspection uncovers major repairs. A financing contingency protects the buyer if their mortgage falls through at the last moment—something that can happen if interest rates shift or if they lose their job unexpectedly.

These contingencies come with deadlines: the buyer must conduct inspections by a certain date, secure financing by another, and so on. Missing these deadlines can void the agreement or lead to renegotiations.

Closing Date and Possession

The closing date sets a target for finalizing the sale. In some cases, you might opt for a swift 30-day closing if both parties are highly motivated; in others, you might need 60 days or more.

The agreement should also clarify when the buyer can take possession of the property, whether this is immediately after closing or possibly a few days later if the seller needs time to move out. Setting these expectations from the start helps you and the buyer plan accordingly and avoid last-minute surprises.

Contingencies: The Safety Nets

Contingencies offer escape routes or negotiation points for both the buyer and seller if certain criteria aren’t met. They’re a normal part of most purchase agreements, especially for first-time buyers who might not have the cash reserves to handle sudden setbacks.

Let’s dig further into the common types of contingencies and how they can protect parties:

Inspection Contingency

An inspection contingency allows the buyer to evaluate the home’s condition—think plumbing, electrical, foundation, and more. If the inspector’s report reveals significant issues, the buyer might ask for repairs, request a price reduction, or walk away altogether.

As an FSBO seller, you should be prepared for these possibilities. Being upfront about any known defects and promptly addressing buyer concerns can prevent a deal from falling apart. After all, about 10% of FSBO sellers say “understanding and performing paperwork” is challenging; dealing with inspection reports smoothly can be part of that learning curve.

Financing Contingency

A financing contingency safeguards the buyer if they can’t secure a mortgage, which could happen for various reasons like credit score changes, job losses, or issues with the lender’s underwriting process.

While this clause primarily benefits the buyer, it also impacts your timeline as a seller. If a buyer’s financing falls through late in the process, you might find yourself rushing to find another buyer or extending your own housing plans unexpectedly.

Appraisal Contingency

Since buyers often finance a major portion of the purchase, their lender will typically require an appraisal to confirm the home’s value. If the appraisal comes in lower than expected, the buyer might not qualify for the full loan amount.

At that point, you can renegotiate the price, wait for the buyer to gather additional funds, or cancel the deal. This scenario is especially relevant when you’re setting your price without an agent’s guidance. If you chose a price that’s significantly higher than recent comparable sales, you might face a low appraisal and need to adjust your expectations.

Additional Clauses and Considerations

Beyond the essentials of price and deadlines, you’ll encounter several additional clauses and considerations that can greatly influence your role and obligations in a residential purchase agreement.

Below, we’ll explore how earnest money deposits, home warranties, and legal disclosures affect and protect the interests of both the buyer and seller:

Earnest Money Deposits

An earnest money deposit is a good-faith payment the buyer offers to show they’re serious about purchasing your home. Typically, this deposit is applied to their closing costs or down payment once the deal goes through.

If the buyer backs out without a valid contingency, you may be entitled to keep the deposit. However, if the buyer cancels for a legitimate reason such as a financing contingency that isn’t met, they usually get their earnest money back.

Home Warranties and Special Provisions

Sometimes, to make your home more appealing or to offset potential buyer concerns you might include a home warranty. This can cover things like HVAC systems or appliances for a specified period. Special provisions, on the other hand, can range from leaving behind certain furniture to including an unusual move-out timeline. The key is clarity: spell out exactly what’s included so the buyer isn’t expecting to find your living room set in place if you intended to take it.

Disclosures and Legal Requirements

Depending on where you live, you may be legally required to disclose certain property defects, lead paint hazards, or HOA details. Omitting these disclosures can lead to lawsuits or contract cancellations. Since 6% of home sales in 2024 were FSBO, it’s clear many sellers opt to handle the process solo—but it’s also a reminder that you, as a FSBO seller, bear the responsibility of meeting all legal requirements without an agent’s support.

Negotiating the Terms

Once an offer is on the table, you’ll often find yourself exchanging counteroffers on price, contingencies, or closing dates. Let’s tackle how to handle these back-and-forth discussions professionally and ensure every agreed-upon change is clearly documented for a smooth path to a final mutual agreement:

Handling Counteroffers

Negotiations can often feel like a chess game. The buyer might counteroffer on price, contingencies, or even the closing date. Aim to keep emotions in check. Be open to give-and-take: maybe you reduce the price slightly if the buyer agrees to a shorter inspection period, or you offer to handle minor repairs in exchange for an as-is sale. Ensure any changes you agree on are in writing to avoid confusion down the line.

Finalizing Mutual Agreement

Once both you and the buyer align on the key terms, you’ll finalize the agreement. Every change, like a revised closing date, should be documented and signed by both parties. This step is crucial for preventing misunderstandings.

A slight oversight like forgetting to initial a page or missing a signature can create loopholes that potentially allow your buyer to back out. If you’re uncertain about the required format or language for an amendment, consider consulting a real estate attorney or a reputable online legal resource. This will save you from costly disputes later the line.

Signing and Executing the Contract

After hammering out the details and reaching a mutual agreement, the next step is to ensure your agreement is signed properly and that each party understands their post-signing responsibilities. Let’s go over what proper execution entails, actions to take right after signing, and how to stay on top of key deadlines:

Importance of Proper Execution

Proper execution means everyone who needs to sign does so, with all required initials and dates included. In some states, notarization might be required for certain documents. Although a real estate notary can help verify identities and witness signatures, you ultimately need to ensure each page is complete and that all parties receive identical copies.

Next Steps After Signing

Once the agreement is officially signed, the buyer typically places their earnest money deposit into an escrow account. You or the buyer will then schedule inspections and appraisals, and the lender (if there is one) will start finalizing the loan. This is also when the buyer may need to prove they have homeowners insurance lined up, another condition that might appear in the purchase agreement.

Monitoring Contingency Deadlines

Deadlines for inspections, financing approvals, and other contingencies are laid out in your contract. Missing any of these cutoffs can void the agreement. Keep a calendar with reminders so you know when to expect an inspection to be completed or a financing contingency to be cleared. If something unforeseen happens like a delay with the lender, both parties might need to sign an amendment to extend the deadline, preserving the deal.

Conclusion

The key to navigating a residential purchase agreement is understanding its core components and the legal responsibilities each clause carries. From listing buyer and seller information to detailing contingencies, closing timelines, and earnest money deposits, each section works together to provide clarity and protection for everyone involved.

Never hesitate to ask questions if a buyer presents terms you don’t fully understand. Staying organized by tracking deadlines, keeping records of any amendments, and ensuring all disclosures are in order will help streamline the process. Simplify this with Propbox; our platform can automate, list, and organize every step for you to reduce your stress and minimize hiccups on the path to closing.