Selling your home is more than just a financial transaction; it’s an emotional journey filled with highs, lows, and important decisions. After all the effort you’ve put into preparing by deep cleaning, staging, taking professional photos, and carefully listing, receiving that first offer can feel like a major achievement.

It’s tempting to accept it right away and move forward. Who wouldn’t be eager to wrap things up and start a new chapter already? However, it’s important to pause and ask: Is this truly the best deal for you?

Instead of jumping at the first offer, take a moment to weigh your options, explore negotiations, and think about whether waiting for a better deal makes sense. Selling your home is a big deal, and taking the time to understand the offer, evaluate it carefully, and plan your next move can help you get the best outcome.

Why Is Your First Offer Significant?

Your first offer is more than just a number: it’s a key indicator of how buyers perceive your home’s value. According to the National Association of Realtors, homes that receive offers early tend to sell closer to the asking price, often achieving 2-5% higher final prices compared to those that stay on the market longer.

Zillow data also shows that ignoring early offers could mean missing out, as properties that linger typically face price reductions and declining interest. Whether the offer meets your expectations or not, it offers valuable insight to help you decide whether to accept, negotiate, or hold out for something better.

Evaluating The First Offer

Now that we’ve discussed the importance of that initial bid, let’s move on to how you can carefully assess it. Evaluating the first offer is about more than just looking at the numbers; it involves considering multiple factors that could impact your sale’s success.

Below, we’ll explore market value comparisons, buyer conditions, and the urgency of your selling timeline.

Offer Vs. Market Value

One of the very first things to consider is how the proposed price stacks up against the property’s current market value. If you’ve hired a real estate agent, they likely provided a comparative market analysis (CMA) when you listed your home. That data can reveal how similar homes in your area are priced and what they eventually sell for.

If the initial proposal aligns with this market analysis – especially if it’s close to or above asking – this could be a strong indication you’ve priced your home appropriately.

But if the offer is substantially lower, you’ll need to ask yourself why. Are there features or concerns about the house that might justify a lower price, or could the buyer simply be testing how negotiable you are? Understanding the market value goes a long way in deciding whether the first offer is fair or needs countering.

Buyer’s Conditions

Price is undoubtedly a massive factor, but don’t overlook the conditions attached to the offer. Buyers may ask for contingencies related to financing, inspections, or even selling their own home first.

For instance, a buyer might insist on an extended closing date because they need to coordinate a move from another city, or they might request repairs based on a pending home inspection.

These contingencies can affect how quickly and smoothly the sale will close. In some cases, buyers might be asking for concessions, such as covering part of their closing costs. If they’re offering a good price but come with a long list of demands, weigh whether meeting those requests will be worth the final sale price.

Striking a balance between a satisfactory amount and reasonable conditions is key to maintaining a positive transaction.

Need For Quick Sale

Sometimes you just need to sell fast. Perhaps you’ve already moved for a new job, or you’re navigating a life change that makes an extended listing period impossible.

If time is of the essence, a slightly lower yet hassle-free offer might be attractive. On the other hand, if your schedule is flexible, you could afford to wait for something closer to your dream price.

Remember, the urgency of your timeline heavily influences whether it makes sense to accept or negotiate. Factor in holding costs, such as additional mortgage payments, insurance, and utilities, which can erode your profits if your home sits on the market too long.

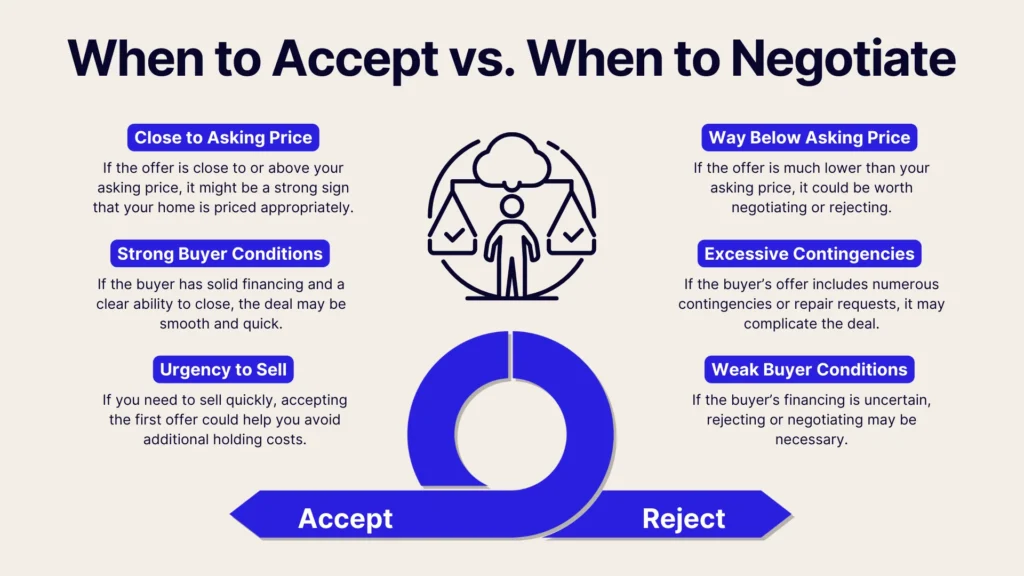

When To Accept The First Offer

After you’ve evaluated that opening bid in detail, you might discover it actually meets your needs perfectly. Let’s look at a few scenarios where accepting right away could be your best course of action.

Offer Meets Asking Price

If the initial bid is right at your asking price (or even a bit higher) this is often the golden scenario.

It suggests your home was priced accurately from the start. Some sellers worry about leaving money on the table when a buyer quickly matches the listing price. However, a swift offer at or near asking can also signal high demand for your home.

Unless you have strong reasons to believe you can trigger a bidding war or receive a significantly better proposal, it’s worth taking a careful look at that first offer. You’ll want to check the contingencies to ensure there are no hidden deal-breakers, but if everything checks out, you might have an ideal situation.

Slow Market Conditions

In a market where properties tend to linger, a reasonable initial bid can feel like a lifeline. When house listings sit for extended periods, buyers become more cautious and might submit offers below the listing price.

If you receive a fair first offer in a sluggish market, it might be smarter to accept instead of holding out for something better that may never come. Waiting too long can lead to the house becoming “stale,” prompting future buyers to believe they hold all the negotiation power.

If you’ve confirmed through local data that the market is indeed slow, a solid first offer could be your best shot.

Buyer’s Strong Financial Position

An appealing offer isn’t just about matching your listing price; it’s also about whether the buyer has the financial stability to close the deal. A buyer who is pre-approved for a mortgage or is offering cash can significantly reduce the risk of the sale falling apart at the last minute.

If the buyer’s financing is secure and they’re showing genuine commitment with a healthy earnest money deposit, you’re looking at a lower-risk sale. This reliability can be invaluable, especially if your timeline or circumstances don’t allow for a deal to collapse after weeks of negotiation.

When To Negotiate Or Reject

Not every first offer will be the right one for you. Sometimes the buyer’s conditions or the price itself simply won’t make sense, prompting a decision to either negotiate or decline. Here are some clear signals that you should consider making a counteroffer – or walking away altogether.

Offer Below Market Value

If the proposed purchase amount is noticeably lower than the figures you’ve gathered from your CMA or recent neighborhood sales, this might be a case of “lowballing.” Some buyers start this way hoping you’ll be eager to make a deal. While it might feel insulting at first, it’s still an offer.

You can engage with a counter-proposal, highlighting comparable sales and explaining why your home’s value is higher. If the buyer comes up in price, great. If not, you’ll know you made your case and can move on to other interested parties.

Navigating these negotiations can be challenging, but tools like PropBox can provide valuable support. With AI-driven insights and automated counteroffers, PropBox helps you respond strategically by tailoring proposals to your preferences – whether it’s price, contingencies, or closing timelines – ensuring a more informed and efficient decision-making process.

Multiple Interested Buyers

When you receive multiple offers – or even multiple inquiries that could turn into offers – your negotiation power increases significantly.

You have options, which puts you in a better position to hold out for the best terms and price. In this scenario, you could either invite all parties to submit their highest and best offers or choose one that seems particularly promising and negotiate exclusively with them.

If that first offer isn’t up to par, and you’re confident others will come, you might decide to reject it outright. Be cautious, though: the real estate market can be unpredictable, and other potential buyers might lose interest if your asking price is too high.

Unfavorable Buyer Conditions

Sometimes, the buyer’s demands aren’t worth the hassle. Maybe they’re insisting on an unreasonably long timeline that conflicts with your move-out schedule, or they want you to cover excessive repairs and closing costs. In some cases, these conditions may increase your risk or reduce your profits more than you’re willing to accept.

If the buyer can’t bend to their requirements, it may be best to reject the offer and seek a more suitable one.

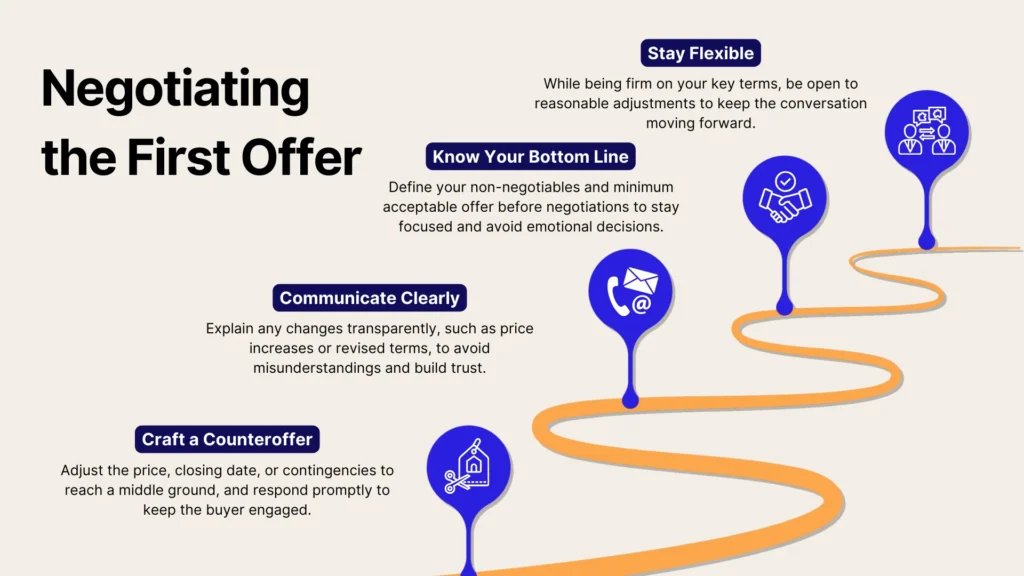

Negotiating After The First Offer

When the first offer doesn’t tick all your boxes, negotiation is your opportunity to find a middle ground. Here, we’ll look at how to craft a successful counteroffer, why clear communication is your ally and the importance of knowing your bottom line throughout this process.

Crafting A Counteroffer

A counteroffer is your way of saying, “I’m interested, but let’s adjust a few things.” This can include raising the sale price, modifying the closing date, or tweaking the requested contingencies.

Before finalizing your counteroffer, consult with your real estate agent, review comparable sales again, and consider how flexible you’re willing to be. It’s wise to respond promptly; a long delay can cause the buyer to lose interest or move on to another property.

The goal is to keep the lines of communication open and keep the buyer motivated to finalize a deal.

Importance Of Clear Communication

During negotiations, misunderstandings can lead to frustration on both sides. Communicate any changes clearly – if you’re increasing the price, explain your rationale based on features of the home, market data, or improvements you’ve made. If you’re asking for a tighter closing schedule, let the buyer know why.

Transparency can build trust and encourage a more cooperative atmosphere. Many deals fall apart over simple miscommunications that could’ve been easily resolved with open and honest dialogue. Being proactive and straightforward can move the sale along more smoothly.

Knowing Your Bottom Line

Before you even begin negotiating, it’s crucial to figure out your absolute bottom line. This encompasses not just the dollar amount, but also any terms you’re not willing to compromise on. For instance, you might be fine with leaving the washer and dryer behind but unwilling to fund a major repair that the buyer wants done.

Understanding your limits beforehand helps you avoid emotional decision-making during negotiations. If the buyer wants more than you’re prepared to give, you’ll know it’s time to step away and wait for another opportunity.

Conclusion

That first offer can be exciting, but it’s important to step back and assess it carefully. Is the price fair? Are the terms favorable? While it might seem tempting to accept right away, reviewing the details ensures you're making the right decision for your goals.

Whether it’s a solid deal or needs some negotiation, taking a strategic approach helps maximize your home’s value. Let PropBox be your go-to selling sidekick throughout this process. With AI-driven offer analysis, automated counteroffers, and clear insights into your bottom line, it simplifies decision-making and empowers you to negotiate confidently. Make your next move easier, smarter, and more profitable with PropBox by your side.