When selling a home, you’ll quickly hear the term “contingencies” pop up in conversations with buyers, agents, and lenders. Simply put, a contingency is a condition that must be met before a real estate deal can fully move forward.

Buyers often include these clauses to protect themselves – if the condition isn’t met, they can back out of the purchase or renegotiate terms without penalty. Sellers, on the other hand, need to know what these conditions entail because each one can affect the timeline, negotiation process, and ultimate success of a home sale.

In this article, we’ll look at how contingencies are defined in the context of real estate and why they matter so much to you as a seller.

What Are Contingencies in Real Estate?

Contingencies let buyers pull out or renegotiate when certain requirements aren’t met, acting like “safety nets” to cover financing, inspections, or unexpected snags. While this makes them sound optional for many sellers, according to the National Association of Realtors, around 25% of delayed or canceled deals in 2022 were tied to inspection or financing contingencies, underscoring their real impact on transactions.

From a seller’s perspective, you’ll want to know how these clauses might stretch out your timeline or lower the odds of a smooth closing, and some may even require extra work or concessions. By understanding these typical conditions, you can plan smarter, negotiate more confidently, and keep better control over the entire selling process.

Types of Contingencies Home Sellers Should Know

Contingencies come in various forms, each addressing a different aspect of the home-buying process. When you know what these are upfront, you’ll be in a stronger position to decide which terms you’re comfortable accepting, negotiating, or rejecting.

Below are some of the most common contingencies you might encounter, along with insights into how they work and what they mean for you as a home seller.

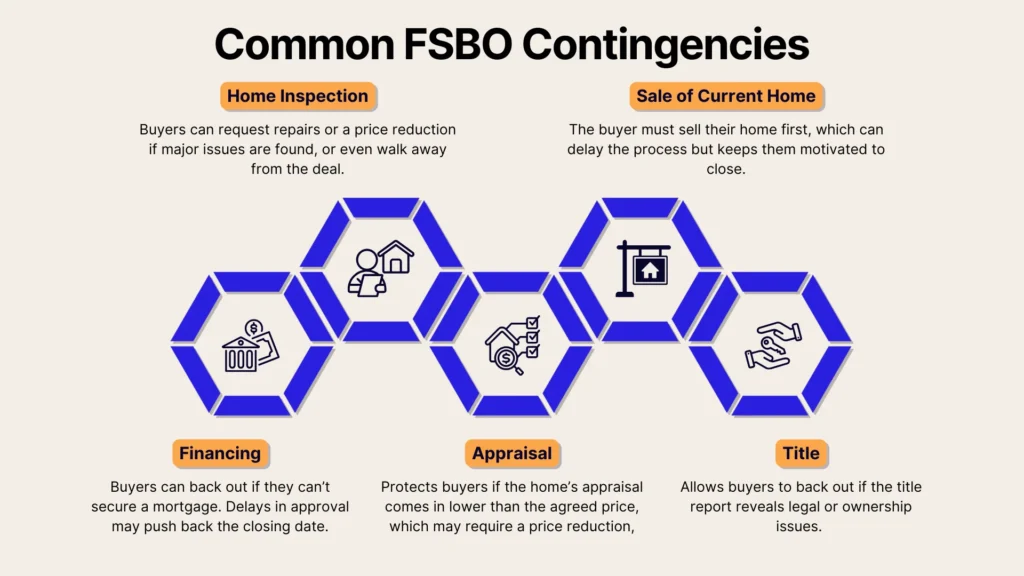

Financing Contingency

A financing contingency gives buyers a safety net if they can’t secure a mortgage, even if they were pre-approved. Lenders can still deny loans due to changes in credit, job status, or debt levels, and with this contingency in place, buyers can walk away without losing their earnest money.

For sellers, financing can be a bit of a rollercoaster: approvals take time, and delays might push your closing date back. If the deal falls through, it’s back to square one, but having multiple offers with solid pre-approvals can give you a much-needed edge and peace of mind.

Home Inspection Contingency

A home inspection contingency lets buyers bring in a pro to check things out, and if they uncover major issues like a leaky roof or faulty wiring, they can negotiate repairs, ask for a price cut, or even walk away.

As a seller, you’ll need to decide whether to fix problems yourself or offer credit to keep the deal moving. Inspections can stretch the timeline, so getting your own inspection before listing can be a smart way to tackle surprises early and keep things running smoothly.

Appraisal Contingency

An appraisal determines your home's fair market value, and lenders won’t finance more than it’s worth. That’s where an appraisal contingency comes in: it protects buyers by ensuring the home’s value meets the agreed price. But if the appraisal comes in low, you might have to lower your price or hope the buyer can cover the difference.

If no compromise is reached, the deal could fall apart. To boost your chances of a smooth appraisal, a few cosmetic upgrades and keeping your home in great shape can go a long way.

Sale of Current Home Contingency

A home sale contingency means the buyer needs to sell their current place before they can commit to yours.

It can slow things down while they list, find a buyer, and close, but the upside is they’re usually super motivated to make it happen. To keep your options open, you can always keep your home on the market in case a buyer with fewer strings attached comes along.

Title Contingency

A clear title ensures no legal claims, outstanding liens, or disputes over the property’s ownership. A title contingency lets the buyer review the title report and back out if it reveals significant problems. Getting ahead of potential issues can make selling smoother.

Ordering a preliminary title report early helps you spot and resolve any red flags, like unpaid liens, before they cause delays. And if you're dealing with tricky ownership situations or inherited property disputes, bringing in a real estate attorney can be a smart move to keep things on track.

From financing to title issues, contingencies can add complexity to your sale. Be prepared for every "what if." Contingencies don’t have to slow you down. You can try PropBox, a tool that helps you analyze and negotiate terms with ease, so you can sell your home smoothly and with fewer surprises.

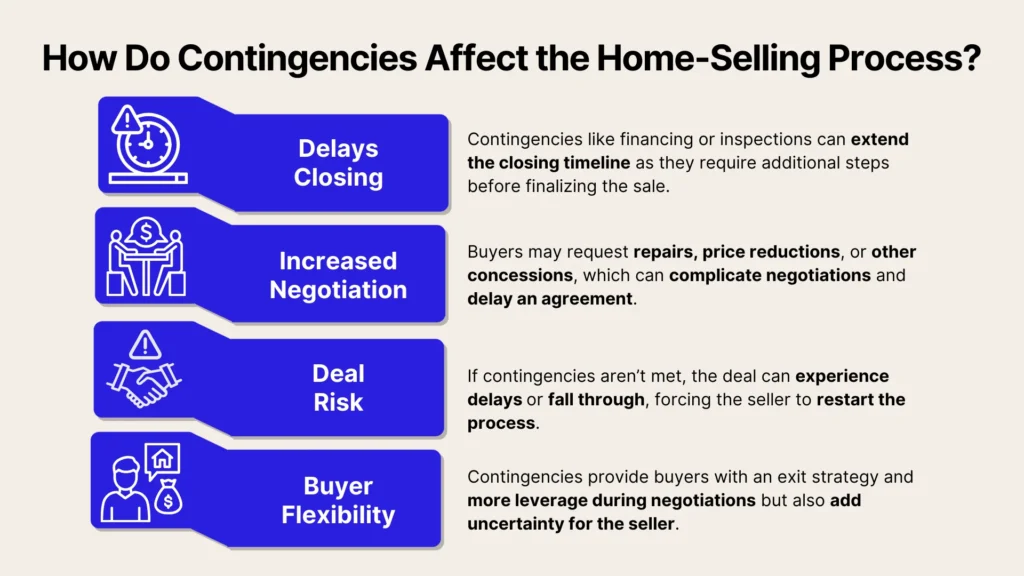

How Contingencies Affect the Selling Process

Contingencies act like safety nets, letting buyers back out or renegotiate if things like financing or inspections don’t go as planned. In fact, about 25% of delayed or canceled deals in 2022 were due to these clauses, showing just how much they can impact a sale.

For sellers, contingencies can stretch timelines and sometimes mean extra work or concessions. But by understanding them, you can plan smarter, negotiate with confidence, and stay in control of the selling process.

Strategies for Home Sellers to Manage Contingencies

Handling contingencies effectively requires both preparation and ongoing communication. By staying proactive about potential issues, you can minimize surprises and keep your transaction on track.

Below are some key strategies for tackling common contingency challenges, from inspection readiness to airtight purchase agreements.

Preparing Your Home for Inspection

The home inspection phase can be a major hurdle, but you can make it a breeze with a little prep.

Tackle obvious fixes like leaky faucets or broken lights beforehand, and give your place a good clean-up – first impressions matter! Having records of repairs, warranties, and maintenance handy also helps show your home is in great shape and ready to go.

Setting Clear Terms in the Purchase Agreement

A well-structured purchase agreement cuts down on confusion and keeps things running smoothly.

Be clear about deadlines and any extension rules to avoid last-minute surprises. If you're comfortable, negotiating fewer or shorter contingencies can help lower your risk. And remember, the more specific the wording, the easier it is to keep everyone on the same page and accountable.

Negotiating Contingency Removal

Once the buyer’s concerns like financing and inspections are sorted, it’s time to move toward contingency removal. Keep things on track by following up with the buyer’s agent regularly, and if needed, sweeten the deal with incentives like credit or covering some closing costs.

But if deadlines keep getting pushed without good reason, it might be your cue to walk away and explore other offers.

The Role of Deadlines in Contingencies

Deadlines are the backbone of any contingency. They ensure both parties move forward in a timely manner. If a buyer misses a deadline, you can often terminate the contract or renegotiate terms. By the same token, if you fail to meet an agreed-upon repair timeline or provide necessary documents on time, the buyer might be able to walk away or request further concessions.

Setting realistic deadlines is key. Try to strike a balance between giving the buyer enough time for tasks like securing financing and scheduling inspections, and not leaving the door open for endless delays. A good rule of thumb is to discuss deadlines early and confirm in writing so that everyone knows where they stand.

Common Challenges with Contingencies and How to Overcome Them

Even with the best planning, contingencies can occasionally throw you a curveball. Knowing common pitfalls helps you respond more effectively when issues arise.

Below are four frequent obstacles sellers encounter, along with practical tips to resolve them and keep your sale on track.

Buyer Financing Falls Through

Finding out a buyer’s loan was denied right before closing is never fun, but you can protect yourself.

Asking for a solid pre-approval letter upfront helps weed out risky buyers, and having a backup offer in your pocket can save you from starting over. In some cases, seller financing could be an option, but it’s something to approach carefully with the right legal advice.

Inspection-Related Demands

Buyers can sometimes go overboard with repair requests after an inspection, but you’ve got options. If their estimates seem too high, bring in your contractor for a second opinion.

Be smart about negotiations – decide what’s worth fixing and what you can push back on. And if your home is priced ‘as is,’ make it clear that major repairs weren’t part of the deal.

Appraisal Issues

A low appraisal can throw a wrench in the deal, but there are ways to handle it. If you think the value overlooked important upgrades or market trends, you can challenge it with more data. Negotiating a middle ground with the buyer or adjusting the price can also keep things moving.

The best approach? Stay realistic from the start by pricing your home based on solid market research.

Lengthy Contingency Periods

Buyers sometimes ask for extra time to sort out financing or inspections, but it’s important to keep things moving. Setting reasonable limits and offering shorter extensions, if needed, can help avoid dragging things out.

Stay in the loop with open communication so you’re not caught off guard by any delays. And if your contract allows, enforcing penalties for missed deadlines can be a good way to keep everyone on track.

Legal Considerations for FSBO and First-Time Home Sellers

Selling a property on your own or for the first time means brushing up on local contingency laws, which can vary by state. Doing your homework or consulting a real estate attorney can help you avoid costly mistakes.

Keeping thorough records of inspections, repairs, and communications is key, and if you're dealing with complex situations like inherited property or unique financing, legal guidance can offer extra protection. Plus, some states have specific rules and disclosures you’ll need to follow, so it’s always best to stay informed.

A home sale involves a lot of documents, and it’s easy to miss something important. PropBox helps you stay organized by generating a checklist of what you need and even verifying your uploads for accuracy, so you can focus on closing without last-minute surprises.

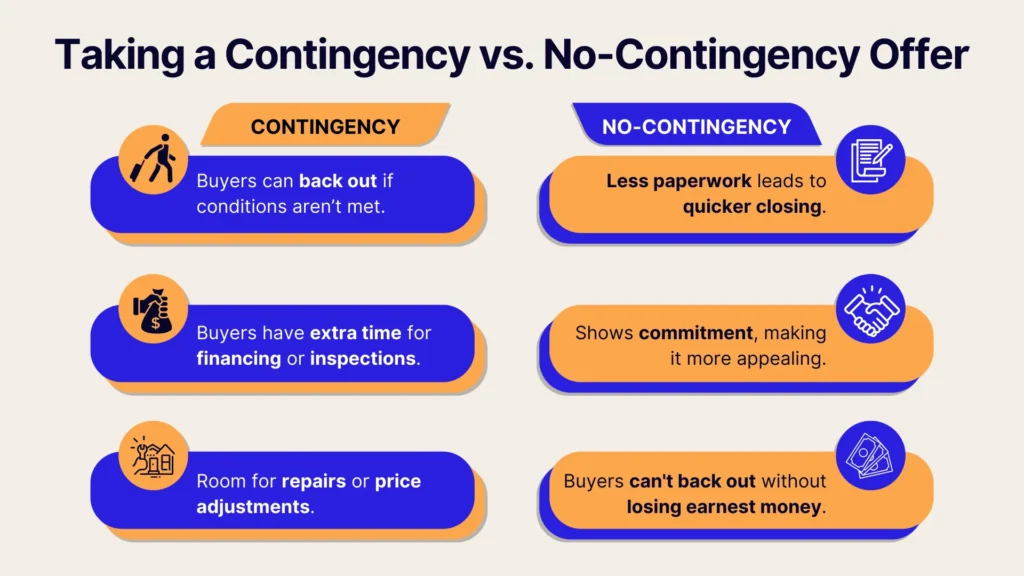

Contingencies vs. No-Contingency Offers

In hot markets, offers with zero contingencies can be tempting since they promise a faster closing and fewer obstacles. With fewer hoops to jump through, there's less uncertainty, and the deal is less likely to fall apart over financing or inspections.

But while these offers sound great, they come with trade-offs – buyers might offer less to balance their risk, and skipping inspections could lead to costly surprises down the road, potentially causing disputes or legal headaches. To attract buyers willing to waive contingencies, it's all about building confidence.

Providing a recent inspection report or showcasing how well-maintained your home is can put their minds at ease. Offering a quick close can also be a big draw for motivated buyers, and being upfront about your home's condition helps create trust, making them more likely to skip the extra conditions.

Conclusion

Contingencies in real estate aren’t just paperwork. They’re crucial to ensuring a smooth sale, and understanding them can help you avoid delays, negotiate better terms, and close with confidence. Whether it’s handling financing hurdles or managing legal documents, being prepared puts you in control of the process.

Why navigate it all alone when PropBox can do the heavy lifting for you? From comparing offers with AI-driven insights to automating paperwork and spotting potential roadblocks before they become problems, PropBox makes selling smarter and stress-free. Take control of your home sale today – try PropBox and close with confidence.