Selling your home without the help of a real estate agent, a.k.a. For Sale by Owner (FSBO), can be a rewarding experience, granting you more control over the transaction and potentially saving money on commissions. One crucial aspect you’ll need to understand is closing costs, those various fees and charges that arise at the end of a home sale.

A common question many FSBO sellers ask is, “Are closing costs negotiable?” The short answer is yes, many are, but not all of them. In this guide, we’ll break down closing costs, show you who typically pays them, discuss which fees can be negotiated, and give you practical strategies to reduce your expenses when selling your home without an agent.

What Are Closing Costs?

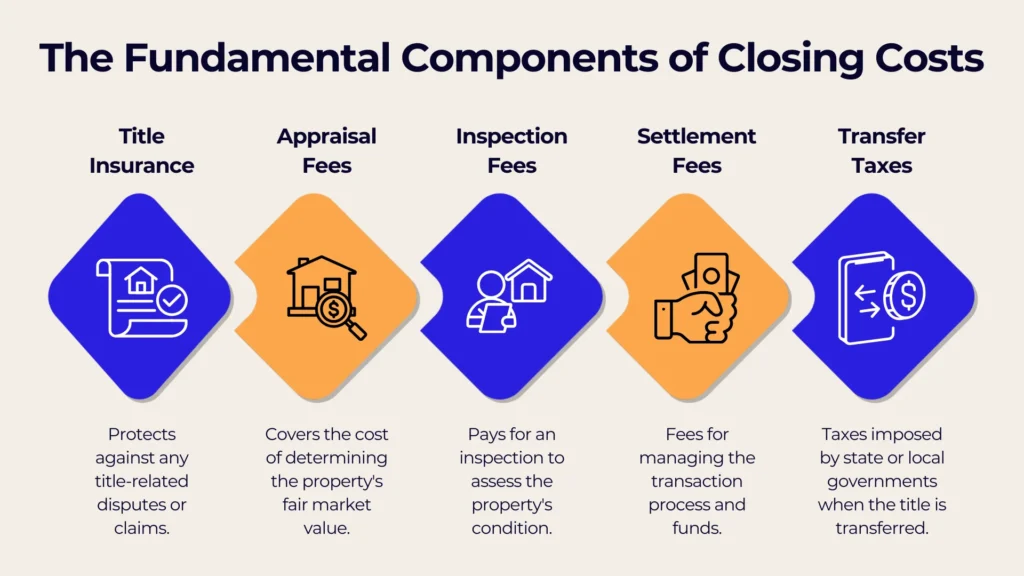

Closing costs refer to the fees, taxes, and administrative charges associated with finalizing a real estate transaction. These costs are typically paid at the closing table when the property’s title formally transfers from the seller to the buyer. While the exact list of closing costs can vary depending on your state, local regulations, and the terms of your sales contract, most transactions include some combination of the following:

- Title Insurance: Protects the buyer (and sometimes the lender) against claims or disputes over the property title.

- Appraisal Fees: Paid to a licensed appraiser who determines the fair market value of the home.

- Home Inspection Fees: Covers the cost of a professional inspection for structural and safety issues.

- Escrow/Settlement Fees: Paid to the escrow or title company for managing funds and documents throughout the closing process.

- Transfer Taxes: State, county, or municipal taxes charged for transferring the property’s title from the seller to the buyer.

- Recording Fees: Fees associated with officially recording the new deed and other documents at the county recorder’s office.

- Attorney Fees: Costs for legal services, if required or chosen by either party.

- Loan-Related Costs: If the buyer is financing the purchase, there will be loan origination fees, underwriting fees, and potential points paid to the lender.

Who Typically Pays Closing Costs?

In a traditional real estate transaction, both buyers and sellers share responsibility for paying various closing costs. Buyers often pay fees related to their mortgage (like loan origination and appraisal) and their share of property taxes. Sellers usually cover expenses such as real estate commissions (if they’re using an agent) and transfer taxes, among other charges.

However, there is no hard-and-fast rule that dictates exactly who must pay which fees. Some states have specific conventions—for instance, in certain locations, the seller customarily pays for the owner’s title insurance, while in others, the buyer does. Market conditions also play a role: in a seller’s market, buyers may be more willing to assume a larger portion of closing costs to make their offers more attractive. In a buyer’s market, sellers might take on some of the buyer’s closing costs to secure a sale.

Are Closing Costs Negotiable?

Yes, closing costs can be negotiable, and that’s one of the most important points for FSBO sellers to recognize. While some costs are fixed by law or set by third-party service providers, many others can be negotiable.

Misconceptions often arise around closing costs because certain fees may appear non-negotiable when, in fact, they can be discussed and altered. For example, a seller might assume transfer taxes are entirely non-negotiable. While the tax rates themselves aren’t negotiable (since they’re government-imposed), the party responsible for paying them can be negotiated.

Which Closing Costs Can Be Negotiated?

When determining which costs are truly negotiable, it’s helpful to distinguish between government-mandated expenses and service-based fees. Government-mandated fees are generally non-negotiable because they are set by law. Service-based fees, however, can often be adjusted. Here are some of the more commonly negotiated closing costs for FSBO sellers:

- Title Insurance Premiums: As a seller, you can shop around for competitive rates since these premiums may vary among providers. You can negotiate who covers these premiums or split them with the buyer.

- Escrow or Settlement Fees: Escrow fees cover the cost of holding and distributing funds, as well as managing documents during closing. You may be able to negotiate the fee amount or decide how it’s divided between you and the buyer.

- Transfer Taxes: Although the tax rate is fixed by the government, you can negotiate which party is responsible for paying the transfer tax. If the buyer is looking to reduce their out-of-pocket expenses, you might offer to pay a portion or all of the transfer tax in exchange for a higher sale price or a quicker closing period.

- Home Warranties: A home warranty can be an attractive perk for buyers, especially if your property is older. Who pays for this warranty—and whether it’s included at all—is negotiable.

- Attorney Fees: In some states, the involvement of a real estate attorney is mandatory, while in others, it’s optional. If attorneys are involved, their fees can sometimes be negotiated, especially if you and the buyer use the same lawyer or if you find a firm offering flat or reduced rates for FSBO clients.

- Loan Origination Fees (If Offering Seller Financing): If you, as the seller, are offering financing to the buyer, there could be costs involved in setting up that loan. The terms, including origination fees, can be negotiated as part of the financing agreement.

What Cannot Be Negotiated?

While there are numerous closing costs that you can influence through negotiation, certain costs are set in stone. These include:

- Government-Mandated Fees: Fees like property taxes, recording fees, and certain transfer taxes are set by law. You can negotiate who pays them, but you cannot alter the amount owed.

- Prepaid Expenses: These can include items like homeowners insurance premiums, mortgage insurance, and HOA dues that need to be paid in advance. These costs are required either by a lender or by the governing body (like an HOA), and the amounts typically can’t be reduced through negotiation.

Remember, just because a fee’s amount might be non-negotiable doesn’t mean you can’t adjust which party pays it. Still, always be aware of local laws and regulations, as some jurisdictions have specific rules about who must bear certain costs.

How Home Sellers Can Negotiate Closing Costs

If you’re selling your home FSBO, you have the advantage of direct communication with buyers and more flexibility in structuring the deal. Here is a step-by-step outline of how you can effectively negotiate closing costs.

Step 1: Research Closing Costs in Your Area

Start by familiarizing yourself with the typical closing costs in your region. Because conventions vary significantly from state to state, local norms play a big role in how fees are split. Some strategies to help you research include the following:

- Online Tools: Use websites that provide estimates of closing costs based on your home’s location and sale price.

- Local Title Companies: Contact several title companies and ask them about average fees and typical allocations of costs in your area.

- Recent Comparable Sales: Talk to neighbors or friends who have recently sold FSBO, or check public records for insights into closing cost structures in your neighborhood.

Step 2: Partner with Experts

Even though you’re selling the home without a listing agent, you don’t have to go it alone entirely. A real estate attorney can advise you on local regulations, draft or review your sale contract, and ensure that any negotiation over fees is legally sound. In some states, an attorney’s involvement is mandatory; in others, it’s optional but highly recommended for FSBO sellers.

You can also ask the title company for assistance. The title company can explain fees such as title insurance and escrow charges, letting you know where you may have room to negotiate. They can also offer guidance on local practices regarding cost allocation.

Step 3: Use Closing Costs as a Negotiation Tool

One of the most common ways to negotiate is by offering concessions or incentives related to closing costs. If buyers are on the fence or concerned about out-of-pocket expenses, covering part of their closing costs can make your property more appealing. This strategy can be especially effective in a competitive market where buyers have multiple options.

If you do offer to cover certain fees, you might negotiate a slightly higher purchase price. This can preserve your net proceeds while easing the buyer’s cash flow concerns. You and the buyer could also agree to split some big-ticket items, like escrow fees or transfer taxes. This approach keeps the financial burden from falling entirely on either party.

Step 4: Compare Service Providers

Many FSBO sellers don’t realize they can shop around for services like title insurance, home inspections, and legal representation. Comparing providers can yield significant savings:

- Title Companies: Request quotes from several title agencies to see who offers the most competitive rates. Ask about special pricing for FSBO clients, since some companies target this niche.

- Attorneys: If your state requires an attorney, or you choose to use one, look for a professional who offers flat-fee packages for FSBO transactions.

- Inspectors and Appraisers: While these costs are often the buyer’s responsibility, having a pre-listing inspection or appraisal could be beneficial. You may find more affordable options by calling multiple firms or seeking referrals.

Step 5: Leverage the Buyer’s Lender

If your buyer is taking out a mortgage, you can sometimes negotiate closing cost allocations in collaboration with their lender. Some lenders offer credits toward closing costs if buyers are willing to accept a slightly higher interest rate. While this arrangement primarily affects the buyer’s costs, it can also influence your negotiations if the buyer needs extra help covering closing expenses.

If the buyer’s lender offers credits to reduce out-of-pocket expenses, you might not need to concede as much on closing costs. In some cases, the lender might allow the buyer to roll certain closing costs into the mortgage, depending on the loan program and the property’s appraisal value.

Benefits of Negotiating Closing Costs for FSBO Sellers

Why does negotiating closing costs matter so much for FSBO sellers? Here are three key advantages:

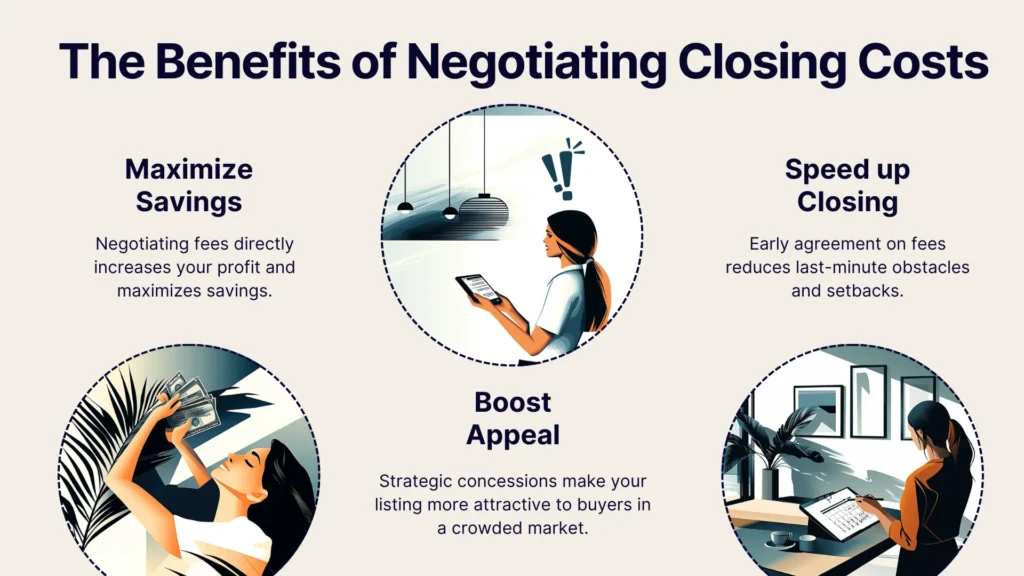

- Potential Cost Savings: Every dollar you save on fees goes directly into your pocket. Negotiating fees and comparing service providers can reduce your overall expenses and maximize your profit.

- Increased Competitiveness: Offering a strategic concession on closing costs can set your listing apart in a crowded market. Buyers typically pay close attention to how much they’ll need at closing. You make your home more attractive by easing that burden—without severely impacting your net proceeds.

- Streamlined Sales Process: Negotiating fees proactively can expedite the closing process. When both parties reach an agreement on costs early, fewer roadblocks arise at the eleventh hour. This efficiency can be a significant advantage if you’re aiming for a quick and hassle-free sale.

Conclusion

Closing costs are a pivotal part of any real estate transaction, and while some fees are fixed, many can be negotiated. As an FSBO seller, you have the opportunity to manage these expenses in a way that benefits both you and your buyer. Above all, remember that flexibility is key. While you may have a target net profit in mind, being open to covering certain closing costs—or sharing them with the buyer—could help your property stand out in the market.

From transfer taxes to title insurance, closing costs can take a big bite out of your proceeds—unless you negotiate effectively. That’s where Propbox comes in. We equip FSBO sellers with a step-by-step plan, automated checklists, and real-time updates to stay ahead of every charge and fee. You’ll avoid the 6% realtor fee, sell for more, and protect your interests better than anyone else can.