If you want to move your home sale forward without bank roadblocks, seller financing can let you do just that. By stepping into the lender’s role, you keep negotiating power, open the door to buyers who may not qualify for conventional loans, and collect steady interest income after closing. Read on to see how a well‑structured seller financing contract can help you reach those goals.

Defining Seller Financing

Seller financing is a purchase arrangement where you accept installment payments over time rather than a single payout on closing day. You extend credit to the buyer, secure that debt with the property, and receive monthly principal and interest until the balance is paid.

Because you control underwriting, closing can be quicker and cheaper than a bank mortgage. You still record a lien, file the promissory note, and follow state rules so both parties remain protected.

The concept removes institutional hurdles but adds new duties for you as a lender. The next section shows how funds move from buyer to seller and which professionals keep the deal on track.

How Seller Financing Works

Seller financing operates much like a private loan secured by real estate. You will see money flow in predictable stages, and several supporting players will help manage paperwork and compliance. Let’s break down this option’s mechanics:

Basic Concept and Flow of Funds

You act as the bank by accepting a down payment and issuing a promissory note for the remaining balance. Payments arrive each month, often with a final balloon payoff after three to five years.

Typical structures include 30‑year amortization with a five‑year balloon or fully amortized 10-to 15‑year notes. Interest‑only periods are also common when buyers plan to refinance soon.

Parties Involved

You and the buyer are the primary parties, but neutral third‑party services matter. For example, a title company records the deed and lien while holding earnest money, and a real estate attorney drafts or reviews documents.

Professional guidance keeps paperwork compliant and minimizes disputes over late fees, insurance, and tax escrows. These specialists charge predictable flat fees that you can budget into closing costs.

Types of Seller Financing Arrangements

No single structure fits every situation, so understanding your options helps you match risk with reward. The next three formats show how ownership and security differ:

Land Contract (Contract for Deed)

With a land contract, you keep the legal title until the buyer completes all payments. The buyer gains equitable title, lives in the home, and carries maintenance duties.

This arrangement lowers upfront costs but limits the buyer’s ability to refinance until the balance is paid. You keep a stronger leverage because the title remains in your name.

Pros

- Simpler foreclosure in many states

- Lower closing expenses

Cons

- The buyer lacks recorded ownership.

Resale or refinancing can be complicated.

Mortgage or Deed of Trust

This structure mirrors a bank loan, but you hold the note. The buyer receives the title at closing, and your lien is recorded in first or second position.

If default occurs, you foreclose through judicial or trustee procedures, just as a bank would, preserving your claim on the property. Recording the lien protects you against future encumbrances.

Lease Option or Rent‑to‑Own

A lease option pairs monthly rent with an option fee that credits part of the future purchase price. The buyer may exercise the option within a set term, usually one to three years.

This format gives buyers time to repair their credit while letting you collect higher rent and a non‑refundable option premium. It works well when you want steady cash flow but are not ready to finance the full purchase immediately.

Key Elements of a Seller Financing Contract

Every strong seller finance deal shares several core provisions. The next part will outline each clause and explain why it matters:

Purchase Price and Down Payment

Agree on a realistic sale price supported by recent comps. A larger down payment lowers your risk and shows buyer commitment. Many FSBO sellers request at least ten percent down; some aim for twenty percent to offset market swings. Larger equity also motivates the buyer to stay current on payments.

Interest Rate and Amortization Schedule

Set a rate that reflects current mortgage averages plus a risk premium. Decide whether payments follow standard amortization, interest‑only periods, or a balloon structure.

Providing a clear amortization schedule helps the buyer track principal reduction and lets you forecast income. You can generate the schedule using spreadsheet software and attach it to the note.

Late Payment Penalties and Default Clauses

Spell out grace periods, late fees, and acceleration rights if the buyer falls behind. A common fee is five percent of the overdue amount after ten days.

Acceleration lets you demand the full balance or initiate foreclosure when defaults exceed a set threshold. Clear rules deter late payments and speed up resolutions.

Loan Term and Balloon Payments

Choose a term that balances your liquidity needs with buyer affordability. Many seller notes run 5 to 10 years, ending with a balloon payoff.

If you want a steady cash flow, a fully amortized 15‑year plan may be preferable, but shorter balloons can prompt faster refinancing. Spell out whether early payoff carries any fee.

With the fundamentals covered, you can focus on drafting the paperwork that brings the deal to life.

Crafting a Seller Financing Contract

Drafting is where plans become enforceable documents that create obligations for both a buyer and a seller. The upcoming subsections show who can help and which forms you cannot skip:

Key Documentation

Every seller financing file should include:

- Promissory note: This states the loan amount, rate, term, and penalties.

- Mortgage or deed of trust: This secures the debt with the property.

- Amortization schedule: This outlines each payment’s principal and interest portions.

Keep digital copies of all signed documents in a secure folder. Cloud storage with two‑factor authentication works well for most sellers.

Working with Professionals

A real estate attorney prepares or reviews the promissory note, deed of trust, and disclosure forms. Their fee is modest compared with the cost of litigation later.

Title companies handle escrow, record liens, and verify that taxes are current, giving both parties confidence in the transaction. They also issue title insurance that protects you against hidden liens.

Ensuring Transparency and Buyer Eligibility

Sellers should always request a credit report, income verification, and proof of funds for the down payment; remember, transparent underwriting prevents future defaults.

Explain repayment terms in plain language and provide disclosures so the buyer understands costs, taxes, and insurance responsibilities. Giving the buyer a simple FAQ sheet can reduce last‑minute questions.

Setting the Interest Rate and Terms

Numbers drive profitability, so you need a logical framework before quoting a rate. Let’s work through how you can set practical benchmarks for seller financing:

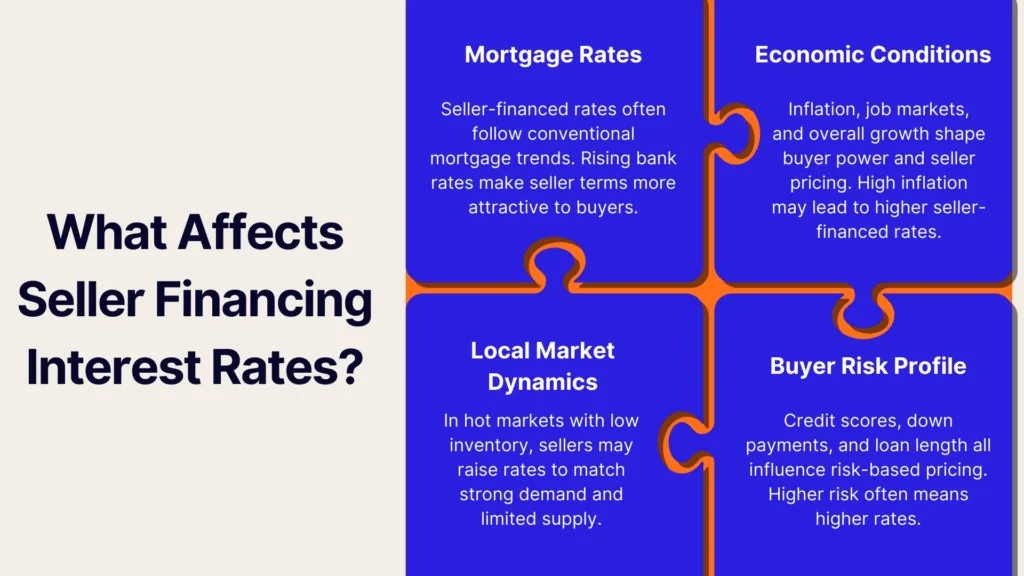

Factors Influencing the Rate

Rates hinge on prevailing mortgage averages, property condition, and buyer credit. In 2024, seller‑financed loans averaged 9%, about two points above conventional mortgages.

Higher rates compensate you for risk and opportunity cost, yet staying within local usury caps avoids legal trouble. Checking your state’s ceiling before finalizing the note protects against future disputes.

Amortization Examples

Let’s consider the following scenario: a $150,000 note at 8% over 30 years yields a monthly payment near $1,100. Adding a five‑year balloon leaves 91% of the principal due at payoff. Interest‑only payments on the same balance drop to $1,000 monthly but leave the entire principal outstanding at balloon maturity.

Buyers planning a refinance often prefer this structure.

Adjustments and Renegotiations

If the buyer refinances, you receive a lump sum that retires the note. You may also agree to modify the rate or extend the term if market conditions shift.

Put any changes in writing and record amendments to keep the lien position secure. Amended documents should be notarized and filed with the county recorder.

Legal and Tax Implications

Staying compliant avoids costly setbacks and may even save you money. The following points highlight the most common legal angles:

Potential Tax Benefits

An installment sale may spread capital gains over several years, potentially lowering your annual tax bracket. Consult a tax advisor to confirm how IRS installment rules apply.

Interest income is taxable, yet you may deduct property taxes you advance if the buyer reimburses you through escrow. Accurate record‑keeping simplifies year‑end filings.

Security Instruments and Lien Positions

Make sure your lien is recorded in first position so you get paid before other creditors if something goes wrong. Ask for proof of homeowner’s insurance that lists you as an additional insured.

Keep an eye on property taxes to make sure they’re paid on time, as unpaid taxes could put your investment at risk. Many sellers use an escrow account to automatically pay taxes and insurance from the buyer’s monthly payments.

State‑Specific Regulations

Some states cap interest rates or mandate specific disclosures. For instance, Texas limits certain seller finance notes to 30‑year terms and restricts balloon clauses. Review local statutes to avoid penalties and protect the enforceability of your contract. Your attorney can provide a compliance checklist before closing.

Comparing Seller Financing to Other Options

Do you want long‑term income or immediate cash? Let’s compare seller financing to other financing options to see if it’s the best option to explore for your home sale goals:

Traditional Mortgage vs. Seller Financing

Bank loans offer immediate cash but come with stricter buyer qualifications and longer closings. Seller financing gives you income over time and flexibility on underwriting.

Closing costs can be up to 3% lower when you bypass institutional lenders, according to 2024 FSBO data. Those savings often offset the interest spread you grant the buyer.

Lease Option or Rent‑to‑Own

A lease option provides a softer commitment for both sides, yet legal protections are weaker than a recorded mortgage. Option fees rarely exceed 5%, so your security is lower.

Seller financing transfers ownership sooner, which can motivate buyers to maintain the property. It also lets you charge interest, increasing total return.

Cash Sales

A cash deal delivers an immediate lump sum and zero collection risk. However, discounting the price to attract cash buyers may erode net proceeds. If you prefer long‑term income and higher total returns, structured payments from seller financing may suit you better.

Conclusion

You now have a practical roadmap for offering seller financing, from structuring payments to safeguarding your lien. Take this organized approach a step further with Propbox; this powerful platform simplifies the paperwork, keeps records organized, and guides you through every compliance checkpoint. Try Propbox now and turn your home sale into a smart investment vehicle.