Selling your home on your own or for the first time can feel like stepping into unknown territory. Between handling paperwork, meeting potential buyers, and negotiating prices, there’s a lot to keep track of. One concept that often comes up during a real estate transaction is earnest money, which is sometimes called a “good faith deposit.” Understanding how it works can give you a sense of security and help you navigate the selling process like a pro.

Ready to dig deeper into this crucial aspect of home-selling? Let’s explore exactly what earnest money is, why it matters, and how you can handle it when you’re selling your home without a realtor or for the first time.

What is Earnest Money?

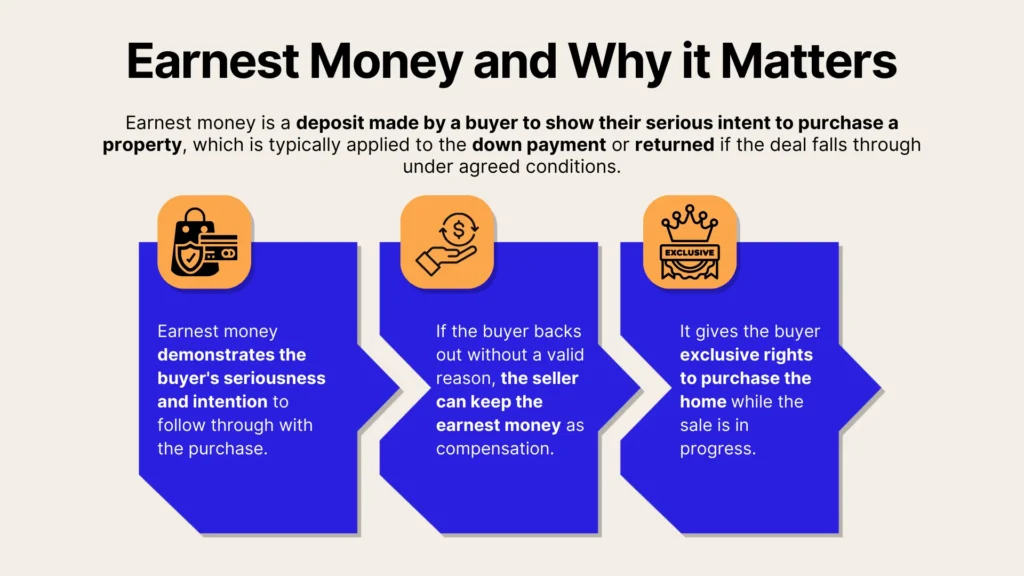

Earnest money is a deposit a buyer offers to show they’re serious about purchasing a home. Think of it as a financial handshake: a way to assure you, the seller, that the buyer genuinely intends to follow through with the deal.

Knowing the purpose of earnest money is the first step. Let’s take a look at why it plays such an important role in the buying process.

Why Earnest Money is Important

You might wonder why a buyer can’t just say, “I’m interested,” without putting down a deposit. Earnest money is a way to show they’re serious, offering tangible proof of their commitment to the purchase. It helps build trust between the buyer and seller because when money is on the line, it’s clear they’re not just testing the waters.

Plus, if the buyer backs out for reasons not covered in the contract, the seller may be entitled to keep the deposit, helping to make up for lost time and potential missed opportunities.

How Does Earnest Money Work?

When a buyer submits an offer, they typically include an earnest money deposit, which is held in an escrow account by a neutral third party, such as a title company or real estate attorney. This money stays in escrow while key steps like the inspection, appraisal, and financing approval take place, ensuring that both parties follow the terms of the contract.

If everything goes smoothly, the deposit is applied toward the buyer’s down payment or closing costs, helping to finalize the deal. However, if the buyer backs out for reasons not covered in the contract, the seller may be entitled to keep the deposit as compensation for time and opportunities lost.

Let's dive into what happens when a buyer puts down their deposit:

The Process of Offering Earnest Money

When a buyer decides to make an offer, they typically outline how much earnest money they’re willing to deposit. This amount is often included in the purchase agreement or offer letter.

Once you and the buyer agree on the terms, the buyer will deposit the earnest money into an escrow account – a neutral account managed by a third party, such as a title company or attorney.

What Happens to Earnest Money During the Sale?

While the real estate transaction moves through steps like the appraisal, inspection, and financing approval, the earnest money stays in an escrow account. Escrow acts like a financial holding pattern, making sure neither party can access the funds without sticking to the contract’s terms.

As closing day approaches, the earnest money usually gets applied to the buyer’s down payment or helps cover closing costs, such as fees for the title company, attorney, or loan origination. This setup provides security for both sides and ensures the money is used appropriately when the deal is finalized.

What Happens if the Sale Falls Through?

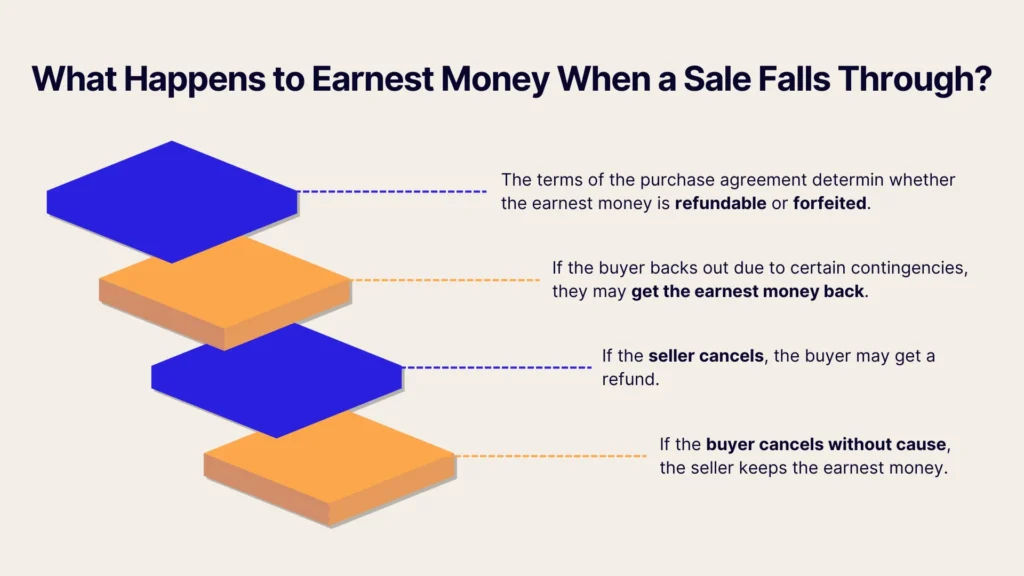

Real estate deals can fall through for various reasons, like financing issues or inspection problems. If a buyer backs out without a valid contract contingency, the seller can usually keep the earnest money.

However, if contingencies are met – such as financing or inspection clauses – the buyer typically gets their deposit back, and both parties walk away.

Earnest Money for FSBO Sellers

When you’re selling your home yourself (FSBO, or For Sale By Owner), you assume more responsibility than you would if you had a realtor. While this can save on commission fees, it also means you need to be fully aware of best practices, especially regarding earnest money.

Here’s why having a solid grasp of earnest money practices is especially important when selling your home on your own.

Why FSBO Sellers Need to Understand Earnest Money

Without an agent, it’s up to you to make sure the buyer is serious and financially capable of following through on the purchase. Earnest money deposits play a key role in this by helping to filter out casual shoppers or those who aren’t quite ready to buy.

When you require a deposit, it encourages only committed buyers to move forward with the contract, giving you more confidence in the deal.

Handling Earnest Money as an FSBO Seller

If you're selling without a realtor, it's important to have a neutral third party like a title company or real estate attorney handling the earnest money deposit. Holding the buyer’s deposit in your bank account can lead to legal and ethical issues, so it’s best to avoid that risk.

Working with a real estate attorney ensures your purchase contract clearly outlines deposit terms, contingencies, and refund conditions, while an escrow or title company can securely hold the funds and manage the necessary paperwork.

Keeping detailed records of deposits, including timestamps and communication about refunds or contract changes, will help you stay organized and protect your interests throughout the process.

Determining the Right Earnest Money Amount

There’s no set rule for how much earnest money a buyer should put down, but it typically falls between 1% and 3% of the purchase price. The exact amount can depend on factors like local market conditions, buyers in competitive markets might offer more to stand out, while in slower markets, smaller deposits are more common.

Property value also plays a role, as higher-priced homes might require larger deposits in dollar terms, even if they stick to the same percentage range. Regional customs can influence expectations too, so it’s a good idea to check with local title companies or real estate attorneys to understand what’s typical in your area.

Tips for FSBO and First-Time Home Sellers

Even though you might be new to the home-selling process, you can still manage your sale confidently and with minimal risk. Earnest money is just one piece of the puzzle, so here are a few extra tips to keep you on the right track.

Vetting Buyers Before Accepting Earnest Money

You’ve found a buyer, and they’re ready to put down a deposit, that’s great! Before moving forward, make sure they’re financially prepared by asking for a copy of their mortgage pre-approval letter, which shows they’ve already cleared some hurdles with a lender.

If a buyer hesitates to provide proof of funds or avoids questions about financing, it could be a red flag, since a serious and reliable buyer should have no problem sharing these details.

Setting Clear Contract Terms for Earnest Money

To avoid confusion or disputes later, it’s important to clearly outline everything in the purchase agreement. Be sure to include contingencies that explain when and how the buyer can get their deposit back, such as if the inspection reveals serious issues or if financing falls through within a set timeframe.

Setting firm deadlines for key steps like inspections, appraisals, and securing financing helps keep the process on track and ensures both parties know what to expect.

Common Mistakes to Avoid

Even with the best preparation, there are pitfalls you’ll want to steer clear of. Here’s how to dodge some typical blunders related to earnest money.

Accepting Too Low of an Earnest Money Deposit

A small deposit might not effectively discourage a buyer from walking away. If a buyer has only put down a few hundred dollars, they might be more willing to abandon the deal if they find a more appealing house or if something minor doesn’t go their way.

Striking a balance – large enough to show real intent, but not so large as to be impractical – can keep everyone motivated to see the deal through.

Mismanaging the Escrow Process

Running an FSBO sale doesn’t mean you have to handle every single detail alone. Failing to set up a proper escrow account or hold funds in a neutral location can cause confusion and legal headaches later. Always work with a third party who understands the local regulations and can hold funds securely until closing.

Failing to Understand Refund Contingencies

You can’t keep the earnest money simply because you’ve decided to do so. If the contract includes certain contingencies – like the buyer needing to sell their old home first or secure financing by a specified date – and those contingencies aren’t met, the buyer is typically entitled to a refund.

Overlooking these details or misunderstanding them can lead to conflicts, wasted time, or even legal disputes.

Conclusion

Navigating the earnest money process is an important part of selling your home, especially if you’re doing it on your own or for the first time. By understanding how to set the right deposit and ensure it’s properly handled, you’re already on the right track. But when it’s time to compare offers and negotiate terms, having the right tools can make all the difference.

With PropBox, you get AI-powered insights and automation that take the guesswork out of evaluating offers, calculating net proceeds, and negotiating with confidence. Don’t let uncertainty slow you down – try PropBox today and take control of your home sale with ease.