Appraisal gaps are a common hurdle that FSBO (For Sale By Owner) and first-time home sellers often face during the home selling process. An appraisal gap occurs when the appraised value of the home is lower than the agreed-upon sale price, creating challenges for both buyers and sellers.

For FSBO sellers, understanding appraisal gaps and their potential impact is important to navigating these situations confidently. In this article, we’ll explain what an appraisal gap is, explore its common causes, and share practical strategies to address it effectively.

Understanding the Appraisal Process

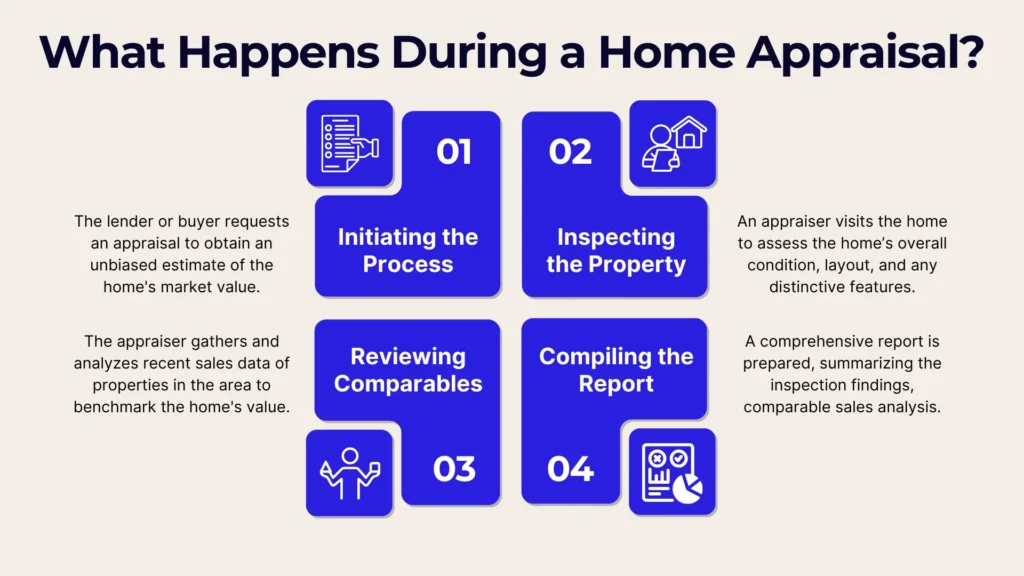

The appraisal process is an important part of any real estate transaction. Rather than being a formality, an appraisal provides a solid foundation for understanding a home’s fair market value. By knowing how the process works, both buyers and sellers can approach their transaction with greater confidence and realistic expectations, helping to pave the way for a smoother experience.

What is a Home Appraisal?

A home appraisal is an independent evaluation of a property's market value conducted by a licensed appraiser. Its primary purpose is determining whether the property’s value aligns with the agreed-upon sale price, protecting lenders from overextending loans and buyers from overpaying.

Appraisals are typically ordered by the buyer's lender after the purchase agreement is signed. The appraiser visits the property, evaluates its condition, and compares it to similar recently sold homes in the area, often referred to as "comps."

Factors Influencing a Home Appraisal

Several factors can impact a home's appraised value:

- Market Conditions: The overall housing market plays a significant role. Values may trend lower in a buyer's market, while in a seller's market, they may trend higher.

- Comparable Sales (Comps): Appraisers rely heavily on recent sales of similar properties nearby. These comparisons establish a benchmark for the home's value.

- Home Condition and Upgrades: The property's physical condition, maintenance, and improvements (e.g., renovations, new appliances, or landscaping) can positively or negatively affect the appraisal.

The Role of Appraisers in the Process

Appraisers are independent professionals trained to assess property value objectively. They take into account numerous details, including the home's size, location, age, and overall condition. Additionally, they consider local market trends and recent sales data, ensuring that their evaluation reflects the current state of the market.

For homeowners, understanding how appraisers approach their work can demystify the process and make it easier to prepare for an appraisal.

What is an Appraisal Gap?

An appraisal gap occurs when a home appraises for less than the agreed-upon sale price. For example, if a buyer offers $350,000 for a home, but the appraisal comes in at $330,000, there is a $20,000 gap. This discrepancy can complicate the transaction, as lenders typically base loan amounts on the appraised value, not the sale price.

Imagine a couple finds their dream home listed at $400,000. After a bidding war, they agree to pay $420,000. The lender orders an appraisal, which values the property at $400,000. The $20,000 gap between the appraised value and the sale price becomes a sticking point that needs resolution.

Common Causes of Appraisal Gaps

Appraisal gaps don’t happen by chance. They often arise from rapidly shifting market dynamics, heightened competition among buyers, or even seller missteps like overpricing. Here are some examples of what causes appraisal gaps:

- In a hot housing market, prices often rise faster than appraisals can keep up. Appraisers rely on historical sales data, which may not reflect the most recent trends.

- When multiple buyers compete, offers can exceed the property’s market value. These inflated sale prices may not align with the appraised value.

- Some sellers list homes above their market value, hoping to attract high offers. This strategy can backfire if the appraisal comes in lower than the sale price.

Incomplete Renovations or Repairs

If a home has unfinished projects or visible wear and tear, the appraiser may assign a lower value. Sellers who fail to address necessary repairs or leave upgrades incomplete may find their home appraises lower than expected, especially when compared to well-maintained properties.

Why Do Appraisal Gaps Matter?

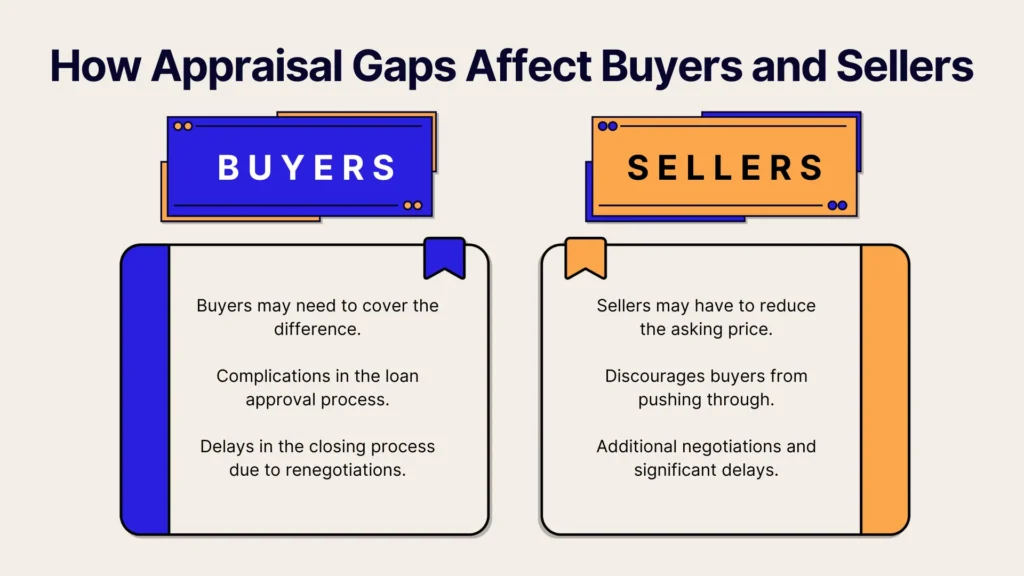

Appraisal gaps can ripple on both sides of a real estate transaction, influencing financial decisions and the overall buying or selling experience. For buyers, these gaps often introduce unexpected financial challenges and stress, while sellers may find their carefully planned sales at risk.

To fully understand the significance of appraisal gaps, let’s explore their impact on both parties.

Impact on Buyers

An appraisal gap can introduce significant challenges. When the appraised value is lower than the agreed sale price, lenders typically calculate loan amounts based on the lower value. This often means buyers must cover the difference out of pocket, leading to unexpected expenses that can strain their budget or even derail their ability to proceed with the purchase.

In addition to financial hurdles, the higher upfront costs can create stress and force buyers to reconsider their options. On an emotional level, appraisal gaps can bring disappointment, especially when they disrupt plans to purchase a dream home. These combined factors make appraisal gaps a challenging obstacle.

Impact on Sellers

Sellers face their own set of challenges when dealing with an appraisal gap. One major risk is the possibility of the deal falling through entirely if the buyer can’t cover the difference between the appraised value and the sale price. Sellers may need to compromise by lowering their asking price or offering other concessions to keep the transaction moving forward.

Another potential outcome is the property spending more time on the market if the deal collapses. A failed sale often requires relisting the property, which could result in receiving lower offers than anticipated, further complicating the selling process. These challenges highlight the importance of preparing for and addressing appraisal gaps early in the transaction.

How Home Sellers Can Prepare for Appraisal Gaps

Navigating the potential pitfalls of an appraisal gap can be nerve-wracking, but fret not – with these tips, you’ll be able to tackle an appraisal gap head-on and confidently negotiate. Let’s dive into how you can prepare for one:

Research and Education

Taking the time to review recent sales of similar homes in the area can provide clarity about current pricing trends. This research helps sellers set realistic expectations about what their property might be worth and avoid overpricing that could lead to appraisal issues.

In addition to personal research, collaborating with experienced professionals and using AI tools like Propbox can be immensely helpful. These services can offer detailed insights into market trends and provide a clearer picture of your property’s value, enabling you to approach their pricing strategy with plenty of information and confidence.

Presentation and Maintenance

Making a property as appealing as possible is a smart way to avoid issues during the appraisal process. If your property has standout qualities, such as custom upgrades or energy-efficient additions, make sure these are documented and brought to the appraiser’s attention.

Don’t forget to present your home in its best light through decluttering, staging, and addressing minor repairs before the appraisal. Fixing leaky faucets or damaged flooring helps create a better overall impression, while a clean, organized, and well-presented home appeals to potential buyers and influences the appraiser’s perception.

Understanding Buyer Concerns

Engaging with buyers openly about potential appraisal challenges can foster a cooperative approach. Consider working together with potential buyers to preemptively discuss options for addressing gaps, such as shared costs or adjusted pricing, reducing the likelihood of surprises during negotiations.

Solutions to Resolve an Appraisal Gap

Resolving an appraisal gap doesn’t have to mean the end of a deal. There are several ways to approach this that can work for all parties involved. Let’s explore the practical options available for bridging the gap and keeping the transaction on track.

Renegotiating the Sale Price

One way to address an appraisal gap is by lowering the sale price to match the appraised value. This approach can help keep the transaction on track and avoid unnecessary delays, making it a practical solution for both parties.

It does come with its drawbacks, as it reduces the seller’s profit and may not be an appealing option in a competitive seller’s market where other buyers might be willing to bridge the gap. This strategy is often used when neither party has the means to cover the gap.

Buyer Options to Close the Gap

Buyers have a few ways to handle an appraisal gap. One option is to increase the down payment, using additional cash to cover the difference between the appraised value and the sale price. Another approach is to explore alternative financing options, as some lenders may offer more flexible loan products to help bridge the gap.

Rebutting the Appraisal

If the appraisal seems inaccurate, both parties have options to address it. They can request a reconsideration of value by submitting additional comparable sales or relevant documentation to the lender, aiming to justify a higher appraisal. Alternatively, they can carefully review the original appraisal report for errors or oversights and challenge any inaccuracies that may have affected the valuation.

Creative Compromises

One approach is for the buyer and seller to split the gap, sharing the financial burden to make it more manageable for both sides. Another option involves seller concessions, where the seller may cover closing costs or include appliances to reduce the buyer’s expenses.

Alternatively, both parties can agree to hold funds in escrow to address any discrepancies in value until the home’s worth adjusts after closing.

Conclusion

An appraisal gap, while challenging, doesn’t have to derail your real estate journey. By understanding the appraisal process and preparing for potential gaps, buyers and sellers can make informed decisions to keep transactions on track. Staying proactive, researching the market, and seeking expert advice are all steps that can help you navigate these situations with confidence.

Appraisal gaps are just one of the challenges FSBO sellers face, but Propbox makes it easy to stay prepared. With features like AI-generated listings and virtual open house management, our platform puts everything you need at your fingertips – all without breaking the bank. Sell smarter with Propbox today.