Selling a home often involves more than just listing a property and waiting for offers. Whether you are a first-time home seller or taking the For Sale By Owner (FSBO) route, you’ll quickly realize that negotiations, inspections, and repair requests can be intricate parts of the process. One way to navigate these complexities is through repair credits.

With 24% of recent homebuyers identifying as first-time buyers (median age 28 and median household income of $97,000), understanding how repair credits function can be particularly valuable if you’re new to real estate transactions. Keep reading this comprehensive guide to understand what repair credits are, why they matter, how they work, and what alternatives you might consider.

What Are Repair Credits?

A repair credit is a sum of money that the seller agrees to contribute toward the buyer’s closing costs or overall purchase price to cover identified repairs. Rather than making the repairs themselves, the seller offers the buyer a financial concession, effectively saying, “Instead of me fixing it, I’ll give you money so you can fix it to your liking.”

How Repair Credits Function in a Purchase Agreement

These credits are formalized in the purchase agreement or closing documents. Typically, buyers discover issues they want fixed during the inspection phase. If you’re selling FSBO, you’ll negotiate directly with the buyer on whether you’ll complete specific repairs or offer a repair credit.

Once the buyer agrees, the details are noted in a contract addendum or an amended purchase agreement so both parties have legal documentation of the arrangement.

Why Are Repair Credits Important?

Lacking an agent’s negotiation expertise, FSBO sellers can use repair credits to simplify discussions and attract buyers willing to handle fixes if compensated. Although FSBO accounts for only 6% of sales, these credits ease the seller’s burden by minimizing the need to juggle contractors—particularly helpful since 17% of FSBO sellers cite “getting the price right” as their main challenge.

Repair credits offer a clear path to first-time home sellers for addressing inspection issues without the hassle of personally supervising every fix. With 24% of buyers also purchasing for the first time and often financing 74% of the home price, well-structured credits can lower closing costs and streamline the transaction, benefiting both buyer and seller.

How Do Repair Credits Work?

Repair credits come into play once a buyer completes a home inspection and presents the seller with a list of concerns. At this juncture, a seller generally has three choices: make the repairs directly, lower the asking price to account for those fixes, or offer a credit so the buyer can handle them later.

Let’s take a closer look at these options and how repair credits come into play.

Negotiating After a Home Inspection

Once a buyer completes their inspection, they’ll present you with a list of concerns. You can:

- Fix the issues yourself by hiring contractors.

- Negotiate a reduced sale price to account for the repairs.

- Offer a repair credit so the buyer can fix it on their own.

In many cases, offering a repair credit is the simplest approach, particularly if you’re selling FSBO and want to avoid the extra work.

Considering Buyer’s Repair Requests

Sellers should carefully review the inspection report to decide:

- Which repairs are urgent or safety-related: These include structural or mechanical issues that pose immediate health or safety risks, as well as problems that might jeopardize financing or insurance. Prioritizing these repairs can prevent larger complications down the line.

- Which ones are minor or purely cosmetic: Although these issues won’t necessarily impact the home’s functionality, they can still affect overall buyer perception. Deciding whether to fix them or leave them unaddressed can depend on budget, buyer expectations, and market conditions.

- Whether offering money instead of a repair would be more cost-effective: Factoring in the time, labor costs, and logistics of scheduling repairs can sometimes make a lump-sum credit preferable. This approach can simplify the process for both parties, especially if buyers prefer to handle the fixes themselves after closing.

Deciding on a Credit Amount

When deciding on a repair credit, start with an estimate of the likely repair costs and add a reasonable buffer for unexpected expenses. Consulting contractors or checking current market rates can offer insight into what typical fixes cost—especially vital for first-time sellers without extensive experience in home maintenance.

It also helps to consider how your property compares to similar homes in the area. If you need a new roof or a significant system overhaul, you may want to offer a higher credit to keep your listing competitive and appeal to buyers who might otherwise shy away from large repairs.

Benefits of Offering Repair Credits

Offering repair credits can streamline the home-selling process in multiple ways, particularly for FSBO sellers or those who value efficiency. By sidestepping the physical labor of repairs, you cut down on potential delays and steer negotiations toward cost, often reducing the time your house spends on the market. Let’s break down these benefits further:

Easier to Close the Sale

By offering a credit, you avoid the delays associated with scheduling and completing repairs. This can shorten the overall timeline from offer to closing, aligning with the typical market pace where homes often sell within 3 weeks.

Attracting More Buyers

Buyers increasingly rely on the internet (51%) or real estate agents (29%) to find their homes, and they compare multiple listings. Being upfront about needed repairs but offering a financial concession can widen your buyer pool.

Simplifying Negotiations

When you cut out the step of physically repairing things, there’s less room for disputes over the quality or timing of the work. The negotiation stays focused on the cost, making it simpler for both parties.

Avoiding Repair Hassles

As an FSBO seller, scheduling contractors can be especially difficult if “Having enough time for all aspects of the sale” (cited by 5% of FSBO sellers) is already a challenge. A credit lets you sidestep these logistical headaches.

Time Savings

When the buyer and seller agree to a repair credit, the sale can proceed smoothly, sparing you from extended back-and-forth negotiations and extra time on the market, which is beneficial if you’re aiming to sell within a planned time frame (cited by 13% of FSBO sellers as a challenge).

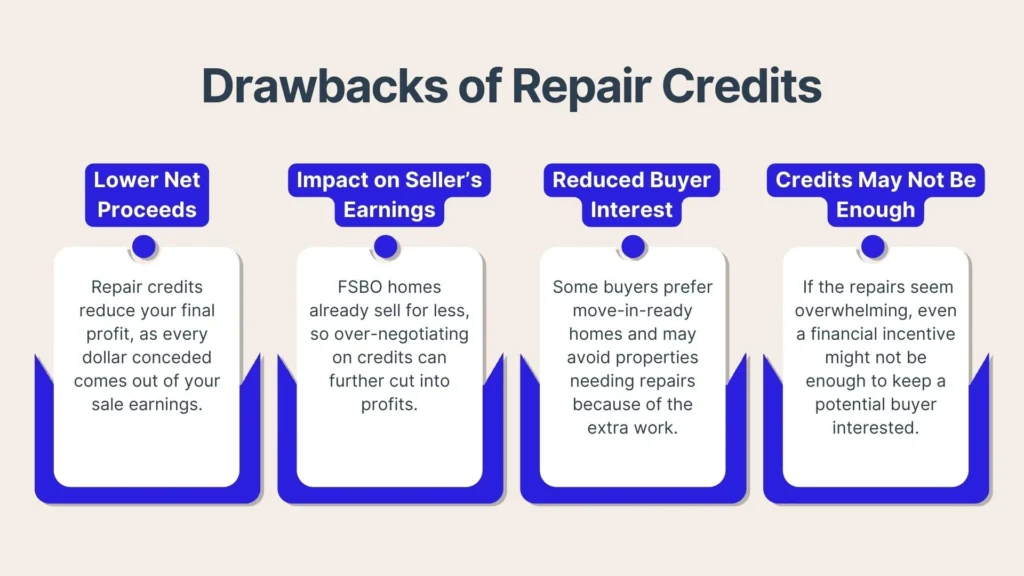

Drawbacks of Repair Credits

While offering repair credits can help expedite a sale, it also means accepting lower net proceeds. Every dollar you concede further reduces your final profit. Additionally, not all buyers are eager to handle repairs themselves, even when they’re given money to do so. Here’s a more detailed explanation of the financial drawbacks of repair credits:

Lower Net Proceeds

While offering credits can speed up closing, it also means giving up a portion of your sale proceeds. For instance, if you concede $3,000 in repair credits, that’s $3,000 less in your pocket.

Impact on Seller’s Earnings

Because FSBO homes already tend to sell at a lower median price ($380,000) than agent-assisted homes ($435,000), every dollar you concede matters. Over-negotiating on credits can lead to a significant cut in your profit.

Reduced Interest From Certain Buyers

Some buyers do not want to handle repairs themselves, even if compensated. A property that requires repairs—even with a credit—may deter “move-in ready” seekers.

Buyers Wanting Move-In Ready Homes

Given that 8% of buyers found their home through friends or neighbors and may already be familiar with its condition, offering credits could be insufficient if the property requires extensive work. These buyers might simply walk away.

Deciding on Repair Credits

Determining how much to offer in repair credits calls for a careful blend of market knowledge, accurate cost estimates, and strategic planning. These are the major considerations before you make this offer to a potential buyer:

Evaluating Repair Costs

It’s crucial to research the average costs for requested repairs. If an HVAC system replacement typically costs $5,000–$7,000, offering $1,000 as a credit might be unrealistic and could sour the deal.

Getting Multiple Repair Estimates

Due diligence protects your bottom line. Getting a few estimates ensures you offer a fair credit that resonates with both you and the buyer.

Considering Market Conditions

In a seller’s market—where demand is high and inventory is low—you have the upper hand and may need to offer only a minimal credit or none at all, since buyers are often vying for limited options. Conversely, when buyers have plenty of choices, providing a repair credit can help your property stand out and might expedite the transaction.

It’s also worth being more flexible if your home has stayed on the market longer than expected or if you’ve already lowered the asking price once (as 21% of sellers do). Instead of another price reduction, a well-structured repair credit can reignite buyer interest without eroding your listing price further.

Alternatives to Repair Credits

While repair credits can smooth negotiations, there are other ways to address a home’s repair needs before selling. Let’s explore the different alternatives you may opt for instead:

Making Repairs Before Listing

One approach is to fix major issues upfront, which can justify a higher asking price. According to the 2024 Profile of Home Buyers and Sellers, 38% of sellers found their agent through referrals from friends or family, underscoring that reputation matters. A well-maintained home can boost buyer confidence.

Assessing ROI on Repairs

Not all repairs or upgrades pay for themselves. If redoing the entire bathroom costs $10,000 but only adds $5,000 in perceived value, it might be more cost-effective to offer a credit instead.

Adjusting Home Price

One way to handle repair needs is to adjust the listing price and sell the home “as-is.” By acknowledging known issues upfront and pricing accordingly, you can appeal to buyers who are willing to handle those repairs themselves—often in exchange for a lower purchase price.

For FSBO sellers, transparency about the home’s condition can prevent misunderstandings and minimize large credit requests later. When buyers know exactly what they’re getting into, negotiations tend to move faster, and all parties can avoid surprises that could derail the sale.

Documenting Repair Credits in the Agreement

When offering a repair credit, it’s essential to include the details, such as the amount, reason, and terms, in writing, typically via an addendum or amended purchase agreement. Different states have varying disclosure requirements, so consulting with a real estate attorney or title company can help you comply with local regulations and avoid legal pitfalls.

Additionally, be aware that certain loan programs place limits on how much of the closing costs sellers can cover. Familiarizing yourself with these guidelines—or having the buyer’s lender confirm them—will help you steer clear of last-minute surprises and ensure a smooth closing.

Tax Implications of Repair Credits

While repair credits generally reduce your net proceeds, they typically aren’t considered a direct expense that you can deduct. Instead, they may reduce your capital gains (if any) on the sale. However, it can get complicated, especially if you’re making major concessions.

For the latest information, it’s best to consult a tax professional or review IRS publications on home sale capital gains. The guidelines can vary depending on your specific situation, including how you structure the credit and which state you live in.

Conclusion

Repair credits offer a financial workaround to address buyer concerns about a home’s condition. They can streamline negotiations by avoiding the complexities of scheduling repairs and dealing with contractors. However, they can also be a double-edged sword, potentially reducing your final profit and discouraging buyers who want a move-in ready home.

For home sellers, especially those concerned with time or unfamiliar with paperwork, credits can simplify the process, though it’s essential to do your homework on repair costs. By understanding how repair credits work and incorporating them thoughtfully, you’ll be better positioned to negotiate successfully, close on time, and meet your overall selling objectives.